What Information Do You Need To File For Bankruptcies: Complete Guide & Key Details

So, you're staring at a mountain of bills that's starting to look suspiciously like Mount Everest, and you're pretty sure you don't have Sherpas trained in debt repayment. Feeling a little like a hamster on a wheel that's gone rogue and is now trying to escape a burning building? Yeah, we've all been there. Or, at least, we've imagined being there, which is almost as good, right? Anyway, if your financial life has gone from "woe is me" to "oh heavens, I need a financial miracle," then buckle up, buttercup, because we're talking about bankruptcy. Think of this less as a solemn legal proceeding and more like a really intense, slightly awkward, but potentially life-saving spa day for your finances.

Now, before you start picturing yourself in a fluffy robe, contemplating your financial sins, let's get down to brass tacks. What magical scrolls do you need to unfurl to even begin this journey? It’s not as scary as it sounds, and honestly, compared to explaining to your mom why you still owe money for that impulse flamenco dancing class from five years ago, it’s a walk in the park.

The "What's Mine is… Well, Maybe Not Mine Anymore" Inventory

First things first, you gotta take stock of your kingdom. This means a full-blown audit of your life, from the lint in your pockets to the diamond-encrusted tiara you might have hidden away (we won't judge, but the court might). We're talking about everything. Your trusty old jalopy that coughs more than a chain smoker? List it. That collection of novelty socks that are slowly taking over your dresser? Yep, they’re on the list. Even that slightly questionable beanie baby collection you swore would make you a millionaire? Especially that.

This is where you’ll need to get super organized. Think of yourself as a forensic accountant who’s also a bit of a hoarder, but in a good way. You’ll need to gather proof of ownership for all your assets. This includes things like:

- Property Deeds: For your humble abode, or that slightly less humble vacation home that you only visited once in a decade (don't worry, we've all done it).

- Vehicle Titles: Even if your car is held together by duct tape and sheer willpower, it’s still an asset!

- Bank Statements: For every account you've ever had. Yes, even that forgotten savings account from when you were eight. Shhh, it's a secret!

- Investment Records: Stocks, bonds, that weird cryptocurrency you bought on a whim… it all counts.

- Valuable Personal Property: Jewelry, art, that vintage vinyl collection that's worth more than your rent.

The key here is transparency. The court doesn't like surprises, especially when it comes to money. Think of it like this: you wouldn't tell your date you're a millionaire and then only have pocket lint and a half-eaten bag of chips to show for it, right? Same principle applies here, just with more stern-faced judges.

The "Who Owes Me… and Who Do I Owe?" Dossier

Now, let's dive into the exciting world of… debt! Yes, the stuff that keeps you up at night, contemplating the meaning of existence and whether instant ramen truly counts as a balanced meal. You need a complete list of everyone you owe money to, and how much you owe them. This is like creating a "most wanted" list, but instead of criminals, it's your creditors. Don't forget the little guys!

This means pulling out all the stops:

- Credit Card Statements: Those trusty plastic rectangles that promised you the moon and delivered… well, a lot of interest.

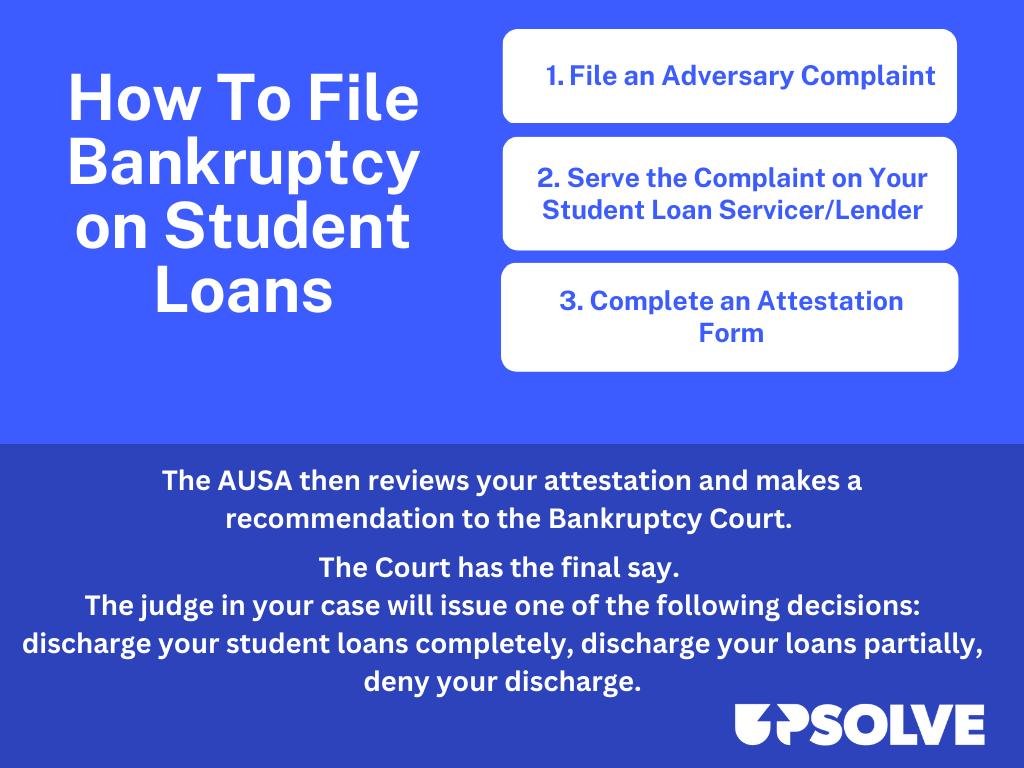

- Loan Documents: Mortgages, car loans, student loans (oh, the joy!), personal loans.

- Medical Bills: Because sometimes the scariest monsters aren't in closets, but in hospital bills.

- Tax Debts: The government is surprisingly persistent, isn't it?

- Any other outstanding debts: This could be anything from your overdue cable bill to that informal loan from your incredibly patient (or incredibly annoying) cousin.

And on the flip side, you'll also need to document who owes you money. This is the part where you might unearth some forgotten IOUs from friends who swore they'd pay you back "soon." Be prepared to potentially pursue these if your lawyer advises it. It's like being a debt detective, but your only reward might be getting back that $20 you lent Brenda for emergency glitter.

The "Show Me the Money (Or Lack Thereof)" Statements

This is where you prove your financial hardship. It’s not enough to feel broke; you need to show the court you're broke. Think of this as your financial sob story, but with supporting documents. You'll need to provide a clear picture of your income and expenses. This can feel like a deep dive into the Mariana Trench of your spending habits.

Get ready to pull:

- Pay Stubs: From your current employer, and even from past employers if you've recently changed jobs.

- Tax Returns: For the past few years. Yes, all of them. Even the one where you declared your pet hamster as a dependent (we're kidding… mostly).

- Bank Statements: Again! These are like the Swiss Army knife of bankruptcy paperwork. They show where your money is coming from and where it's disappearing to.

- Proof of Other Income: Alimony, child support, that side hustle selling artisanal dog sweaters on Etsy.

You’ll also need to meticulously document your living expenses. This includes rent or mortgage, utilities, food, transportation, insurance – the whole shebang. The court wants to see that you're not living like a rockstar on borrowed time. They want to see that your expenses are, well, necessary. So, that daily triple-chocolate latte habit might need a little… adjustment.

The "Why Me, Oh Why Me?" Explanation

Beyond the numbers, you'll need to explain why you ended up in this pickle. This is your chance to tell your story. Was it a medical emergency that bankrupted your bank account? A job loss that sent your income into a nosedive? Or perhaps a series of unfortunate events that would make a Greek tragedy look like a light comedy? The court wants to understand the circumstances.

This might involve:

- A Statement of Financial Affairs: This is your formal explanation of your financial situation. Think of it as a very serious autobiography of your debt.

- Credit Counseling Certificate: In most cases, you'll need to complete a credit counseling course before filing for bankruptcy. It's like a pre-flight safety check for your finances.

- Explanation of Debts: You might need to briefly explain the origin of your major debts. For example, "I took out a $50,000 loan for a business that involved artisanal pigeon training. It didn't pan out."

It's important to be honest and forthright. Lawyers are like financial detectives, and they can help you present your case in the best possible light. Think of them as your financial fairy godmother, but with a much better understanding of legal jargon.

Surprising Facts You Might Not Know!

Did you know that bankruptcy isn't always the end of the world? In fact, it can be a fresh start! It's like hitting the reset button on your financial life, albeit a rather dramatic reset. Also, depending on the type of bankruptcy you file (Chapter 7 or Chapter 13, for the curious), some debts might be dischargeable, meaning they're wiped clean. Poof! Gone!

And here's a little tidbit: The wealthiest people in the world have sometimes utilized bankruptcy to restructure their businesses. So, it's not just for folks who are living on ramen and dreams. It's a tool, a powerful one, that can be used by many.

Filing for bankruptcy can feel overwhelming, like trying to herd cats while juggling flaming torches. But with the right information and a good dose of humor (and maybe a really strong cup of coffee), you can navigate the process. Remember, it’s a step towards getting your financial life back on track. And who knows, you might even emerge with a newfound appreciation for the humble spreadsheet.