What Can You Claim Working From Home: Answers To The Questions Everyone Is Asking

So, you've officially joined the glorious ranks of the Work-From-Home Warriors! You've traded the soul-crushing commute for the serene solace of your own domain. You've mastered the art of the perfectly balanced pajama-bottomed professional look. But now, as you settle into this new rhythm, a question starts to bubble up, a whisper in the hallowed halls of your home office (aka, the dining room table): "Can I actually claim stuff for this?"

And the answer, my friends, is a resounding, confetti-popping, virtual high-five YES! It turns out that the powers that be, in their infinite wisdom (and probably after seeing how many of us started brewing our own coffee instead of shelling out five bucks a pop), have decided that some of your home office expenses are, in fact, tax-deductible. Imagine! Your comfy chair could be paying you back! Your extra-bright desk lamp might just be a tiny, glowing money-maker!

The Sacred Space: Your Home Office!

Let's start with the most obvious, the very heart of your WFH empire: your home office. Now, before you go claiming your entire living room because you occasionally check emails while binge-watching your favorite show, there's a little catch. This space needs to be your dedicated workspace. Think of it as your command center, your innovation hub, your secret lair where brilliant ideas are hatched (and where you sometimes hide from the delivery person). It needs to be a place you use exclusively for work. So, that spot on the sofa where you "work" while also napping? Probably not. But that little nook in the spare bedroom that's bursting with filing cabinets and a slightly-too-enthusiastic houseplant? That’s prime real estate for deductions!

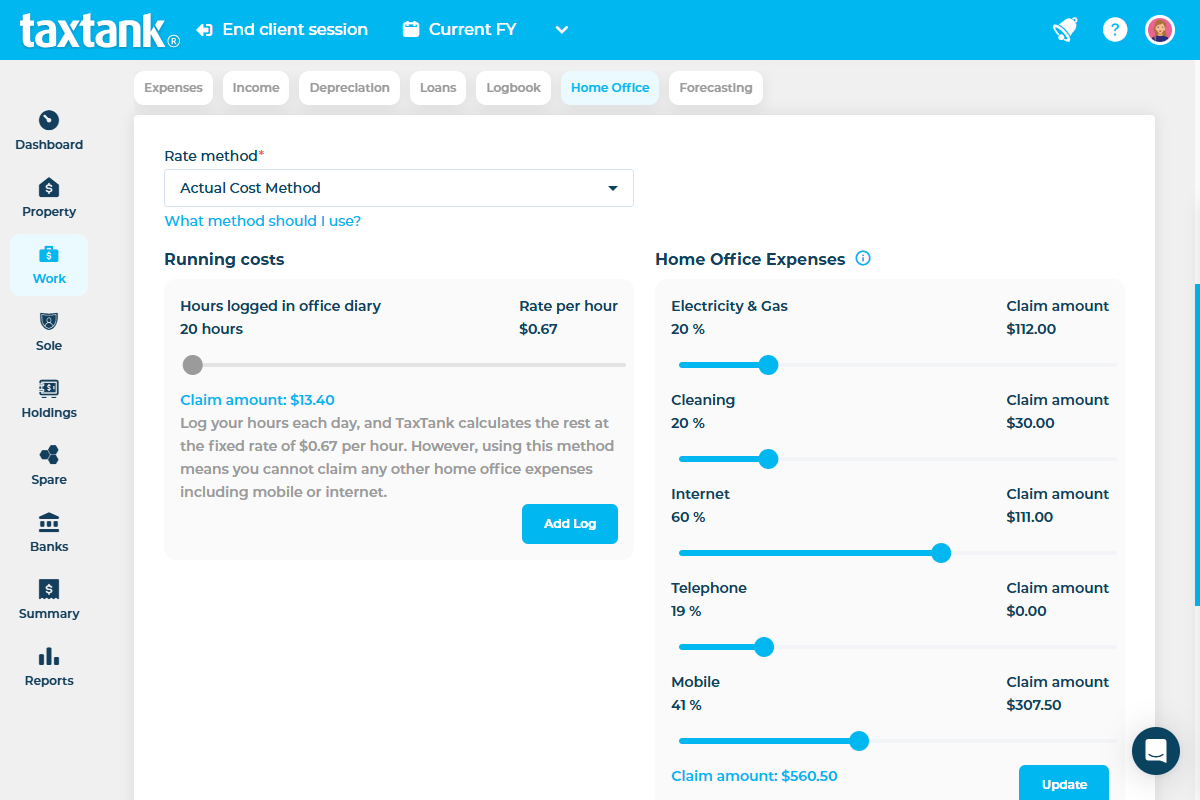

The government, bless their organized little hearts, usually wants you to calculate this deduction based on the square footage of your dedicated workspace compared to the total square footage of your home. So, if your awesome home office is 100 square feet and your house is 1000 square feet, congratulations, you’re looking at claiming about 10% of certain home expenses! More on those in a sec.

The Tools of the Trade: Tech and Gadgets!

Every warrior needs their arsenal, and yours, my WFH comrade, likely involves some serious tech. That super-speedy internet that lets you zoom through meetings without buffering? That fancy new monitor that’s so big it practically has its own zip code? That ergonomic keyboard that saves your wrists from turning into tiny, shriveled raisins? These are your allies!

Many of the computer equipment and accessories you buy for work can be deducted. This includes things like laptops, desktops, printers, monitors, keyboards, mice, and even that ridiculously expensive webcam that makes you look like a movie star. Just remember, the key is that these are necessary for you to do your job. If you're claiming a gaming PC you also use for work, it gets a bit trickier, but generally, if it’s essential for your WFH duties, it’s a potential write-off. Think of it as investing in your productivity, which, in turn, invests in your future tax refunds!

Keeping the Engine Running: Utilities and Bills!

Ah, the glamorous world of utilities. Normally, you just pay these and move on with your life. But when you’re WFH, a portion of these bills can become your financial fairy godmother. That’s right, the electricity that powers your laptop, the heating that keeps you from turning into a popsicle, and the internet that connects you to the world – a portion of these costs can be claimed!

Remember that home office square footage we talked about? This is where it shines again! You can often claim a portion of your utility bills, including electricity, gas, water, and even internet service. It’s like your home is secretly paying you for the privilege of being your workplace. How’s that for a sweet deal? Just don’t go turning up the heat to a tropical 85 degrees just to claim more!

Office Supplies: The Little Things That Add Up!

Pens, paper, staplers, that ridiculously cute desk organizer you just had to have – these are the unsung heroes of the home office. And guess what? They can often be written off too! Even if you’re not stocking a full-blown corporate stationery cupboard, the everyday items you use to keep your work flowing are fair game. Think about it: if you’re constantly printing documents, the ink and toner for your printer is a definite deduction. Those stacks of paper? Yep, those too. And who can forget the humble pen? It might seem small, but these little expenses add up, and claiming them is like finding loose change in the couch cushions of your tax return!

The Mysterious Realm of Home Expenses

This is where that home office square footage really comes into play. If you have a dedicated home office, you might be able to claim a portion of your general home expenses. This could include things like:

Mortgage interest (if you own your home)

Rent (if you rent your home)

Your Top 8 Work at Home Questions & My AnswersProperty taxes

Homeowner's insurance

Utilities (as mentioned before, but this is the broader category)

Claim For Working From Home And Uniform at Juan Zuniga blogHome repairs and maintenance (that specifically relate to your home office, like fixing a leaky faucet in that room)

It’s like a secret handshake with the taxman, where the more dedicated your workspace, the more of your home’s general upkeep can be recognized as a business expense. It’s a bit of a calculated dance, and it’s always a good idea to consult with a tax professional for the specifics, but the potential is there to recoup some of those everyday living costs that are now supporting your professional endeavors!

So there you have it! Your work-from-home life isn't just about comfy pants and endless coffee. It's also about being smart and savvy with your expenses. Don't let those hard-earned dollars slip through your fingers like sand. Embrace the deductions, claim your dues, and let your home office work for you, both for productivity and for your pocketbook! Happy deducting!