Vanguard Institutional Total International Stock Market Index Trust Ticker: Complete Guide & Key Details

Ever feel like your financial world is a little… local? Like you’re happily sipping your latte at your favorite cafe, but the wider world of investment opportunities is just a blurry postcard you’ve never actually visited? Well, pull up a comfy chair, because we’re about to take a casual stroll through the fascinating landscape of international investing, specifically with a spotlight on the Vanguard Institutional Total International Stock Market Index Trust (ticker: VTSNX). Think of this as your chill guide to going global with your portfolio, minus the jet lag and questionable street food decisions.

Now, before you start imagining spreadsheets that would make a tax accountant sweat, let’s keep it breezy. We’re talking about a way to tap into the growth engines of the entire world, excluding the good ol’ U.S. of A. Why is that important? Because staying solely domestic can be like only ever listening to your favorite band. You love them, sure, but there’s a whole universe of amazing music out there waiting to be discovered! The same applies to your investments.

Unpacking the Name: What's in a Ticker?

Let’s break down that mouthful of a name, shall we? Vanguard – you probably know them. They’re the folks who’ve been championing low-cost, accessible investing for ages. Think of them as the friendly neighborhood barista of the finance world, always ready with a solid, reliable brew.

Institutional – this part might sound a bit intimidating, like it's only for big wigs in corner offices. But don't let it fool you! While it’s called "institutional," these types of funds are often accessible to individual investors through retirement plans like 401(k)s or by meeting certain minimum investment requirements. It’s like getting the VIP treatment at a concert, but without the ridiculously overpriced bottled water.

Total International Stock Market Index Trust – this is where the magic happens. "Total International Stock Market" means it’s designed to give you exposure to a huge chunk of the stock markets across the globe, excluding the United States. It’s not picking and choosing a few star players; it’s more like buying a ticket to the entire international league, with all its ups and downs, its triumphs and its… well, let's just say its "learning experiences." "Index Trust" means it’s an index fund, aiming to mirror the performance of a specific benchmark index. No active stock-picking here, which often translates to lower fees and a more predictable, diversified approach.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A6OOX7PBSVEJ5BXDFSPKGLO72M.png)

Why Go Global? It's More Than Just Souvenirs

So, beyond the cool factor of saying you invest internationally, what’s the real deal? Diversification, my friends! It’s the golden rule of investing, like the golden rule of life: don’t put all your eggs in one basket. If the U.S. market hits a rough patch – maybe a bit of economic turbulence, a sudden urge for everyone to wear bell-bottoms again – your international investments might be doing just fine. They could even be thriving, helping to cushion any domestic blows.

Think about it: the world is a massive place, bursting with innovation, diverse economies, and unique cultural influences. From the bustling tech hubs of Asia to the emerging markets in South America, there are opportunities popping up everywhere. The VTSNX aims to capture that broad spectrum, giving you a slice of growth from places you might only know from travel documentaries or delicious international cuisine.

Plus, different markets have different cycles. What’s booming in Europe might be taking a breather in Asia, and vice-versa. By spreading your investments across these varied landscapes, you're smoothing out the ride. It’s like enjoying a diverse playlist instead of listening to the same song on repeat for hours. Variety, as they say, is the spice of life – and a smart investment strategy.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

Key Details: The Nitty-Gritty, Without the Grind

Alright, let’s get a little more specific, but we’ll keep it light. When you’re looking at a fund like VTSNX, a few things are super important:

Expense Ratio: Your Fee Friend

This is a biggie. The expense ratio is the annual fee charged by the fund to cover its operating costs. For index funds, especially from Vanguard, these are typically very low. Think of it as the small service charge for a really great meal. A low expense ratio means more of your investment returns stay in your pocket, not in the fund manager’s. VTSNX is known for its competitive expense ratios, which is a huge plus.

Holdings: What's Actually in the Basket?

This fund holds stocks of companies from developed and emerging markets outside the U.S. It’s designed to be broad. We’re talking about hundreds, if not thousands, of companies. You won't find it heavily weighted towards just a handful of tech giants in one country. Instead, it's a diversified snapshot of the global economy. This is like getting a sampler platter of the world’s best international dishes – a little bit of everything, so you don’t miss out on any culinary delights.

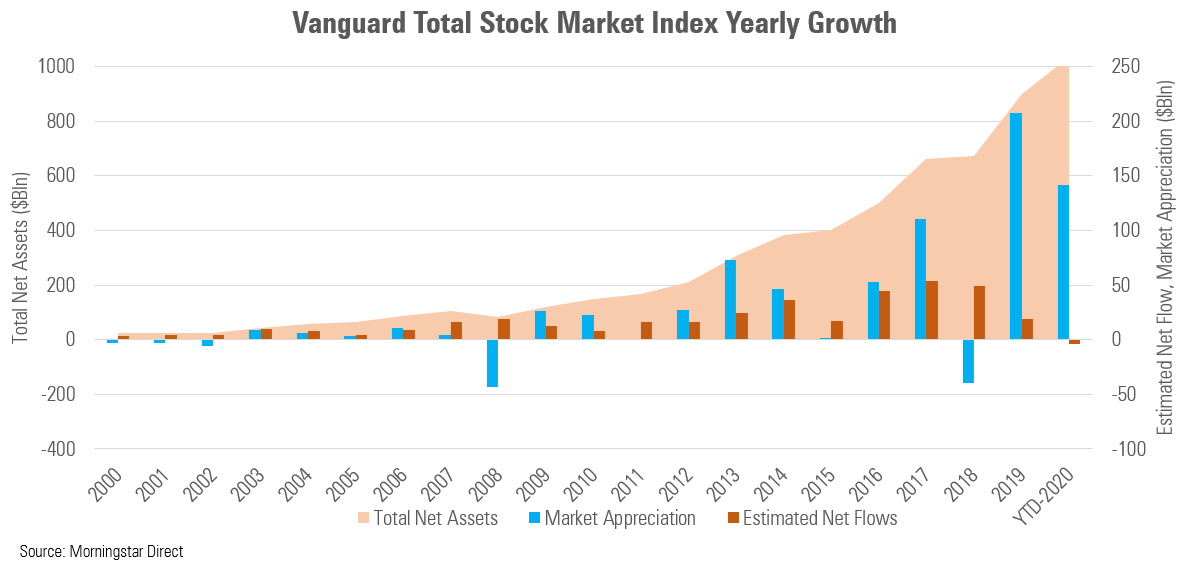

Performance: Keeping an Eye on the Trends

No one can predict the future, but understanding a fund’s historical performance can give you a sense of its potential. Since it’s an index fund, its performance will closely track its benchmark index. You’ll want to see how this benchmark has performed over time in various economic conditions. Think of it like checking the weather forecast for a trip – you know what to expect, even if there might be a surprise shower.

Risk Tolerance: Is It Your Cup of Tea?

International investing, by its nature, comes with its own set of risks. These can include currency fluctuations (the value of foreign currencies against the dollar), political instability in certain regions, and differing economic conditions. VTSNX, by diversifying across many countries, aims to mitigate some of these individual risks. However, it’s still a stock fund, so it will experience market volatility. It’s like choosing a hiking trail: some are gentle strolls, others are more challenging mountain climbs. Make sure the path aligns with your comfort level.

Practical Tips for Your Global Adventure

So, how do you actually bring VTSNX (or a similar international index fund) into your investment life? Here are some easy-going tips:

- Check Your Retirement Plan: This is often the easiest entry point. Log into your 401(k) or similar plan portal and see if VTSNX, or an equivalent international index fund, is offered as an investment option. If it is, consider allocating a portion of your contributions to it.

- Understand Your Allocation: How much should you invest? There’s no one-size-fits-all answer, but many financial advisors suggest a healthy portion of your portfolio (say, 20-40%) should be allocated to international stocks for effective diversification. Think of it as seasoning your portfolio – too little and it’s bland, too much and it might be overwhelming.

- Rebalance Periodically: Markets move. Over time, your international allocation might grow or shrink relative to your domestic investments. Periodically (like once a year), you might want to rebalance your portfolio to bring it back to your target allocation. It’s like tidying up your closet to make sure everything is in its rightful place.

- Don't Panic Sell: International markets can be more volatile than the U.S. market. When you see dips, remember the long-term picture and resist the urge to sell in a panic. Think of it as weathering a storm; eventually, the sun will shine again.

Fun Little Facts to Ponder

Did you know that Japan has the third-largest stock market in the world? Or that the MSCI Emerging Markets Index, which VTSNX likely includes components of, covers countries that are experiencing rapid growth and industrialization? These are the places that might be shaping the future of innovation and consumer trends. It’s like investing in the next big thing before it’s even a thing!

Also, consider the cultural exchange. When you invest in companies around the world, you’re indirectly supporting businesses that create jobs, innovate, and contribute to economies far beyond your own backyard. It’s a subtle, yet powerful, way to connect with the global community, all from the comfort of your own home.

A Daily Reflection: Beyond the Familiar

Think about your morning commute. You see familiar buildings, familiar faces. Now, imagine that commute stretched across continents, through bustling metropolises and quiet, growing towns. That’s the essence of what an international index fund like VTSNX offers: a way to participate in that global journey. It's not just about chasing returns; it's about acknowledging that the world is a vast, interconnected tapestry of opportunity. And by weaving a small thread of your investments into that tapestry, you're not only diversifying your financial future, but you're also, in a quiet, unassuming way, becoming a participant in the grand, unfolding story of global progress. So, the next time you enjoy a coffee from Colombia or a gadget made in Taiwan, remember that your investments can also be a part of that global flavour, adding a rich and diverse note to your financial well-being.