What Happens If You Have A Negative Credit Card Balance: Complete Guide & Key Details

Ever looked at your credit card statement and seen a little minus sign before the number? It’s like finding an extra cookie at the bottom of the bag – a happy little surprise! But what does it really mean when your credit card balance goes into the negatives? Let's dive into this curious corner of your financial life.

Imagine your credit card is like a magical money wallet. You can borrow from it, and then you pay it back. Usually, you owe the card company money, making your balance a positive number. But sometimes, things get a little topsy-turvy, and the wallet ends up owing you!

The Great Credit Card Reversal!

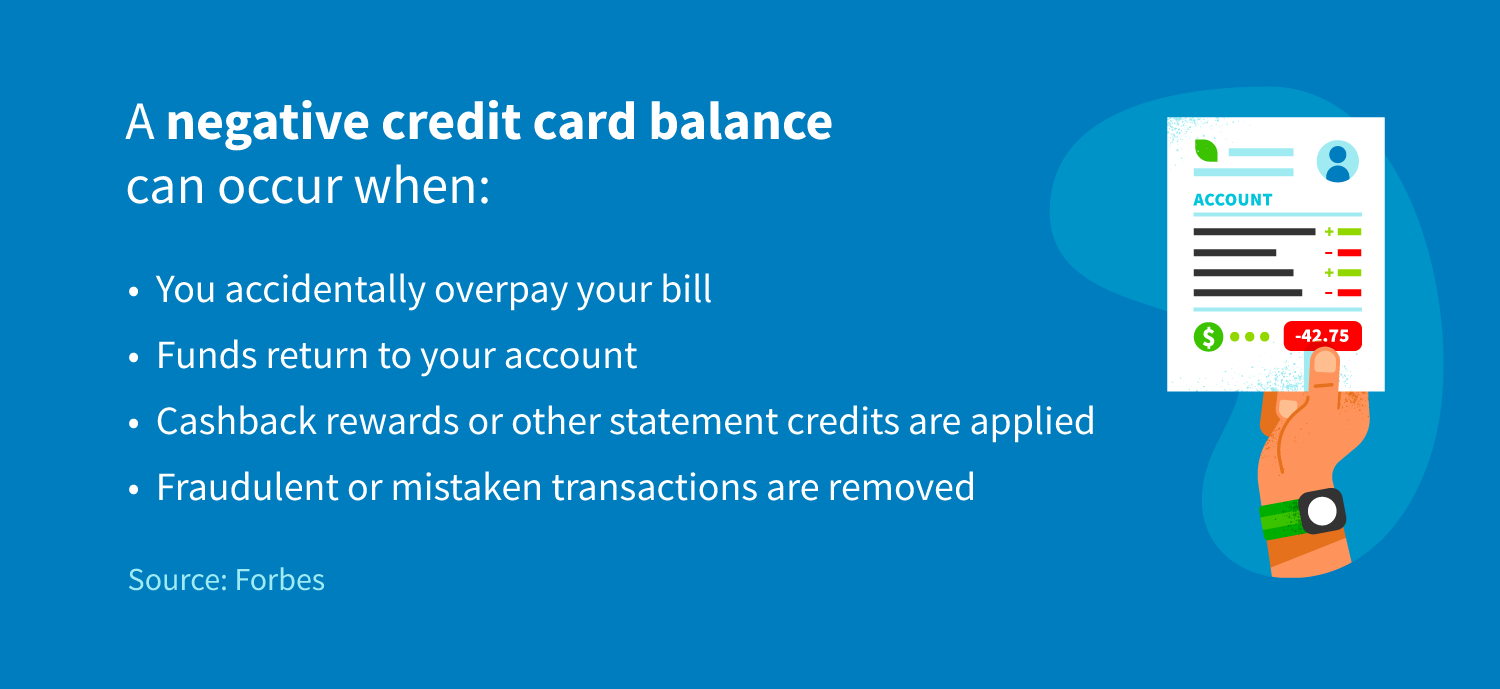

So, how does this magical reversal happen? It’s usually due to a few common scenarios. Think of them as the universe playing a little prank on your statement.

Oops! A Double Payment!

This is probably the most common reason for a negative balance. You meant to pay off your entire bill, maybe you even set up an automatic payment. But then, on top of that, you remembered another purchase and decided to make a second payment!

Now your wallet is overflowing with your own money. The credit card company received more than they were owed, and instead of keeping the extra cash, they're now in your debt. It’s like accidentally tipping your barista twice – a bit awkward, but they're probably not complaining!

When Refunds Get Rowdy

Another frequent flyer in the negative balance club is a big, beautiful refund. You returned that amazing sweater you bought, or perhaps that concert ticket you couldn't use. The store sent the money back to your credit card.

If this refund is bigger than what you currently owe on the card, voilà! Your balance dips into the red. It's a little reward for being a savvy shopper or a responsible concert-goer who knew when to say "no more."

Promotional Magic and Welcome Bonuses

Sometimes, credit card companies are like generous grandparents, showering you with gifts. They might offer a shiny introductory 0% APR period or a tempting cash-back bonus. These can sometimes result in a temporary negative balance, especially if you've made a large purchase during the promotional period.

It’s their way of saying, "Welcome aboard!" or "Thanks for spending with us!" It feels pretty good to have the card company owing you a little something, doesn't it?

So, What Happens When My Balance is Negative? Is It Free Money?!

This is the million-dollar question, isn't it? The short answer is: it’s not exactly free money you can cash out. But it is a good thing, and it can even be a little heartwarming in its own quirky way.

The Card Company Owes YOU!

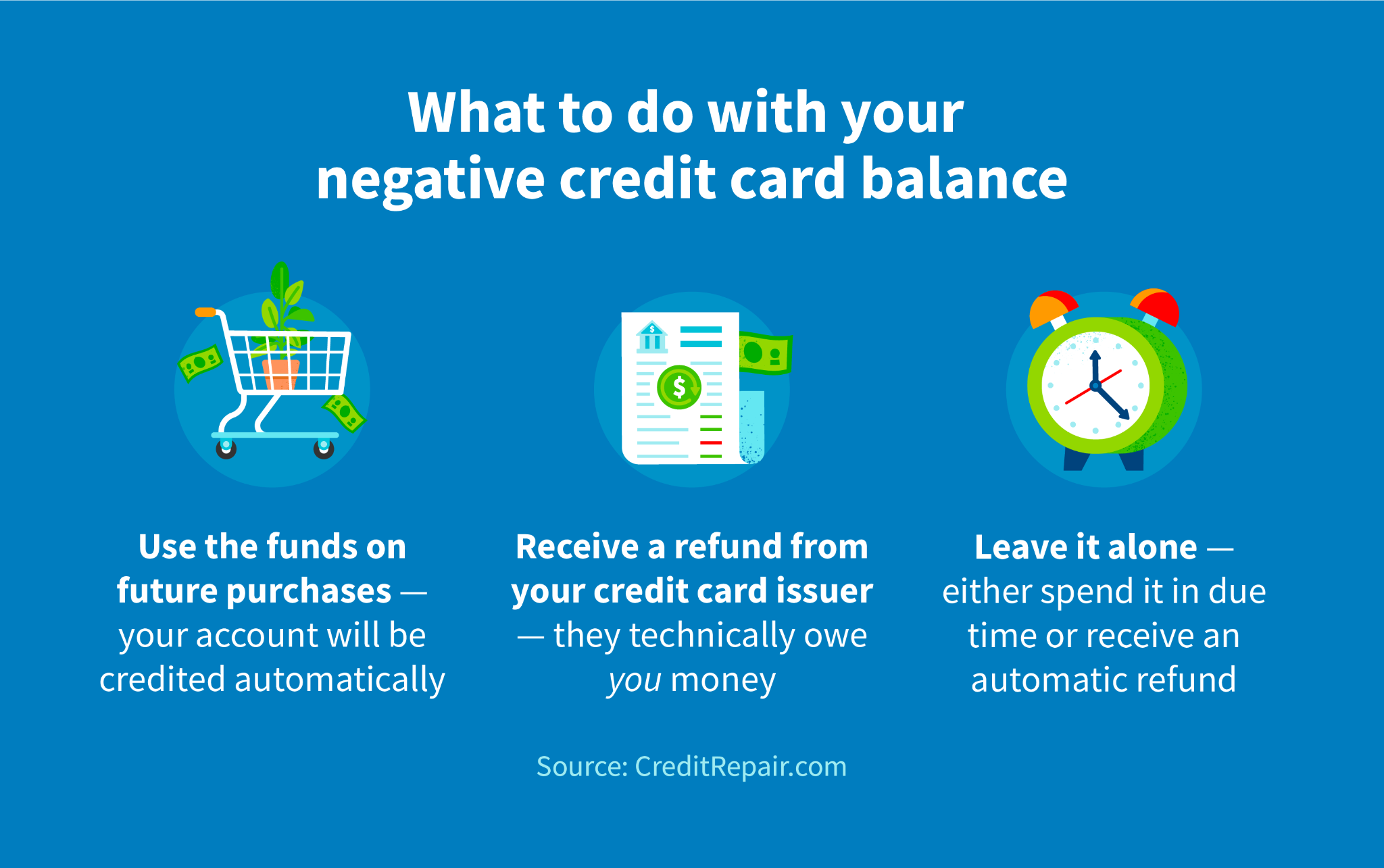

Think of your credit card account like a little ledger. When your balance is negative, it means the card company owes you money. They can’t just keep your overpayment or your refund indefinitely.

Instead, that negative balance acts like a credit on your account. It will be applied to any future purchases you make. So, that negative $50? It means your next $50 of spending is essentially on the house!

Can I Get a Check? (The Heartwarming Part)

This is where things get interesting, and sometimes a little heartwarming. If your negative balance is significant enough, you might be able to request a cash refund from the credit card company. Imagine, they send you a check for the money you're owed!

It’s like the credit card company saying, "You know what? You've been a great customer. Here’s your money back, no strings attached." This usually happens when the negative balance is a substantial amount, and it’s a nice little bonus.

What If I Don't Want to Spend It?

If you don’t plan on using that card for a while, or you simply don’t want to spend the money, most credit card companies will eventually send you a refund check. They don't want to hold onto your money forever, especially if it’s a sizable amount.

It’s a testament to responsible financial behavior. You’ve managed your account so well that you've earned a little payout. It's a small win that feels surprisingly good.

The Little Nuances and Quirky Bits

Now, while a negative balance is generally a good thing, there are a few tiny details to keep in mind:

It's Not an Infinite Well of Cash

Let’s be clear: a negative balance isn't an invitation to go on a wild spending spree expecting the card company to cover it all. The credit card company still has limits, and they're not going to let you borrow endlessly just because your balance is negative.

The negative balance is simply an indication that they owe you money. Once that money is "spent" through future purchases or refunded to you, it’s gone. The magic of the negative balance is temporary.

Interest Still Likes to Play

While you won't be charged interest on a negative balance (because, well, they owe you!), if you make new purchases that bring your balance back into positive territory, then normal interest rules will apply to those new charges.

It’s like the balance resets. The temporary truce with interest is over once you start owing them money again. So, keep an eye on your spending!

The "No Negative Balance" Club

Believe it or not, some credit card companies are a bit more particular. While many will let your balance go negative, some might have policies that prevent it, or they might automatically convert it to a credit for future use without the option of a cash refund.

It's always a good idea to check your cardholder agreement or give your credit card company a quick call if you're unsure. They're usually happy to explain their quirky rules.

The "Surprise!" Factor

For many, seeing a negative balance is a delightful surprise. It’s a little financial anomaly that can bring a smile to your face. It’s a moment where the abstract world of numbers and credit lines feels a little more tangible and rewarding.

It’s a sign that you’re managing your finances well, or that you’ve benefited from a good deal. It’s a small, unexpected joy in the often mundane task of managing money.

So, the next time you see that little minus sign on your credit card statement, don't fret! It's not a mistake, and it's definitely not a cause for alarm. It's simply your credit card company giving you a little nod, acknowledging that for this moment, they owe you a bit of good fortune. Enjoy the feeling – it’s a rare and pleasant surprise!