Vanguard Total Bond Market Index Fund Institutional Plus: Complete Guide & Key Details

Alright, let's talk about something that might make some people's eyes glaze over faster than a burnt toast convention: bonds. Specifically, a bond fund. And not just any bond fund, but the Vanguard Total Bond Market Index Fund Institutional Plus. Sounds like a mouthful, right? Like a robot trying to order a latte. But hang in there, because this seemingly dry topic can be surprisingly… well, not exciting, but definitely important. Think of it as the reliable friend who always shows up on time, even if they don't tell the best jokes.

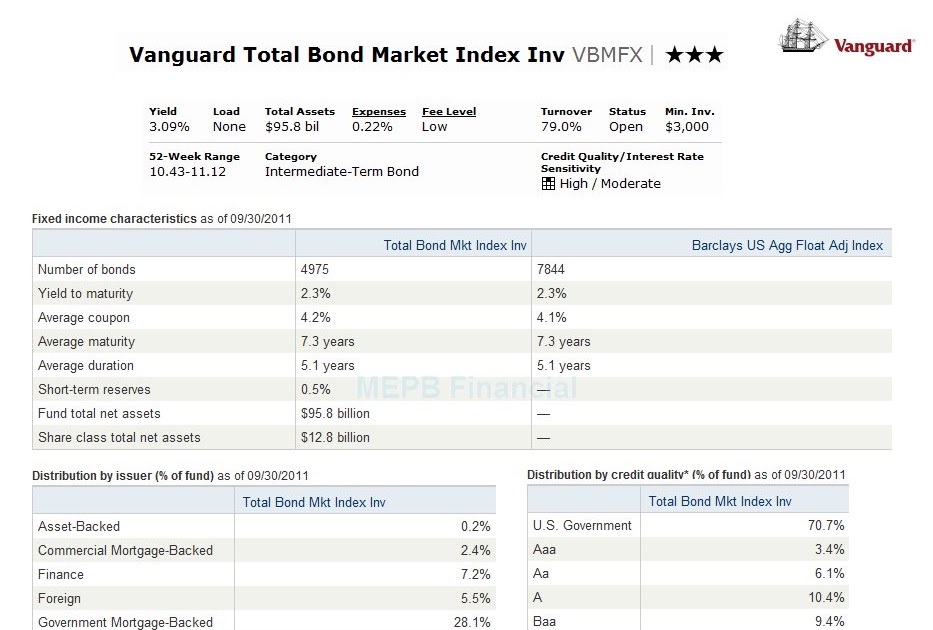

So, what is this beast, the Vanguard Total Bond Market Index Fund Institutional Plus? Imagine a giant basket. This basket is filled with a little bit of almost every kind of bond you can think of in the US. We’re talking government bonds, corporate bonds (from big companies and maybe even some that are a little less big), and mortgage-backed securities. It’s like a buffet for your money, but instead of tiny quiches, you get debt from Uncle Sam and his friends.

Why would anyone want to put their money in such a thing? Well, bonds are generally considered less risky than stocks. Stocks are like that thrilling rollercoaster – lots of ups and downs, potential for huge wins, but also the possibility of feeling a bit queasy. Bonds, on the other hand, are more like a gentle Ferris wheel. You still go up and down a bit, but it’s a much smoother ride. And for many people, especially as they get closer to that mythical land called retirement, a smoother ride is exactly what they’re looking for. They want their money to be there, doing its thing, without keeping them up at night wondering if it’s decided to pack its bags and join the circus.

Now, the "Institutional Plus" part of the name is kind of a wink and a nod. It basically means this fund is designed for big players, like pension funds or super-wealthy individuals. They get a slightly better deal, like a VIP lounge at the airport. But don't let that scare you! The regular version of the Vanguard Total Bond Market Index Fund is readily available to us regular folks. The "Institutional Plus" often just means even lower fees because of the sheer volume of money involved. So, while you might not get a tiny velvet rope, you're still getting a pretty sweet deal with Vanguard's commitment to low costs.

Let's talk about why an index fund is a big deal. Think of it like following a recipe. An index fund doesn't try to be fancy or pick the "best" stocks or bonds. It just tries to perfectly replicate what's in a specific market index, like the Bloomberg U.S. Aggregate Bond Index. This index is like the official scoreboard for the US bond market. So, this Vanguard fund is essentially saying, "Okay, we're going to own a little bit of everything that's on that scoreboard, in the same proportions." It’s not trying to outsmart the market; it’s just trying to be the market, in a small, manageable way.

This is where my unpopular opinion might pop its head out. Many people are obsessed with finding that one magical stock or that hot new trend. They want to be the star of their own financial movie. And that's fun! But for most of us, the real win isn't in hitting a home run every time. It's in consistently showing up, doing the smart thing, and letting the power of compounding do its magic over time. The Vanguard Total Bond Market Index Fund is the financial equivalent of consistently showing up. It’s not going to give you bragging rights at a cocktail party, but it might give you a much more comfortable retirement party down the line.

What are the key details you should know? Well, first and foremost, it's diversified. We already covered that, but it bears repeating. You're not putting all your eggs in one, potentially leaky, basket. Second, low costs. Vanguard is famous for this. Lower fees mean more of your money stays invested and working for you. Think of it as a tiny but mighty superhero fighting off expensive fund managers. Third, it's designed to be stable. While no investment is completely risk-free, bonds, especially a broad fund like this, are generally more predictable than individual stocks. It’s the dependable sidekick, not the flashy lead character.

Now, it's not all sunshine and roses. Bond prices can still go down. Interest rate hikes can make existing bonds less valuable. But the beauty of a fund that holds thousands of different bonds is that the ups and downs tend to smooth out. It’s like having a whole choir singing, rather than just one solo artist who might hit a wrong note. You're likely to get a more harmonious outcome.

The Vanguard Total Bond Market Index Fund Institutional Plus is like the reliable sweater in your closet. It’s not the most exciting piece of clothing, but you know it’s going to keep you warm when you need it.

So, while it might not have the glitz and glamour of a meme stock or the thrill of a day trading adventure, understanding and perhaps even investing in something like the Vanguard Total Bond Market Index Fund Institutional Plus (or its more accessible cousin) is a seriously smart move for many. It’s about building a solid foundation for your financial future, one well-diversified, low-cost bond at a time. It's the unsung hero of a well-balanced portfolio. And sometimes, the unsung heroes are the ones who truly deserve the spotlight.