What Documentation Do You Need To Open A Bank Account: Complete Guide & Key Details

Think opening a bank account is about as exciting as watching paint dry? Think again! Getting your finances in order is actually a super-empowering step, and it all starts with a few simple pieces of paper. It’s like collecting the secret ingredients to unlock a vault of financial freedom! Understanding what you need can make the whole process a breeze, saving you time and frustration. Plus, it’s a foundational skill for adulting that’s genuinely useful. Let’s dive into the fun world of bank account documentation!

Why Does This Even Matter?

At its heart, opening a bank account is about proving you are who you say you are and that you're a legitimate person wanting to engage in the banking system. Banks have a responsibility to know their customers, largely to prevent things like identity theft, fraud, and money laundering. It’s a bit like a friendly bouncer at the coolest club, making sure everyone’s on the guest list and playing by the rules. This “Know Your Customer” (KYC) process is standard practice worldwide and for good reason!

The benefits of having a bank account are huge. It’s where your hard-earned money can be kept safe and sound, earning a little bit of interest along the way. It makes paying bills, receiving payments, and managing your budget so much easier. Imagine not having to carry around wads of cash or worry about losing checks. A bank account is your gateway to a more organized and secure financial life.

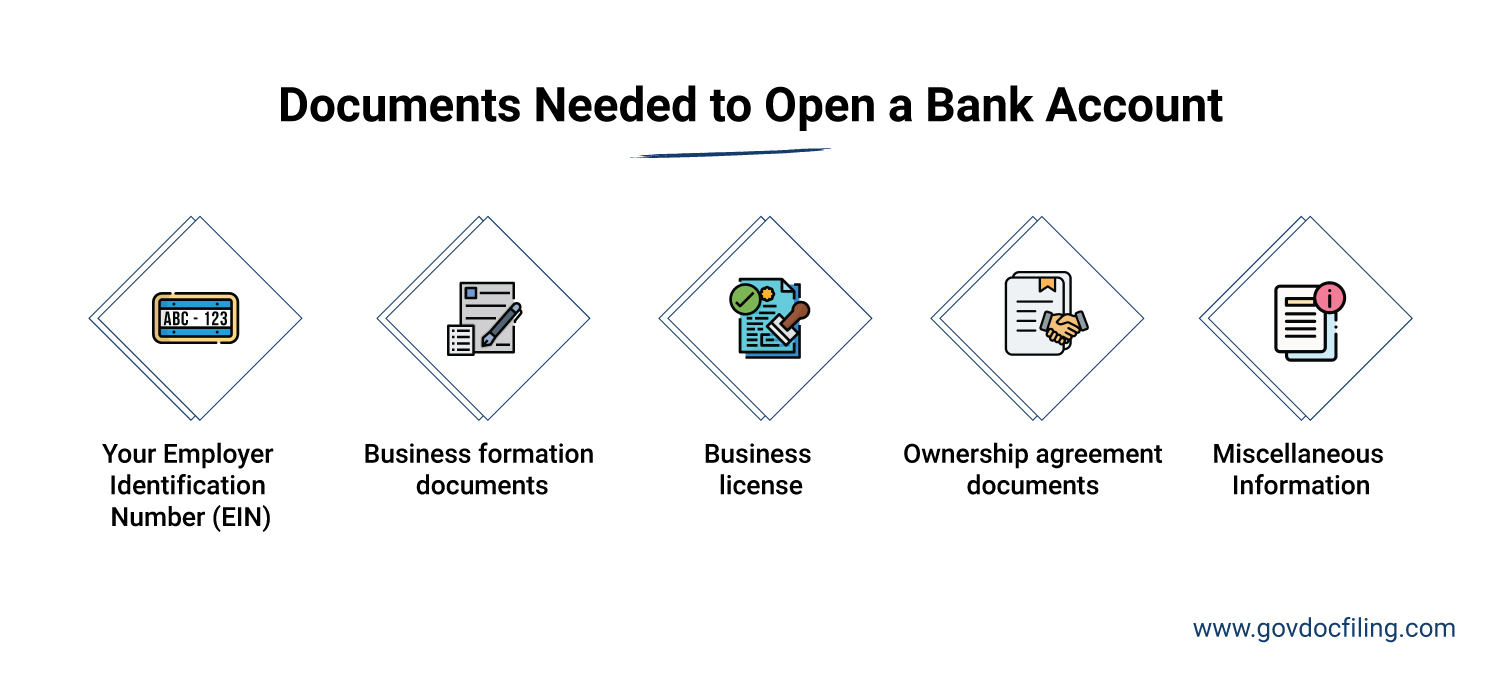

The Essential Arsenal: What You'll Need

Most banks require two main categories of documents: one to prove your identity and another to prove your address. Think of it as your financial identity card and your home base confirmation.

1. Proof of Identity: Who Are You?

This is where you show them your smiling face and your official name. The goal here is to confirm you are a real, living person. Here are the most common and accepted forms:

- Government-Issued Photo ID: This is your golden ticket! The most universally accepted forms are:

- A valid driver's license. Make sure it's not expired!

- A valid state-issued ID card (if you don't drive).

- A valid passport. This is excellent if you have one, especially for international banks or if you're looking to open an account quickly.

- Other acceptable IDs might include a military ID or a national ID card, depending on the bank and your citizenship.

- Secondary Identification (Sometimes Required): In some cases, especially if your primary ID is slightly older or has limitations, a bank might ask for a second form. This could be:

- A Social Security card (though they usually just need the number, not the physical card).

- A birth certificate (less common for general account opening, but can be useful).

- A major credit card with your name on it.

2. Proof of Address: Where Do You Live?

This document shows the bank that you have a stable place of residence. They need to know where to send statements and important mail. Again, these need to be recent:

- Utility Bills: This is a very common one. Think electricity, gas, water, or even internet/cable bills. They must clearly show your name and current residential address. Usually, they need to be from the last 60-90 days.

- Bank or Credit Card Statements: If you already bank elsewhere or have credit cards, a recent statement showing your address is usually a good bet.

- Lease Agreement or Mortgage Statement: If you rent or own your home, your current lease or a recent mortgage statement will do the trick.

- Government Mail: Official correspondence from government agencies (like tax documents or jury duty notices) that show your name and address can also work.

- Pay Stubs: Some banks might accept a recent pay stub if it clearly lists your address.

Important Note: Documents like a P.O. Box address are generally not accepted as proof of residence. Banks need a physical address where you can be reached.

3. Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

This is crucial for tax reporting purposes. Banks need to report any interest earned on your accounts to the IRS. For US citizens, this is your SSN. For non-citizens who are required to pay taxes in the US but don't have an SSN, you'll need an ITIN.

What About Minors or Special Cases?

If you're opening an account for a minor, you'll typically need the same documentation for the adult (parent or guardian) who is opening the account, plus proof of the minor's identity and relationship to the adult. This could be a birth certificate.

For non-citizens, requirements can vary slightly. You might need your passport, visa, or other immigration documents in addition to proof of address. It's always a good idea to check with the specific bank you're interested in to get their exact list.

The Final Check: What Else Might You Need?

Initial Deposit: While not a document, most accounts require a small initial deposit to get started. The amount varies by bank and account type.

A Friendly Bank Representative: Sometimes, the most important "document" is your willingness to ask questions and engage! Don't be afraid to call ahead or speak with a teller if you're unsure about anything.

So there you have it! armed with your photo ID, proof of address, and your SSN/ITIN, you're well on your way to opening a bank account. It’s a simple process that opens up a world of financial possibilities. Happy banking!