Vanguard Total Bond Market Ii Index Fund

Hey there, curious minds and fellow travelers on the road to financial well-being! Ever find yourself staring at a menu of investment options and feeling a little… overwhelmed? It’s like trying to pick a favorite flavor of ice cream when there are a hundred to choose from, right? Well, today, let’s take a little detour and chat about something that might sound a tad technical at first, but is actually pretty neat once you dig into it. We’re going to explore the Vanguard Total Bond Market II Index Fund. Don't worry, no complicated jargon here, just a friendly chat about what this thing is and why it might be worth a second glance.

So, what exactly is a "Total Bond Market Index Fund"? Think of it like this: imagine you want to taste a little bit of everything in the world of bonds. Not just one specific type, but a huge, diverse buffet of them. That’s essentially what an index fund does. It tries to mirror the performance of a specific, broad market index. In this case, it’s the "Total Bond Market." Pretty straightforward, right? It’s like saying, "I want to invest in the whole darn bond market, not just a tiny corner of it."

And this "II" in the name? Well, that usually just signifies a specific share class or version of the fund, often designed for certain types of investors or with slightly different fee structures. For us regular folks just trying to understand it, think of it as a specific flavor of that big bond buffet – a really popular and accessible one, at that.

Now, why bonds, you might ask? Aren’t stocks the exciting ones, the ones that make headlines? Stocks are definitely the flashy rock stars of the investment world, no doubt about it. They can soar to amazing heights! But bonds? Bonds are more like the steady, reliable bass players of your investment band. They might not always be the loudest, but they provide the foundational rhythm and stability. They’re the ones that tend to be a bit less… wild than stocks.

When you invest in stocks, you’re essentially buying a little piece of a company. If that company does well, your piece becomes more valuable. But if the company hits a rough patch, or the whole economy gets shaky, your piece can lose value pretty quickly. It’s a bit like riding a roller coaster – lots of ups and downs!

Bonds, on the other hand, are more like loans. When you buy a bond, you’re lending money to an entity – it could be the government (federal, state, or local) or a corporation. In return for lending them your money, they promise to pay you back with interest over a set period, and then return your original loan amount. It’s like you’re the bank, and they’re the borrowers. Sounds pretty responsible, doesn't it?

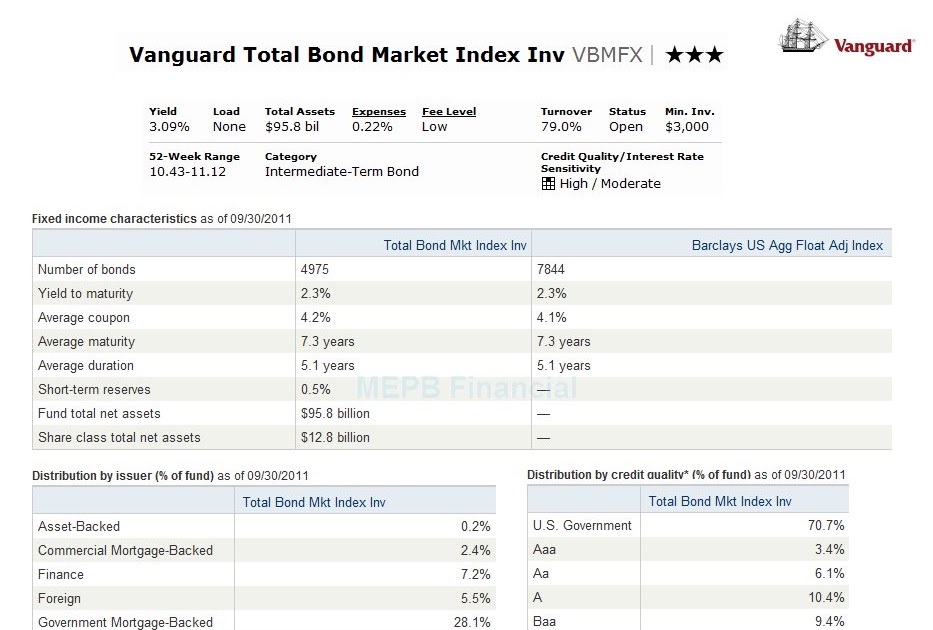

The Vanguard Total Bond Market II Index Fund, by investing in a total bond market index, gives you exposure to a vast array of these loans. We're talking about a huge mix. This includes things like U.S. Treasury bonds (considered super safe), corporate bonds (from companies, varying in risk), and mortgage-backed securities (loans tied to real estate). It’s a whole spectrum!

Why is this "Total Market" approach so cool?

Well, think about it. If you tried to pick individual bonds yourself, you’d have to become an expert on interest rates, credit ratings, and economic forecasts. It’s like trying to curate your own personal music festival. You'd need to know who the headliners are, who the up-and-coming artists are, and how to book them all. Exhausting, right?

An index fund does all that heavy lifting for you. Vanguard, in this case, essentially says, "We’re going to buy a little bit of everything that’s in this big bond index." So, if one type of bond is doing fantastically well, you get a little boost. If another type is having a tougher time, the impact on your overall investment is cushioned by all the other bonds you own. It’s like having a diverse portfolio of musical genres at your festival – if the rock tent is a bit quiet one night, the jazz tent or the folk stage might be rocking, keeping the overall vibe alive.

This diversification is a really important word in investing. It’s all about not putting all your eggs in one basket. The Total Bond Market II Index Fund is a prime example of diversification in action, but for bonds. It spreads your investment across thousands of different bonds, which helps to smooth out those inevitable bumps in the road.

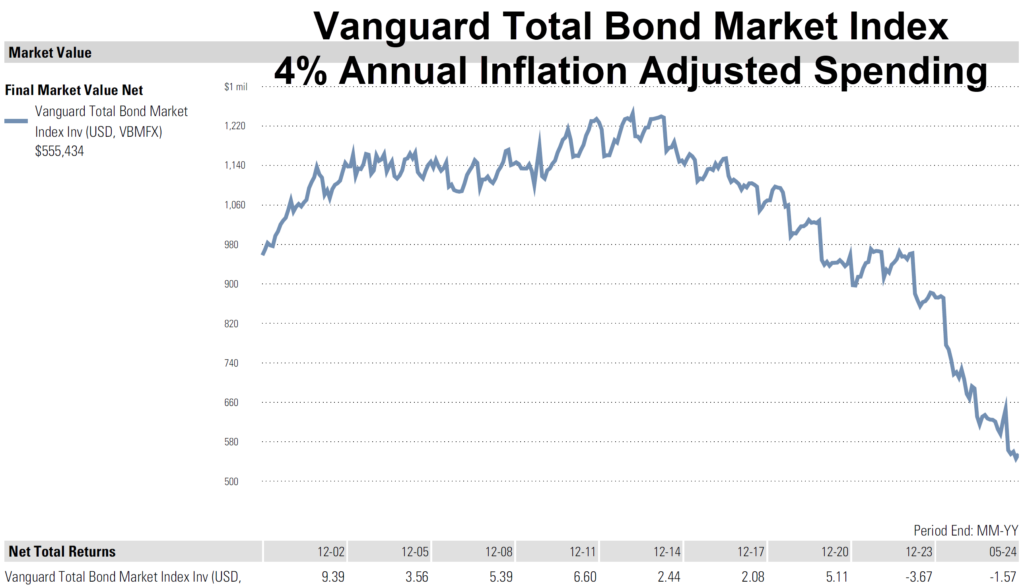

So, imagine you’re looking for some stability, some predictable income, and a way to reduce the overall volatility of your investment portfolio. This fund could be like that cozy blanket on a chilly evening. It’s not the most thrilling thing, perhaps, but it provides comfort and security.

Another reason why these types of funds are so popular is their low cost. Vanguard is pretty famous for offering low-cost index funds. Think about it: if you’re buying a massive basket of bonds, you want the people managing that basket to be efficient and not charge you a fortune for their services. Lower fees mean more of your investment money stays working for you, compounding over time. It’s like getting a really good deal on that concert ticket – more money left over for snacks and merchandise!

The "Index Fund" part means it's passively managed. This means rather than a team of highly paid managers actively trying to pick the "best" bonds (which is really, really hard to do consistently), the fund simply aims to track the performance of its benchmark index. This passive approach is a big reason why the fees are so low. It's like ordering from a well-established, popular restaurant menu versus a place where the chef creates a new, experimental dish every night. The predictable menu is usually more cost-effective!

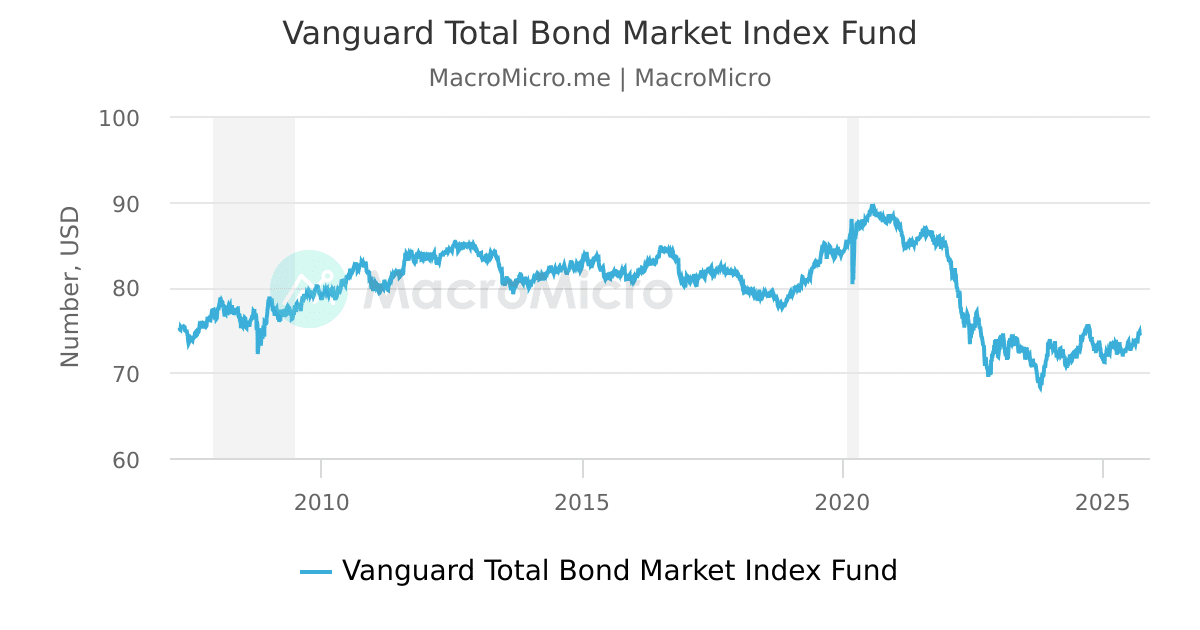

Now, a quick word of caution, because no investment is entirely without risk. While bonds are generally considered less risky than stocks, they’re not risk-free. Interest rate changes can affect the value of existing bonds. If interest rates go up, the value of older, lower-interest bonds might go down. Also, while government bonds are very safe, corporate bonds carry the risk that the company might not be able to pay back its debt (though this fund diversifies across many companies to mitigate this).

However, for many investors, the goal of holding a fund like the Vanguard Total Bond Market II Index Fund is to be a diversifying component of a larger portfolio. It’s often used to balance out the more aggressive growth potential of stocks. Think of it as adding a strong foundation to a tall building. The building might have some flashy, modern additions at the top, but that solid foundation is crucial for its stability.

So, if you’re curious about adding a bit of ballast to your investment journey, or if you’re looking for something that offers a steady hum of income and a potentially smoother ride compared to the wilder swings of the stock market, the Vanguard Total Bond Market II Index Fund is definitely a fund worth exploring. It's like a well-tuned instrument in your financial orchestra, playing its steady, important part.

It's a way to get broad exposure to the vast world of U.S. bonds in a simple, low-cost, and diversified way. It’s not the most exciting investment out there, but sometimes, in the world of finance, steady and reliable can be incredibly powerful. And for that, we can certainly be curious and a little bit impressed!