Vanguard Institutional Index Fund Institutional Shares Ticker: Complete Guide & Key Details

Let's talk about money. Specifically, a big, important-sounding fund. You might have seen it pop up. It's called the Vanguard Institutional Index Fund Institutional Shares. Sounds like something out of a superhero movie, right? The ticker symbol is like its secret code: VTSNX.

Now, before your eyes glaze over and you start dreaming of a beach instead, hang in there! We're going to make this as painless as possible. Think of it like decoding a secret handshake. A very, very important financial handshake.

So, what exactly is this beast of a fund? In simple terms, it's a giant pool of money. A really, really, really giant pool. And all that money is used to buy a little bit of almost every publicly traded company in the United States. Yep, you heard that right. It's like owning a tiny slice of the American dream.

Why would you want a tiny slice of everything? Well, it's kind of like diversifying your pizza toppings. You don't want just pepperoni, right? A little bit of mushroom, some onion, maybe even pineapple if you're feeling adventurous. This fund does that for stocks.

The "Institutional Shares" part is a bit of a wink and a nod. It basically means this fund is for the big players. Think pensions, endowments, and other large organizations. They're the ones with the serious dough to invest.

But hey, even if you're not managing a giant pile of money, understanding it is still pretty cool. It's like knowing how the engine of a fancy sports car works, even if you just drive a trusty sedan.

The Name Game: Unpacking VTSNX

Let's break down that mouthful of a name. Vanguard. You've probably heard of them. They're the folks who are all about low costs and keeping things simple. They're like the sensible accountant of the investment world.

Then there's Institutional Index Fund. This tells us two important things. It's a fund, so money goes in and out. And it's an "index fund." This is where the magic happens, or at least the very sensible investing happens.

An index fund tries to mimic a specific market index. Think of an index like a list of the biggest and most important companies. The S&P 500 is a famous example. It includes 500 of the largest U.S. companies. This Vanguard fund aims to track something similar, but often broader.

And finally, Institutional Shares. As we mentioned, this is for the big leagues. This usually means lower fees because the investors are so large. It's like getting a bulk discount on your financial ingredients.

The Secret Code: Ticker VTSNX

So, what's the deal with VTSNX? This is the shorthand. When financial folks want to talk about this fund quickly, they use its ticker symbol. It's like a nickname.

Imagine you're at the grocery store. You don't say "the refrigerated carton of dairy product that comes from a cow." You say "milk." VTSNX is the "milk" for this specific fund.

It’s how brokers and financial platforms identify it. It's the digital fingerprint of the fund. Pretty neat, huh?

Why All the Fuss About Indexes?

Okay, so why are index funds so popular? My unpopular opinion? They're often the smartest choice, even if they sound less exciting than picking the next big tech startup.

Here's the thing: beating the market is hard. Like, really hard. Most professional money managers, the ones who go to fancy schools and have lots of fancy charts, still struggle to do it consistently.

An index fund doesn't try to be a superhero. It doesn't try to pick the winning stocks. It just aims to match the performance of the market. Simple, right?

And the best part? Because it's not trying to outsmart everyone, the costs are usually super low. Low fees mean more of your money stays yours, working for you. It’s like getting a bigger slice of that pizza we talked about.

"Trying to pick individual stocks is like trying to guess which raindrop will hit the ground first. An index fund is like enjoying the rain."

That's my highly scientific, probably inaccurate, but hopefully amusing analogy. It just makes sense to own a little bit of everything when trying to predict the future is nearly impossible.

Key Details: What You (Might) Need to Know

Now, for some slightly drier, but still important, details. Remember, this is the institutional version. So, direct access for individual investors can be a bit tricky. It's usually accessed through retirement plans like 401(k)s or other employer-sponsored plans.

Think of it like a VIP club. You usually need an invitation, which in this case, comes in the form of being part of a large organization that has negotiated access.

But! The principles of this fund apply to many similar, publicly available Vanguard index funds. You can get that "tiny slice of everything" in other ways.

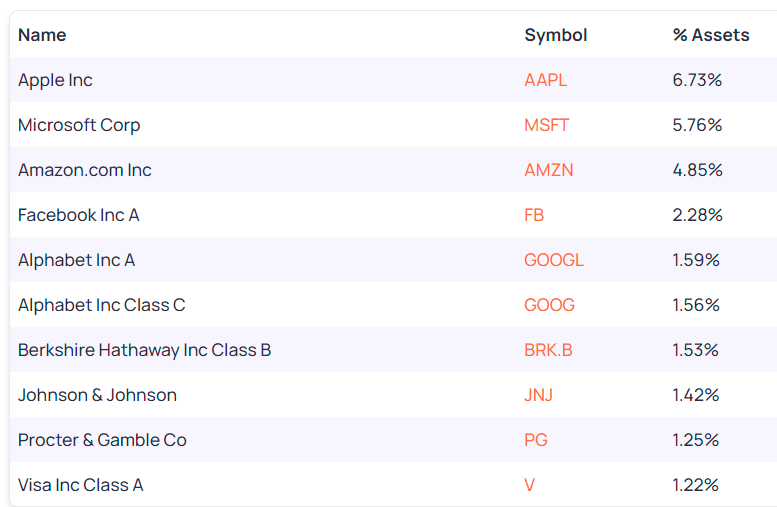

The fund's investment objective is typically to track a broad U.S. stock market index. This means it holds a huge number of stocks, spread across different industries.

The expense ratio, which is the yearly fee you pay to own the fund, is generally very, very low for institutional funds like this. That's a huge win for investors.

Another key detail is its stability. Because it holds so many different companies, the ups and downs of any single company have a much smaller impact on the overall fund. It’s like having a sturdy ship in a stormy sea.

The "Unpopular" Opinion

Here’s where I might get some flak from the stock-picking gurus. My "unpopular" opinion is that for most people, and for a significant chunk of their investments, a broad-based index fund like the one behind VTSNX is probably the best way to go.

It's not flashy. It won't make you a millionaire overnight (unless you're already investing millions). But it's a reliable, low-cost way to participate in the growth of the U.S. economy over the long term.

It’s the sensible, dependable friend in the chaotic world of investing. It doesn't promise the moon, but it usually delivers you to a pretty good place eventually.

So, next time you hear about the Vanguard Institutional Index Fund Institutional Shares with the ticker VTSNX, don't be intimidated. Think of it as the giant, diversified, low-cost engine powering a big part of the financial world. And maybe, just maybe, consider if a similar, more accessible version could be right for your own financial journey. It's not always about the flash; sometimes, it's about the steady, smart climb.