What Does Expansionary Fiscal Policy Do To Interest Rates: Complete Guide & Key Details

Hey there! Grab your mug, let's chat about something that sounds super serious but is actually kinda fascinating: expansionary fiscal policy and what it does to interest rates. Yeah, I know, "fiscal policy" can make your eyes glaze over, right? But stick with me, it's like figuring out how your wallet and the economy do a little dance together. Think of it as us just decoding some grown-up economic mumbo jumbo over a virtual coffee.

So, what's the big deal with expansionary fiscal policy anyway? Basically, it's when the government decides to give the economy a little boost. Like when you're feeling a bit sluggish and need a pick-me-up? That's what the government is doing for the whole country! They're trying to get things moving faster, create more jobs, and generally make everyone feel a bit wealthier. Sounds good, right?

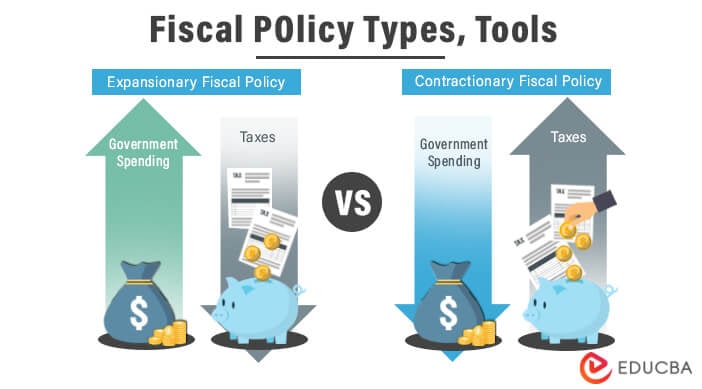

How do they do this boosting? Well, there are a couple of main ways. The government can either spend more money, or they can cut taxes. It’s like they’re saying, “Hey everyone, here’s more cash to play with!” More government spending could be on, I dunno, building new roads (yay, smoother commutes!), funding schools, or even giving out stimulus checks. Tax cuts mean you get to keep more of your hard-earned dough. Who doesn't love that?

Now, let's get to the juicy part: what does all this economic pep-talking do to interest rates? This is where it gets a little… complicated. And by complicated, I mean, sometimes it goes up, and sometimes it might not budge as much as you'd think. It’s not always a straightforward, one-size-fits-all answer, which is why we're digging in!

The "Crowding Out" Effect: A Classic Tale

The most talked-about side effect of expansionary fiscal policy on interest rates is something economists love to call the "crowding out" effect. Sounds a bit aggressive, doesn't it? Like everyone's trying to squeeze into the same tiny elevator.

Here's the gist: when the government spends a ton of money, especially if they're borrowing it (which they often are!), they suddenly become a huge borrower in the financial markets. Think about it. They're not just asking for a little bit; they're asking for billions, or even trillions. They’re the biggest kid on the block wanting all the toys.

To get all that money, the government has to issue bonds. These are basically IOUs. And to make sure people buy these mountains of government debt, they have to offer a decent return. What’s a decent return? Well, that translates to higher interest rates on those bonds.

Now, imagine you're a company, or even just an individual, who also wants to borrow money for a new factory, a car, or, you know, that super fancy espresso machine you’ve been eyeing. If the government is already offering super attractive rates on its super-safe bonds, why would lenders give you money at a lower rate? They wouldn't! They’d rather lend to the government, the ultimate safe bet.

So, what happens? The demand for loanable funds goes up (everyone wants money!), but the supply stays the same or even shrinks because lenders are flocking to government bonds. This increased demand and relatively stable supply naturally pushes interest rates up. It’s like a bidding war, and the government, with its deep pockets (or deep borrowing power), often wins, driving up the price (interest rate) for everyone else.

This is the classic theory, and it's definitely a real thing to watch out for. When the government goes on a spending spree, especially funded by debt, it can indeed make borrowing more expensive for everyone else. So, that boost to the economy from government spending might come with a side of pricier loans. Bummer, right?

But Wait, There's More! (The Nuances)

Okay, so "crowding out" makes it sound like interest rates always shoot up like a rocket. But economics is rarely that simple, is it? If it were, we'd all be retired millionaires by now, or at least have a much better handle on when to buy that espresso machine.

There are a few things that can soften this blow, or even make interest rates do something else entirely. It's like there are secret tunnels and escape routes in our economic labyrinth!

The Role of Expectations: What We Think Will Happen

One of the biggest factors is what people expect to happen. If everyone believes that the government's expansionary policy will lead to a booming economy and higher future incomes, they might be more willing to lend money now, even at slightly lower rates, because they anticipate better returns later.

It’s a bit like when you know your favorite coffee shop is having a huge sale next week. You might hold off on buying that latte today, expecting to get it cheaper (or more of them!) tomorrow. In the economic world, if people expect future growth, they might be less sensitive to current interest rate hikes. They’re playing the long game!

:max_bytes(150000):strip_icc()/expansionary_policy-FINAL-a00b207b3c604a3b8303abe44ca571ae.png)

Also, if the expansionary policy is seen as temporary, its impact on long-term interest rates might be limited. Lenders are more focused on what rates will be in five or ten years, not just next month. If they believe the government will eventually rein in its spending and borrowing, the "crowding out" effect might be less severe.

The State of the Economy: Is It Truly Booming?

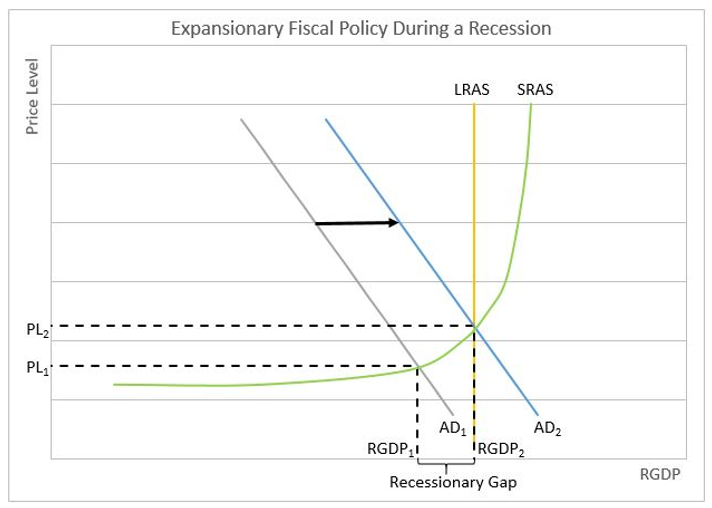

The current state of the economy is a massive influencer. If the economy is in a deep recession, like everyone’s hoarding their cash and businesses are too scared to invest, then the government stepping in with more spending might actually be a good thing. In this scenario, the increased demand for loanable funds might be absorbed by a lot of idle money sitting around.

Think of it like a desert. If there's hardly any water, even a small rain shower makes a big splash. But if it's already a swamp, adding more water might not change the water level dramatically.

In a recession, interest rates might already be super low. The government's borrowing might push them up a little, but not enough to scare off businesses from taking advantage of those still-low borrowing costs to invest and grow. Plus, if the government is spending on things that directly stimulate demand (like infrastructure projects), it can actually boost overall economic activity, which in turn can increase the demand for money for private investment.

It's a bit of a delicate balance. Too much government borrowing when the economy is already cooking with gas? Higher interest rates. Government borrowing during a slump? Might not move the needle as much, and could even be beneficial.

:max_bytes(150000):strip_icc()/Monetary-Policy-ca2313abbf3646e38301b40f3a53a476.png)

Monetary Policy's Role: The Central Bank's Tango

And then there's the other major player: the central bank! Think of them as the conductor of the economic orchestra. They have their own tools, primarily setting monetary policy, which directly influences interest rates. They can, for instance, raise or lower their benchmark interest rate (like the Fed Funds Rate in the US).

If the government is using expansionary fiscal policy to goose the economy, the central bank might react. If they're worried about inflation (prices going up too fast), they might raise their own interest rates to counteract the fiscal stimulus. This would, of course, push borrowing costs up for everyone.

Conversely, if the central bank believes the economy needs a boost and the government's fiscal policy is just a part of the puzzle, they might keep their interest rates low, or even lower them further. This would help to offset any upward pressure on rates from government borrowing.

So, the central bank can either amplify the interest rate effects of fiscal policy or act as a dampener. It’s like a synchronized swimming routine between fiscal and monetary policy. Sometimes they’re in sync, sometimes they’re doing their own thing!

The Size and Scope of the Policy: How Big is the Splash?

The sheer scale of the expansionary fiscal policy matters too. A small tax cut or a minor increase in government spending is unlikely to send interest rates soaring. It’s like a gentle ripple versus a tsunami.

But a massive stimulus package, especially one that involves huge amounts of government borrowing, has a much greater potential to significantly impact interest rates. The bigger the government's demand for money, the more likely it is to compete with private borrowers and drive up costs.

So, if you hear about a multi-trillion dollar infrastructure plan, that's when you'd start paying closer attention to potential interest rate movements. A little sprinkle of cash? Not so much worry.

So, What's the Verdict?

Alright, deep breaths. We've covered a lot of ground. When the government uses expansionary fiscal policy – spending more or cutting taxes – the most common prediction is that it will lead to higher interest rates. This is primarily due to the "crowding out" effect, where the government's massive borrowing competes with private borrowers.

However, it's not a guaranteed slam dunk. Several factors can influence the outcome:

- Expectations: What people think will happen in the future can override immediate effects.

- Economic Conditions: In a recession, the impact might be minimal or even positive.

- Monetary Policy: The central bank can step in and either push rates up or down.

- Scale of Policy: A small stimulus won't do much; a massive one will have a bigger impact.

It’s like asking what happens when you add sugar to your coffee. Usually, it makes it sweeter, right? But if you’ve got a really bitter blend, you might need more sugar. And if you’re already adding milk and cream, the sugar’s effect might be different. The economy is just a slightly more complicated coffee order!

Ultimately, understanding how expansionary fiscal policy affects interest rates is about understanding the interplay between government actions, private sector behavior, and the watchful eyes of the central bank. It's a constant dance, a balancing act, and definitely more interesting than it sounds at first blush!

So next time you hear about the government spending big, you'll have a better idea of the potential ripple effects, especially on those all-important interest rates. Cheers to that! Now, about that espresso machine...