Western Alliance Bank High Yield Savings Premier: Complete Guide & Key Details

Alright folks, gather ‘round, grab a virtual muffin, and let me tell you about something that might just make your wallet do a happy little jig: Western Alliance Bank’s High Yield Savings Premier account. Now, I know what you’re thinking. "Savings account? Sounds about as exciting as watching paint dry." But hold your horses, because this ain't your grandma's dusty old piggy bank. We're talking about a place where your hard-earned cash doesn't just sit there collecting dust bunnies; it's practically tap-dancing its way to a bigger balance.

Imagine this: you've got a little nest egg, maybe from that side hustle selling artisanal cat sweaters online, or perhaps from bravely battling the urge to buy another avocado toast. Whatever it is, you want it to grow. You want it to work for you. And that’s where Western Alliance Bank swoops in, like a superhero in a sensible business suit, ready to give your money a serious glow-up. The High Yield Savings Premier account is their shining star, a beacon of… well, decent interest rates. Shocking, I know.

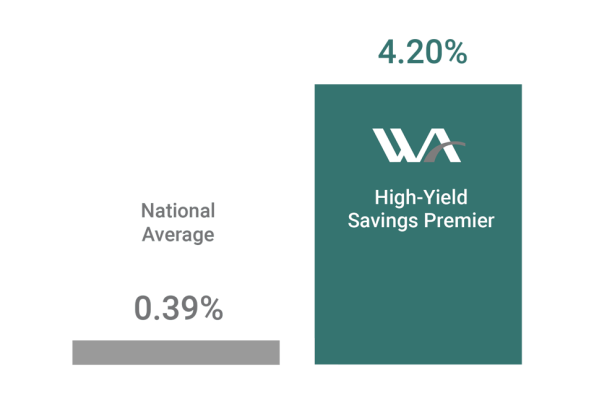

Let’s dive into the juicy bits, shall we? First off, the big kahuna: the interest rate. Now, this isn't some measly trickle; it’s more like a delightfully robust stream. We’re talking about rates that will make you do a double-take. Forget the pennies you're earning at your brick-and-mortar bank that’s probably still using fax machines. This account is designed to give your money a serious boost. Think of it as a personal trainer for your finances, shouting motivational slogans at your dollar bills.

But it’s not all about the flashy numbers. Western Alliance Bank, which, by the way, is a real thing and not just a figment of my caffeine-addled imagination, offers this account with a focus on simplicity. They know you’re busy. You’ve got important things to do, like perfecting your sourdough starter or figuring out why your Wi-Fi signal is weaker in the bathroom. So, they’ve made it easy to set up and manage.

One of the coolest things about this account is the accessibility. While some high-yield accounts make you jump through flaming hoops to get your money back, Western Alliance Bank keeps it pretty straightforward. You can usually access your funds without too much fuss. It’s like having a secret tunnel out of a boring party – essential for those "emergency" ice cream runs.

Now, let’s talk about the minimum balance. This is where some people start to sweat. Will they need to sell a kidney to even open the account? Thankfully, the Premier version often has a pretty manageable minimum. It’s not like they’re asking for the deed to your prized collection of vintage lava lamps. It’s designed to be accessible for folks who are serious about saving but might not be hoarding Scrooge McDuck-level fortunes just yet. Always double-check the exact figure, as it can change faster than fashion trends, but generally, it’s reasonable.

Another key detail is the online banking experience. Western Alliance Bank has invested in a pretty slick digital platform. This means you can check your balance, make transfers, and generally keep an eye on your money’s progress without leaving your couch. Think of it as your financial command center, powered by comfy pants and excellent Wi-Fi. No more waiting in line behind someone who’s arguing about a bounced check from 1998.

And what about security? This is crucial. Your money needs to be safer than Fort Knox. Western Alliance Bank is an FDIC-insured institution. This means your deposits are protected up to the standard maximum, giving you peace of mind. So, you can sleep soundly knowing your savings are in good hands, not being used as collateral for a dodgy llama-breeding scheme.

Let’s consider the types of savings goals this account is perfect for. Is it for a down payment on a house that you'll probably fill with more plants than furniture? Is it for that dream vacation where you'll finally learn to speak fluent Italian (or at least order pasta convincingly)? Or perhaps it's for building a truly epic emergency fund, the kind that can withstand a zombie apocalypse or a sudden craving for a $20 artisanal donut? Whatever your goal, a high-yield savings account can help you get there faster.

Here’s a little secret: the reason these accounts offer higher interest rates is often because they are online-focused. This means lower overhead for the bank. They don’t have to pay for a gazillion fancy branches with marble floors and tellers who judge your questionable deposit amounts. This cost saving is then passed on to you, the customer, in the form of a more generous interest rate. It’s a win-win, like finding an extra fry at the bottom of the bag.

One thing to be aware of is the limited transaction capabilities. Savings accounts, by nature, aren't meant for daily spending. There are usually limits on the number of withdrawals or transfers you can make per month. This is a regulatory thing, designed to distinguish savings from checking accounts. Think of it as a gentle reminder that this money is for growing, not for buying a lifetime supply of novelty socks every Tuesday.

So, to recap, the Western Alliance Bank High Yield Savings Premier account is like finding a hidden treasure chest in your backyard. It offers a competitive interest rate that makes your money work harder, is generally easy to access, and comes with the security of being FDIC insured. The online interface is user-friendly, and the minimum balance requirements are usually quite reasonable.

It’s an excellent option for anyone looking to earn more on their savings without tying up their funds in long-term CDs or dealing with the volatility of the stock market. Think of it as the smart, responsible choice for your money, but with a little extra sparkle. It’s not going to make you a millionaire overnight, unless you’re already starting with a suspiciously large pile of cash. But it will help your savings grow steadily and surely, allowing you to reach your financial goals a little faster. And in the grand scheme of things, that’s pretty darn exciting, wouldn’t you agree?