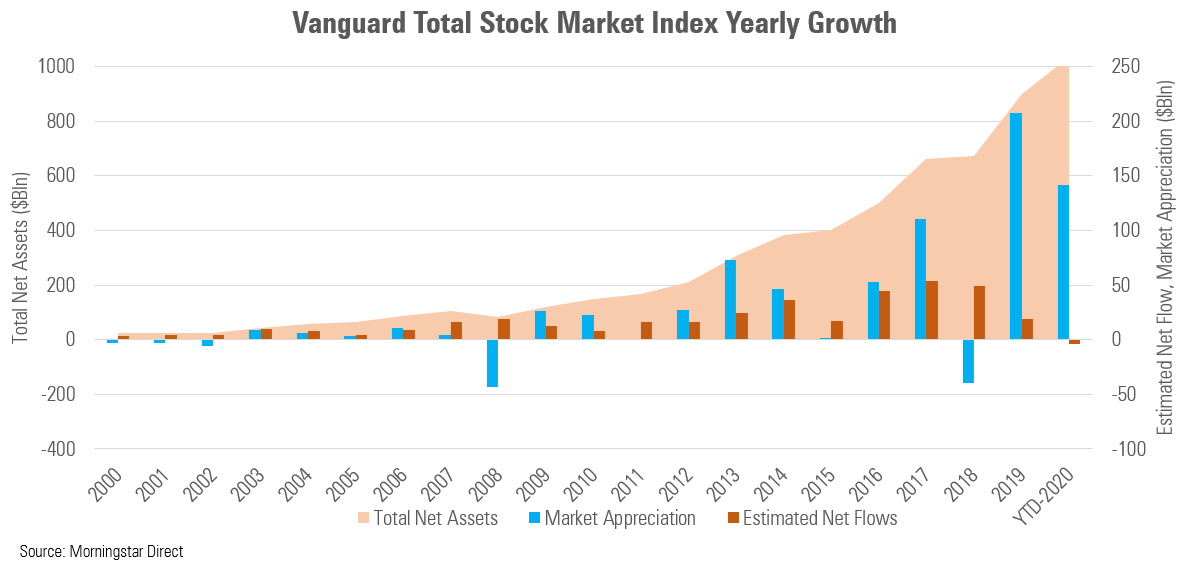

Vanguard Institutional Total International Stock Market Index: Complete Guide & Key Details

Ever feel like your investment portfolio is a bit... small-town? Like it's only ever visited the same familiar streets and never dared to explore the bustling metropolises and charming villages of the global financial scene? Well, buckle up, buttercup, because we're about to introduce you to a ticket to the whole darn planet's stock markets, and it's called the Vanguard Institutional Total International Stock Market Index. Yes, it's a mouthful, but trust me, it's the financial equivalent of a passport stamped with adventure!

Imagine this: you're craving pizza, but you've only ever had the one from your local joint. Delicious, sure, but what about that Neapolitan masterpiece in Italy? Or that deep-dish delight in Chicago? The world of investing is pretty similar. You might have a fantastic handle on your domestic stocks, but you're missing out on a whole buffet of flavors and opportunities across the globe. That's where this mighty Vanguard fund swoops in, like a financial superhero with a map of the entire world.

Your All-Access Pass to Global Goodies

So, what exactly is this Vanguard Institutional Total International Stock Market Index, anyway? Think of it as a giant, super-diversified basket overflowing with stocks from pretty much every country outside of the United States. We're talking about companies in Europe, Asia, South America, Africa – you name it, they're likely in this basket. It's like a "choose your own adventure" for your money, but instead of picking your path, you're letting Vanguard do the heavy lifting.

This fund is designed to mirror the performance of a massive index that tracks the stock market performance of developed and emerging markets around the world (excluding the U.S.). So, instead of you having to research and buy individual stocks in, say, Japan, Germany, or Brazil, this one fund does it all for you. It's the ultimate "set it and forget it" for globetrotters of the financial world. No more staring at confusing ticker symbols from faraway lands!

Why Bother Going International? It's All About the Spice!

You might be thinking, "But I like my American stocks! They're reliable!" And they are! But relying only on one country's market is like eating only vanilla ice cream. It's good, but imagine the deliciousness of strawberry, chocolate, pistachio, and maybe even some exotic durian flavor! Different markets move at different speeds and in different ways. Sometimes, while the U.S. market is taking a nap, international markets are doing a happy dance. Or vice-versa!

By diversifying internationally, you're spreading your risk. If one country's economy hits a bump in the road, it's less likely to derail your entire investment ship. It's like having multiple lifeboats on your grand voyage. Plus, you get to tap into the growth potential of economies that are booming and innovating in ways that might be different from what you're used to. Think of the technological leaps happening in South Korea or the burgeoning consumer markets in India!

It's like having a tiny piece of every major economic powerhouse in your pocket!

Key Details: The Nitty-Gritty (But Still Fun!)

Now, let's get down to some of the important stuff, explained in plain English. Since this is an "institutional" fund, it's generally geared towards larger investors or retirement plans. But the idea behind it is what's really important for anyone thinking about going global with their investments.

Low Costs are King (or Queen!): Vanguard is famous for its incredibly low fees, and this fund is no exception. Think of fees as little gnomes nibbling away at your returns. Vanguard's gnomes are practically on a diet. Lower fees mean more of your hard-earned money stays invested and working for you. It's like getting a bigger slice of the pizza!

Broad Diversification is Your Best Friend: As we've said, this fund is incredibly diversified. You're not just buying a few international stocks; you're buying thousands of them. This wide net means you're capturing the overall performance of the international stock market. It's the ultimate "don't put all your eggs in one basket" strategy, but for global stocks!

Index Tracking Magic: This fund aims to track an index, meaning it tries to mirror the performance of a specific benchmark. It's not trying to be a stock-picking genius; it's aiming to give you the market's return. This "passive" approach is a big reason why the fees are so low and why it's so effective for long-term investors.

Emerging Markets Included: This fund doesn't just stick to the super-developed countries. It also includes "emerging markets." These are countries that are developing rapidly and have the potential for high growth. It's like getting a ticket to the VIP section of the global economy!

The Bottom Line: Your Global Investment Adventure Awaits!

The Vanguard Institutional Total International Stock Market Index is more than just a fund; it's an invitation. An invitation to expand your investment horizons, to tap into global growth, and to potentially build a more robust and resilient portfolio. It's the financial equivalent of packing your bags and saying, "The world is my oyster... and my stock market!" So, next time you're thinking about your investments, remember that the world is a big, exciting place, and there's a whole lot of potential waiting to be discovered. Happy investing, you global financial explorer!