What Entities Make Up The Secondary Mortgage Market: Complete Guide & Key Details

Ever wondered where all that mortgage money really comes from after you sign on the dotted line? It's not like your friendly neighborhood bank suddenly has a bottomless pit of cash just for home loans. Nope, there's a whole secret world humming behind the scenes, a place where mortgages go on vacation and get a new lease on life. Welcome, my friends, to the absolutely dazzling, surprisingly vital, and dare I say, fun world of the Secondary Mortgage Market!

Think of your mortgage as a super cool concert ticket. You buy it from the band (the bank), but that ticket can be resold to other fans, right? The Secondary Mortgage Market is like the ultimate fan club for mortgages, where these loan "tickets" get bought, sold, and bundled up like a superstar's greatest hits album.

So, who are the rockstars and roadies in this incredible operation? Let's dive in, shall we? Get ready for a whirlwind tour of the entities that make this whole mortgage magic happen!

The Big Players: Who's Making the Moves?

Mortgage Lenders (The Original Band Members)

These are the folks you know and love (or at least, tolerate) when you're trying to buy a house. Banks, credit unions, and specialized mortgage companies are the ones who actually give you that big, beautiful loan. They're the ones who interview you, check your credit score with the intensity of a detective on a hot case, and hand over the cash for your dream home.

But here's the kicker: once they give you the loan, they don't always keep it in their pocket. It's like they wrote a smash hit song and are ready to sell the rights to a record label to fund their next album. This is where the secondary market swoops in to save the day (and their balance sheets!).

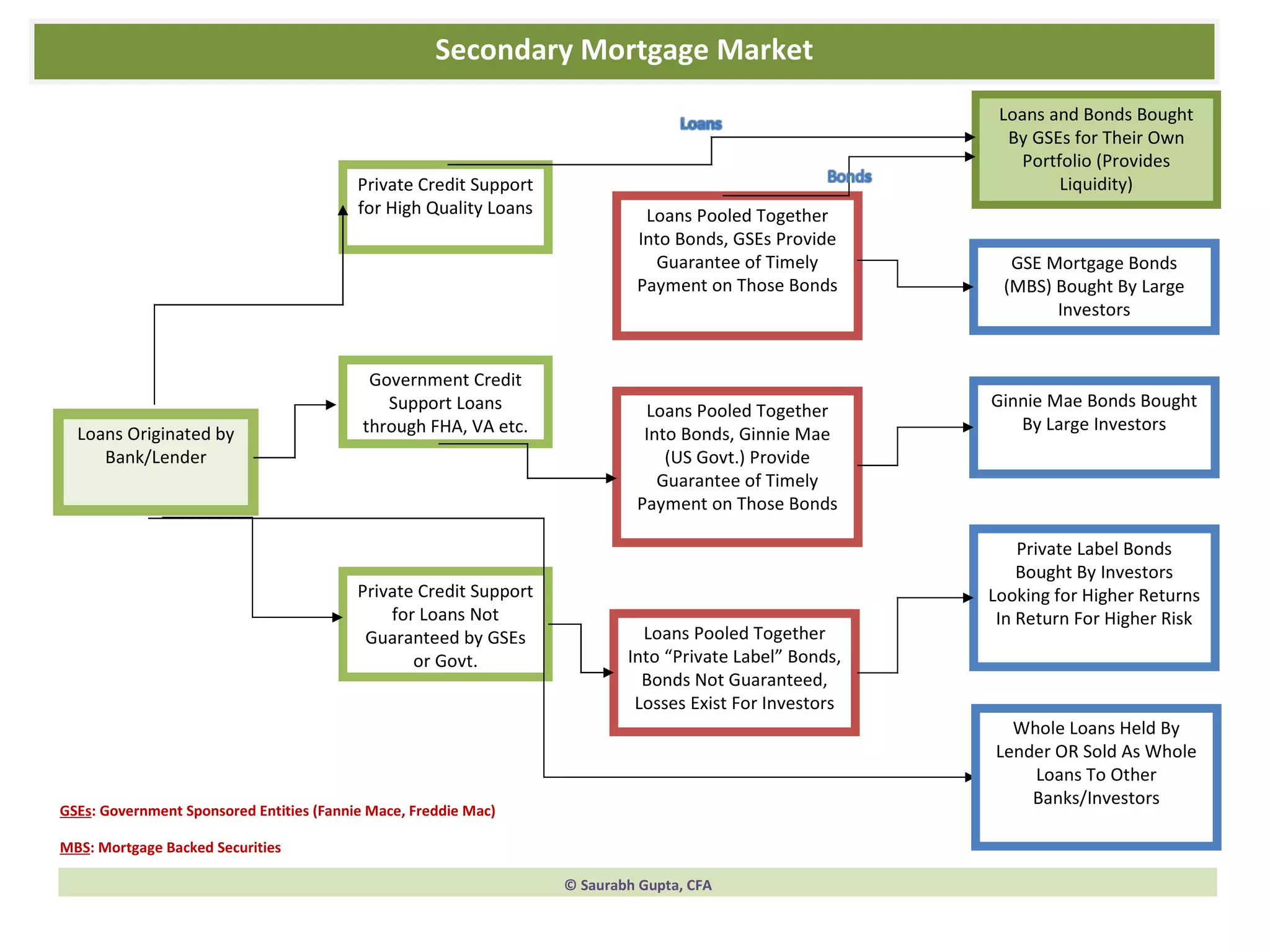

Government-Sponsored Enterprises (GSEs) - The Mega-Fans

These guys are the undisputed kings and queens of the secondary mortgage market. Imagine them as the super-promoters who can guarantee thousands, even millions, of concert tickets will be sold. They're not technically government-owned, but they have a special relationship that gives them a whole lot of clout and a mission to make housing more affordable.

The two titans here are Fannie Mae (full name: Federal National Mortgage Association) and Freddie Mac (full name: Federal Home Loan Mortgage Corporation). These two are like the Beyoncé and Jay-Z of the secondary market, constantly churning out deals and keeping the housing industry humming. They buy up those mortgages from lenders, package them into shiny new securities, and sell them to investors.

Think of them as the ultimate remix artists. They take a bunch of individual mortgage "songs" and mash them up into a chart-topping "album" that investors all over the world want to buy. This allows lenders to get their cash back fast, so they can go out and make more loans, creating a beautiful, never-ending cycle of homeownership dreams coming true!

Ginnie Mae - The Special Guest Star

Then there's Ginnie Mae (Government National Mortgage Association). This one is a government agency, so it's like the official patron of the arts for mortgages. Ginnie Mae doesn't buy mortgages directly like Fannie and Freddie. Instead, it guarantees securities that are backed by mortgages insured or guaranteed by other government agencies.

This means Ginnie Mae is like the ultimate safety net for certain types of loans, especially those for veterans (VA loans) and lower-income families (FHA loans). If you've got a loan that Ginnie Mae has your back on, investors can sleep a little easier knowing their investment is super secure. It's like having a velvet rope around your investment, just in case!

Investors - The Die-Hard Fans

Who buys all these mortgage-backed securities? A whole universe of investors! We're talking about pension funds for teachers and firefighters, insurance companies, mutual funds, hedge funds, and even individual wealthy folks. They're looking for a steady stream of income, and those mortgage payments provide just that.

Imagine them as the ultimate music collectors, eager to get their hands on those mortgage "albums." They trust the GSEs and Ginnie Mae to package these things nicely and reliably, so they can collect their dividends like a consistent royalty check. It's a win-win-win for everyone involved: the homeowner gets a house, the lender gets cash, and the investor gets a return.

Investment Banks and Financial Institutions - The Producers and Managers

These are the masterminds behind the scenes, the ones who actually create and sell these mortgage-backed securities. Investment banks take the mortgages bought by Fannie Mae and Freddie Mac and turn them into those enticing investment products. They're the ones who market them, price them, and make sure they find their way to the eager investors.

Think of them as the record label executives and shrewd managers. They know how to package the music, make it sound amazing, and get it into the hands of the right fans. They take a cut for their expertise, of course, but their role is absolutely crucial in making the whole secondary market machine run so smoothly. They're the ones who keep the industry's complex gears turning!

Mortgage Insurers - The Bodyguards

Sometimes, especially for loans with smaller down payments, lenders want a little extra protection. That's where mortgage insurers come in. Companies like MGIC, Radian, and Essent Guaranty step in to cover the lender's back if the borrower happens to default on the loan.

They're like the fearless bodyguards of the mortgage world. By insuring these riskier loans, they enable lenders to offer them in the first place, which ultimately helps more people get into homes. Their presence makes the whole system feel that much more robust and reliable, like a superhero team always ready to leap into action!

It's a Symphony, Not a Solo!

So, there you have it! The secondary mortgage market isn't just a jumble of acronyms and confusing financial jargon. It's a vibrant ecosystem, a carefully orchestrated symphony where different players work together to achieve a common goal: making the dream of homeownership a reality for millions.

From the initial lender who shakes your hand to the global investors who buy a piece of your mortgage, each entity plays a vital and often unsung role. It's a system that, while complex, is designed to be efficient, reliable, and, dare I say, a little bit magical. It’s all about making sure there’s enough capital flowing to build those beautiful homes and fill them with happy families!