Vanguard Institutional Index Fund Institutional Plus Shares Compare: Complete Guide & Key Details

Hey there, financial adventurers! Ever feel like navigating the world of investing is like trying to solve a Rubik's Cube blindfolded? Yeah, I get it. But what if I told you there's a way to simplify things, a way to get a big slice of the market without needing a degree in rocket science? Let's talk about something that sounds a little fancy but is actually pretty darn cool: the Vanguard Institutional Index Fund Institutional Plus Shares. Stick with me, this might just be the key to unlocking some serious investing joy!

Now, before you start picturing stuffy boardrooms and guys in pinstripe suits, let's demystify this beast. At its heart, this fund is all about tracking the stock market. Think of it like a mirror reflecting the performance of a huge chunk of America's biggest companies. When the market goes up, this fund tends to go up. When it dips, well, you get the idea. It's not about picking individual winners (which, let's be honest, can be a nail-biting adventure!), but about owning a little bit of everything.

So, What's the "Institutional Plus" Deal?

You might be asking, "Why the fancy name? Is it for superheroes or something?" Well, sort of! The "Institutional" part generally means these shares are designed for large organizations – think pension funds, endowments, that sort of thing. They're buying in bulk, which often translates to super low costs. And "Plus"? That usually signifies some extra bells and whistles, or in this case, potentially even lower expenses or other benefits tailored for these bigger players. It's like getting the VIP treatment at the investment concert!

But here's the exciting part for you: even if you're not managing a multi-million dollar endowment, understanding these kinds of funds can still be incredibly beneficial. Vanguard, as a company, is famous for its commitment to keeping costs down. And when costs are low, more of your hard-earned money stays invested and working for you. It's like finding a secret shortcut to a bigger nest egg!

The Magic of Indexing: Why It's Actually Fun

Let's talk about why this whole "indexing" thing is more exciting than it sounds. Instead of trying to guess which company's stock will skyrocket next week (a recipe for stress, anyone?), index funds offer a diversified approach. You're spreading your risk across hundreds, or even thousands, of companies. This means if one company stumbles, it's not going to tank your entire investment. It's like having a really, really big basket to hold all your financial eggs!

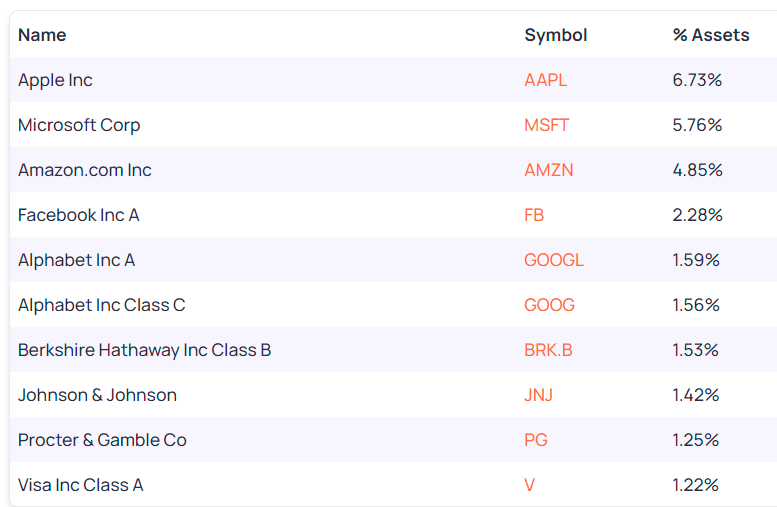

And the Vanguard Institutional Index Fund Institutional Plus Shares specifically aims to mirror a major stock market index, like the S&P 500. This index represents about 500 of the largest publicly traded companies in the U.S. So, by investing in this fund, you're essentially taking a stake in the backbone of the American economy. How cool is that? You're not just investing; you're participating in the growth of major industries, from technology to healthcare!

Unpacking the Key Details (Without the Headache!)

Okay, let's get down to the nitty-gritty, but we'll keep it light, I promise! When you're looking at a fund like this, a few things are super important to notice:

- Expense Ratio: This is like the fund's annual fee. Vanguard is renowned for its low expense ratios, and institutional shares often have some of the lowest in the industry. Think of it as paying a tiny toll to ride on a super-fast, well-maintained highway. The less you pay in tolls, the more money you have to enjoy the destination!

- Tracking Error: This measures how closely the fund follows its benchmark index. A low tracking error means the fund is doing a great job of mirroring its target. It's like a really talented impersonator – they sound and act just like the real thing!

- Fund Objective: Simply put, what is this fund trying to achieve? In this case, it's to provide broad market exposure by tracking a specific index. Easy peasy!

- Investment Minimums: Since these are "institutional" shares, there might be higher minimum investment requirements compared to retail funds. But don't let that scare you! It just highlights the scale these funds operate on. And even if you can't invest in these specific shares today, understanding them points you towards Vanguard's broader, accessible index fund options.

The beauty of a fund like the Vanguard Institutional Index Fund Institutional Plus Shares is its simplicity and its long-term growth potential. It's not about chasing fads or trying to beat the market. It's about calmly and consistently participating in the market's upward journey over time. Imagine this: you set it up, and then you can focus on the fun stuff in life – family, hobbies, that trip you've always dreamed of!

Making Investing More Fun? Yes, It's Possible!

You might be thinking, "How on earth can investing be fun?" Well, when you take the guesswork and the stress out of it, it can be incredibly empowering! Knowing that your money is working for you in a low-cost, diversified way can bring a real sense of peace and excitement for the future. It's like planting a seed and watching it grow, knowing you've given it the best possible environment to thrive.

Understanding these kinds of powerful investment tools, even if they seem a bit complex at first glance, is like gaining a superpower. It's the superpower of financial confidence. It allows you to make informed decisions, set achievable goals, and look forward to a future where your money is helping you live the life you want.

So, don't be intimidated by the fancy names! The world of investing has amazing tools that can help you grow your wealth steadily and reliably. The Vanguard Institutional Index Fund Institutional Plus Shares, while perhaps geared towards larger investors, represents a fantastic philosophy: low costs, broad diversification, and long-term growth. It’s a beacon of how accessible and effective investing can be.

Take a moment to explore Vanguard's offerings, or even just dive deeper into the concept of index investing. You might just discover that building your financial future can be not only smart but also a genuinely inspiring and rewarding journey. Go forth, learn more, and let your money work its magic!