What Info Do I Need For A Cashier's Check

Ever heard of a cashier's check? It’s like a super-powered personal check. Think of it as a VIP pass for really important payments. It's got a certain pizzazz, a bit of a mystery that makes you wonder, "What's the secret sauce?"

This isn't just any old piece of paper you write from your checkbook. Oh no. A cashier's check is a whole different ballgame. It's drawn directly from the bank's own funds. That’s what makes it so trustworthy and, dare we say, a little bit fancy.

So, you're thinking about getting one? Maybe for a big purchase, like a car, or a down payment on a dream home. It feels like a grown-up move, right? It’s a step up from swiping a card or writing a regular check. It shows you mean business.

But before you waltz into the bank and demand this magical money order, there’s a little preparation involved. You can't just show up empty-handed and expect wonders. The bank needs some intel. They’re like the friendly gatekeepers to this special financial realm.

The Essential Ingredients for Your Cashier's Check Quest

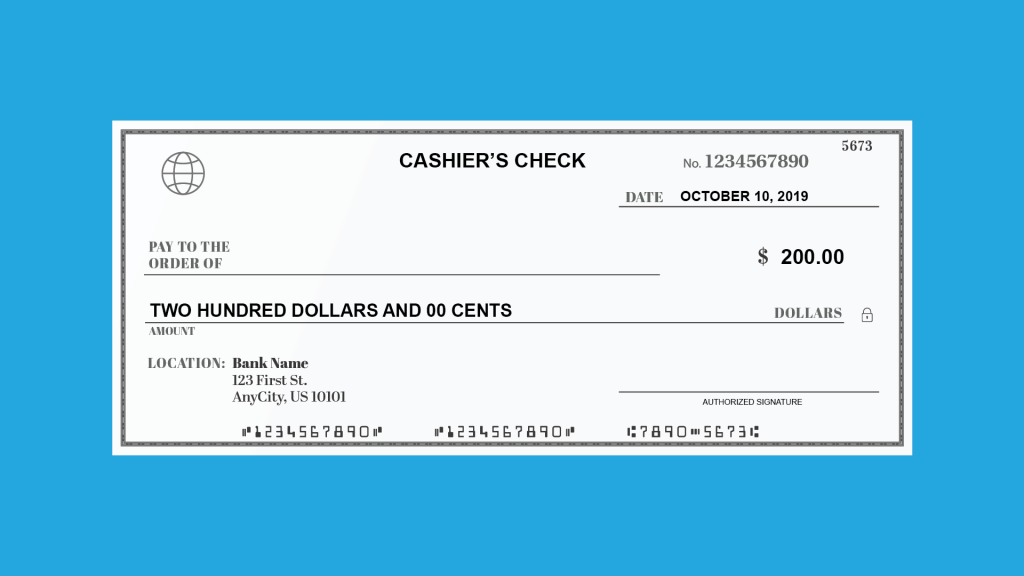

First things first, you'll need to know the exact amount you want on the check. This is non-negotiable, the North Star of your mission. Get this wrong, and your whole quest might go sideways. So, double-check, triple-check, maybe even ask a wise owl.

You also need to know who you're paying. This means the full, legal name of the payee. Think of them as the lucky recipient of your financial generosity. It’s like addressing a really important birthday card. No abbreviations, no nicknames, just the official moniker.

This is where it gets interesting. The bank needs to know your identity, too. They’ll ask for your driver’s license or another valid form of photo ID. This is their way of saying, "Yep, that's you, the one with the money!" It adds a layer of security and makes the whole process feel official.

And, of course, you need the funds to buy the cashier's check. This usually comes directly from your checking or savings account. The bank will debit your account for the full amount of the check, plus any fees. So, make sure your account is as ready as you are for this financial adventure.

Sometimes, you might need to provide the payee’s address. While not always mandatory for the check itself, it’s good practice. It’s like having an extra piece of information in your detective kit. It adds to the completeness of the transaction.

Why This Little Piece of Paper is a Star

So, what makes this cashier's check so special, so much cooler than a regular check? It's all about guarantee. When you get a cashier's check, the bank is essentially saying, "This money is good. We’ve already taken it out of your account and are holding it for you."

This means the payee doesn't have to worry about your check bouncing. No more anxious waiting by the mailbox for funds to clear. It’s instant peace of mind for everyone involved. It's the ultimate in financial confidence.

Imagine handing over a cashier's check for a car. The seller sees that little emblem from the bank, and their eyes light up. They know the money is as good as cash. It smooths over transactions like a charm. It's the VIP treatment for payments.

Think of it as a “money order” but on steroids. It’s a step up in terms of security and acceptance. It’s the go-to for situations where trust is paramount. It elevates the transaction from ordinary to extraordinary.

The process itself can be a little adventure. Walking into a bank, talking to a teller about this specific financial instrument, it feels like you're part of a secret handshake. You're engaging with the banking system in a deliberate and secure way.

And the fees? Yes, there are usually small fees. But consider them the price of admission to this exclusive club of secure transactions. It's a small investment for big peace of mind. It’s worth every penny for that guaranteed good feeling.

Sometimes, the bank might even ask about the purpose of the check. This isn't just nosiness; it's a security measure. They want to ensure the transaction is legitimate. It's like them giving you a nod of approval.

It’s a tangible representation of secured funds. It’s not just a promise; it's a verified payment. This is why so many businesses and individuals prefer them for large or important transactions. It's the gold standard of financial assurance.

So, when you need to make a payment that requires ultimate trust and certainty, a cashier's check is your superhero. It swoops in and saves the day, ensuring your funds are secure and your transaction is smooth. It’s a financial knight in shining armor.

Remember, the bank is your partner in this. They want to help you secure your funds and make your payments with confidence. Don't be shy about asking questions. They're there to guide you through this process.

Getting a cashier's check is more than just a financial transaction; it’s an experience. It’s about understanding the layers of security and trust that go into modern finance. It's a peek behind the curtain of how money moves securely.

It’s that feeling of accomplishment when you hand over that official-looking check. It signifies a successful and secure exchange. It’s the triumphant feeling of a job well done financially. It’s a small victory in the world of payments.

So, the next time you have a significant payment to make, consider the charm and security of a cashier's check. It’s a little bit of financial magic, backed by the power of the bank. It's a tool that brings confidence and ease to your important transactions. It's definitely worth exploring.

The power of a cashier's check lies in its inherent guarantee. It's a symbol of secured funds and a smoother transaction. It's the ultimate in financial reassurance.

Think of the story it tells. It's a testament to your preparedness and your commitment to a secure exchange. It’s not just a piece of paper; it’s a promise of payment. And that promise is guaranteed by the bank itself.

It’s like having a special handshake with the financial world. You present your validated payment, and the other party knows it’s good. No questions, no doubts, just a clean and clear transaction. It’s the way of the financially savvy.

So, gather your information, head to your bank, and embark on your cashier's check adventure. You’ll be armed with the knowledge of what you need, and you’ll be stepping into a world of secure and confident payments. It’s a journey worth taking.