Vanguard Target Retirement 2030 Trust I Ticker Symbol: Complete Guide & Key Details

Hey there! So, you're thinking about your golden years, huh? Smart move, seriously. It feels like a million years away sometimes, doesn't it? But then you blink, and suddenly, BAM! Retirement is knocking. And if you're aiming for 2030, well, that's practically around the corner, like the next season of your favorite show. Today, we're diving into something called the Vanguard Target Retirement 2030 Trust I. Sounds a bit fancy, right? Like a secret handshake for the financially savvy. But honestly, it’s just a super helpful tool designed to make your retirement dreams a reality. And its ticker symbol? Super important! It's your little secret code to find this guy. We'll get to that!

So, what is this thing, really? Imagine a giant, perfectly curated buffet for your retirement. That's kinda what a target-date fund is. And this one? It's specifically for folks who are eyeing retirement in, you guessed it, 2030. No need to be a financial wizard here, which is a big win for all of us, am I right? It’s all about taking the guesswork out of it. They’ve done the heavy lifting so you don’t have to. Pretty sweet deal.

Now, about that ticker symbol. Drumroll, please! The ticker symbol for the Vanguard Target Retirement 2030 Trust I is VTTHX. Yep, VTTHX. Say it with me: V-T-T-H-X. Easy peasy, lemon squeezy. Think of it like your favorite coffee shop’s secret menu item, but instead of a fancy latte, it gets you a ticket to a relaxed future. You'll use this code to find it on brokerage platforms, financial news sites, anywhere you’re tracking your investments. It's your little digital fingerprint for this specific fund. So, remember VTTHX. Jot it down. Tattoo it on your forehead (okay, maybe not that last part, but you get the idea).

Why 2030, you ask? Well, if you're planning to hang up your work boots around that year, this fund is practically tailor-made for you. It’s designed to be aggressive now, when you've got time on your side. Think of it like a young athlete training hard. It’s going to be invested in things that have the potential for more growth. Stocks, usually. They’re a bit more exciting, a bit more… well, volatile. But that’s okay! Because when you're young (financially speaking), you can afford to take a few more swings. You have time to recover if the market does a little wobble, or a big wobble, for that matter.

As you get closer to 2030, though, this fund isn’t going to stay static. Oh no. It’s smart. It automatically starts shifting its strategy. It becomes more conservative. It’s like that athlete getting older and switching to a less demanding, more strategic game. It’ll gradually move into more stable investments, like bonds. Bonds are typically seen as the steady Eddy of the investment world. Less flashy, but definitely more reliable when you’re getting ready to actually spend that money. So, the fund is constantly adjusting for you. It’s like having a personal financial coach, but one that never asks for a ridiculously high hourly rate. Just the expense ratio, and we'll get to that later!

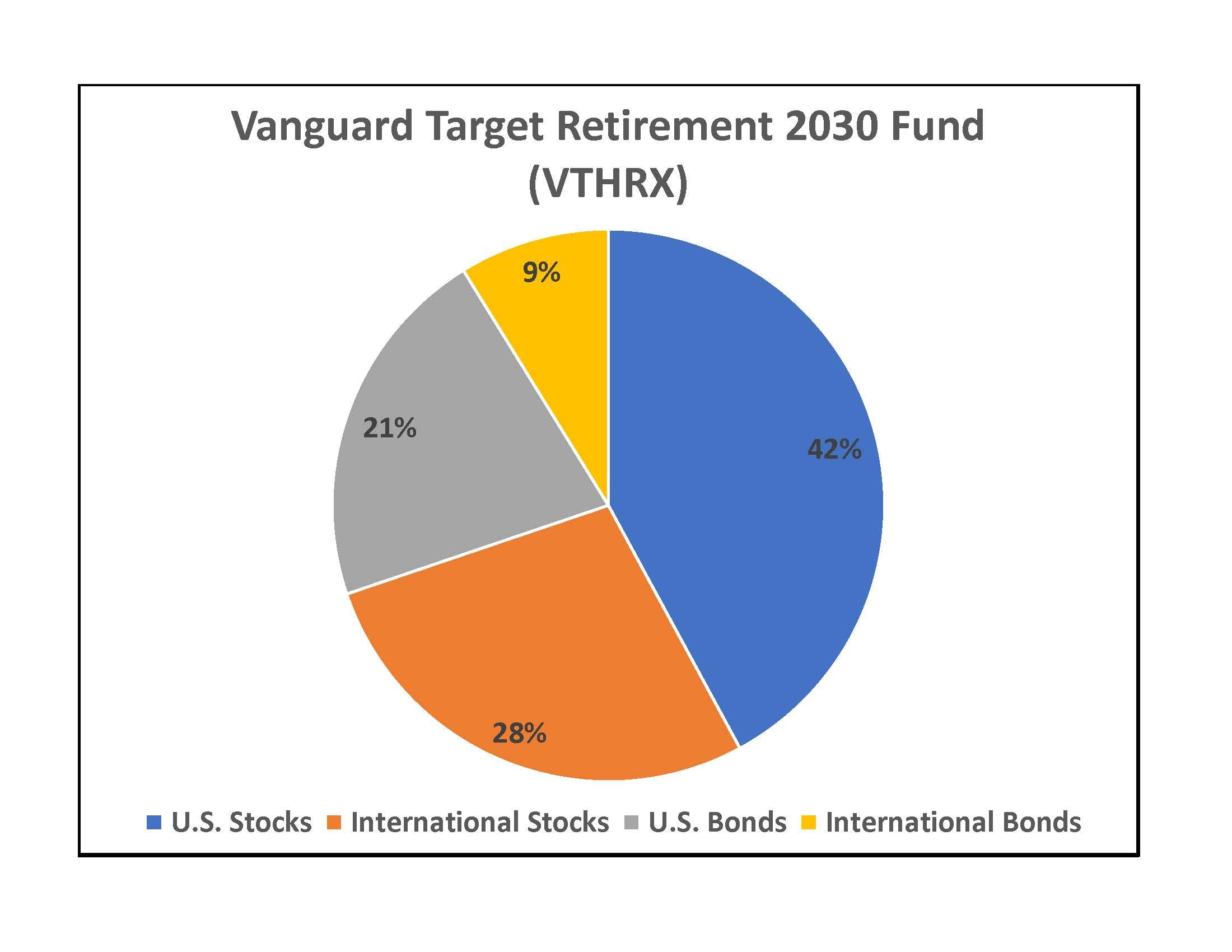

So, let’s break down what’s actually inside this magical VTTHX. It’s a fund of funds. Don’t let that intimidate you. It just means Vanguard isn't directly buying individual stocks and bonds themselves for this specific fund. Instead, they’re buying shares of other Vanguard index funds. Think of it like ordering a pre-assembled gift basket. You get a little bit of everything, all put together by the pros. This includes a mix of U.S. stocks, international stocks, and bonds. A real diversified smorgasbord! Diversification is your best friend in investing, by the way. It means you’re not putting all your eggs in one basket. If one basket tips over, you’ve still got others. Phew!

The beauty of a target-date fund like VTTHX is that it takes care of all the rebalancing for you. You know how sometimes you mean to adjust your portfolio, and then life just… happens? Yeah, me too. But with this fund, the folks at Vanguard are doing that for you. They’re making sure the mix of stocks and bonds stays appropriate for your retirement year. It’s like a financial auto-pilot. You just set it and… well, you still need to keep contributing, but you don’t have to fiddle with the controls as much. Major brownie points for convenience, wouldn’t you say?

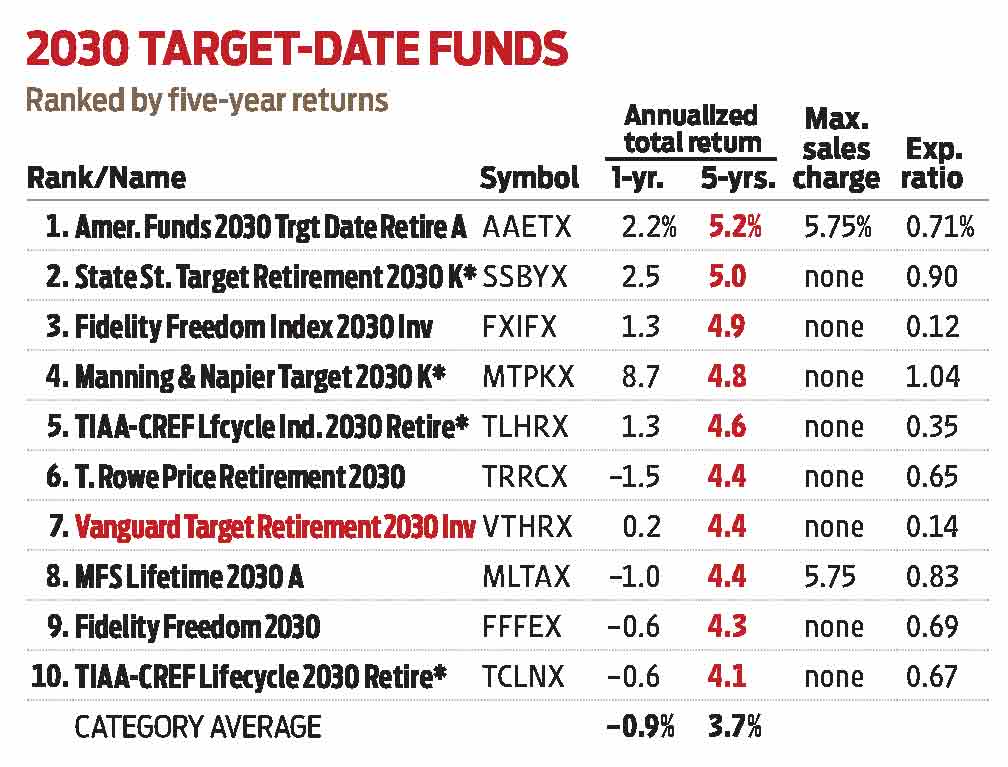

Now, let’s talk about the nitty-gritty: the costs. Because, let's be honest, nobody wants to see their hard-earned money disappear into fees. Vanguard is known for its low costs, and VTTHX is no exception. This is a HUGE deal. High fees can really eat into your returns over time. It’s like paying a hefty toll on a road trip. The longer you travel, the more you pay. So, when Vanguard offers low expense ratios, it means more of your money stays invested and working for you. It’s a serious advantage. For VTTHX, the expense ratio is typically quite competitive, usually a fraction of a percent. It’s really a testament to Vanguard’s philosophy: keep costs down, pass the savings onto investors. They’re practically saints in the investing world. Okay, maybe not saints, but definitely really good guys.

What does that low expense ratio actually mean for you? Imagine you have $10,000 invested. If the expense ratio is 0.10% (that’s a super low example, but you get the idea), you’re paying $10 a year in fees. If it were 1%, you’d be paying $100 a year. Over 10, 20, or even 30 years, that difference adds up to a lot of money. Money that could be compounding and growing for your retirement. So, when you see that low number for VTTHX, give yourself a little pat on the back. You’re making a smart, cost-effective choice. It’s the financially responsible thing to do, like finally cleaning out that junk drawer you’ve been avoiding for months.

So, who is this fund for? Primarily, it's for people who want a simple, hands-off approach to retirement investing and who are targeting retirement around the year 2030. If you’re the type who gets a little anxious about managing your own investments, or if you simply don’t have the time or inclination, a target-date fund like VTTHX is a fantastic option. It’s perfect for beginners, but it’s also great for seasoned investors who appreciate the convenience and built-in rebalancing. It’s like a set-it-and-forget-it meal, except this meal is designed to feed your future self a very comfortable retirement. And who doesn’t want that?

Think about the alternatives. You could try to build your own portfolio of individual stocks and bonds. That requires a lot of research, ongoing monitoring, and the discipline to rebalance regularly. Or, you could invest in a traditional mutual fund that requires active management. Those often come with higher fees. For many people, the effort and the cost just aren't worth it. Target-date funds like VTTHX offer a middle ground. They’re professionally managed (in the sense that the allocation is automatically adjusted), they’re diversified, and they’re low-cost. It’s a win-win-win situation, really.

Let’s talk about the “Trust I” part of the name. Does that mean anything special? Not really, for most investors. It usually refers to the specific share class of the fund. Vanguard offers different share classes for its funds, sometimes to cater to different types of investors or different platforms. For the individual investor looking to buy this fund, “Trust I” is just part of its official designation. It doesn't typically change the underlying investment strategy or the performance significantly compared to other share classes of the same fund. So, don’t lose sleep over it. Just focus on VTTHX!

What are the potential risks of VTTHX? Well, like any investment that includes stocks, there's always the risk that the market could go down. Target-date funds are designed to mitigate some of that risk by becoming more conservative over time, but they can't eliminate it entirely. If there's a major market downturn just before or shortly after you plan to retire, it could impact the value of your savings. That’s why having a time horizon of 2030 is important for this specific fund. If you're retiring in 2050, you'd want a different target-date fund with a much more aggressive allocation. It’s all about matching the fund to your timeline.

Another thing to consider is that a target-date fund offers a pre-set allocation. You don't get to pick and choose exactly how much goes into that emerging market stock fund or that high-yield bond fund. The fund managers have decided that for you. For some people, that’s a huge relief. For others, it might feel a little restrictive if they have strong opinions about specific asset classes. But honestly, for the vast majority of people aiming for retirement, this pre-set allocation is exactly what they need. It’s designed to be a balanced approach.

So, where can you actually buy VTTHX? If you have a brokerage account, like at Vanguard itself, Fidelity, Schwab, or any other major brokerage firm, you can usually search for it using its ticker symbol: VTTHX. You can also often find it within retirement plans like a 401(k) or an IRA. If you’re participating in a company-sponsored retirement plan, check the list of available investment options. It might be there! If it’s not, you might have to open an individual retirement account (IRA) to invest in it directly.

When you're looking at your investment statements, don't be surprised if VTTHX appears as a single line item. That's the beauty of it! It represents your entire diversified portfolio for retirement in one convenient package. It’s like having a perfectly organized filing cabinet, where all your retirement documents are neatly tucked away in one folder. No more searching through a messy pile of papers, or, in this case, a confusing list of individual holdings.

The bottom line? If you’re looking towards 2030 and you want a simple, low-cost, and automatically adjusting way to invest for your retirement, the Vanguard Target Retirement 2030 Trust I (VTTHX) is definitely worth a serious look. It’s designed to grow your money when you’re younger and protect it as you get closer to retirement. It takes a lot of the stress and complexity out of investing, leaving you more time to actually enjoy planning your retirement. So, go ahead, do a little research, check it out, and see if VTTHX is the right ingredient for your retirement recipe. Your future self will thank you for it!