What Is A Subsidized And Unsubsidized Student Loan? Explained Simply

Alright, let's talk about student loans. You know, those things that seem to hang around longer than that one friend who crashes on your couch for "just a week" and then suddenly it's been six months? Yeah, those. And when you start looking into them, you'll inevitably bump into two terms that sound like they're straight out of a secret government briefing: subsidized and unsubsidized student loans. Don't let the fancy names scare you. Think of it like this: you're heading off to college, ready to conquer the world (or at least pass that notoriously difficult Intro to Basket Weaving class), and you need a little financial help. These loans are basically different flavors of that help.

Imagine you're at a buffet. You've got your plate, you're eyeing up the mac and cheese, the prime rib, and that suspiciously good-looking Jell-O mold. Now, the price of the buffet is set, but sometimes, the manager might offer a little deal. Maybe they'll say, "Hey, if you show your student ID, we'll knock a few bucks off the tax on your meal." Or maybe they'll say, "We'll cover the tip for your waiter for the first hour!" That's kind of how a subsidized loan works. It's like the government is giving you a little wink and a nod, saying, "We've got your back on some of this interest stuff while you're still busy figuring out what a Bunsen burner is for."

The "Government's Got My Back" Loan: Subsidized

So, a subsidized student loan is like getting a sweet deal on your tuition money. The biggest perk here is that the government pays the interest on the loan while you're in school at least half-time, during your grace period (that's usually about six months after you graduate or leave school), and during periods of deferment. Think of it as someone else picking up the tab for the appetizer while you're still deciding on your main course. You're not racking up extra costs while you're busy learning the difference between Shakespeare and Socrates.

This is a huge deal, folks. When you take out a loan, there's a little extra charge that gets added onto the original amount over time. It's called interest, and it's like a sneaky little fee that grows if you don't pay attention. With a subsidized loan, for a significant chunk of time, that sneaky fee is being handled by Uncle Sam. So, when you finally graduate and start looking at your loan balance, it's going to be closer to the amount you actually borrowed, not some inflated number that makes you want to move to a remote island and live off coconuts.

Picture this: you're heading off to college, brimming with optimism and about three pairs of mismatched socks. You need to buy textbooks, pay for that dorm room that smells vaguely of old gym socks and regret, and maybe, just maybe, afford a decent cup of coffee that isn't brewed in a communal pot. You get a subsidized loan. It's like the universe has gifted you a magic money bag. While you're deep in the trenches of late-night study sessions fueled by questionable energy drinks, the interest is just… poof! Gone. Vanishing into thin air, handled by the powers that be. You can focus on learning, on making friends, on figuring out how to do your own laundry without turning everything pink. It’s about giving you a breather, a financial siesta, so you can actually get something out of your education without the looming dread of interest piling up.

This is especially clutch if you're from a family where every dollar is already stretched thinner than a superhero's Spandex. A subsidized loan can be a real game-changer, allowing you to pursue your dreams without the immediate worry of interest costs snowballing. It's the government saying, "We believe in your education, and we're willing to help shoulder some of the burden while you're investing in your future." It's like getting a scholarship, but for the loan itself.

The "You're On Your Own, Kid" Loan: Unsubsidized

Now, let's talk about the unsubsidized student loan. This is where things get a little more… adult. Think of this as the buffet where you have to pay the full price, and any "deals" are up to you to find. With an unsubsidized loan, you are responsible for paying the interest from the moment the loan is disbursed, even while you're in school.

Remember that interest we were talking about? The sneaky fee? Well, with an unsubsidized loan, that interest starts ticking from day one. It's like the meter in a taxi is running from the second you get in. So, while you're off learning about existentialism, that interest is busily growing, adding itself to your principal loan amount. This means that when you graduate, your total debt will likely be higher than the amount you initially borrowed. It's like ordering a pizza and then realizing they also charged you for the box, the delivery person's time, and a small fee for breathing the same air as the pizza.

Let's use another analogy. Imagine you're building a treehouse. With a subsidized loan, it's like your parents are helping you pay for the nails and the lumber while you're building. With an unsubsidized loan, they're giving you the money for the nails and lumber upfront, but you're also responsible for paying them back for the time it takes to hammer those nails in and saw that lumber. The clock is ticking on that interest!

So, while you're in college, that interest is being added to your loan balance. This is called "capitalization." It's a fancy word for "your debt is growing, even though you're not really using the money for anything yet." It's like having a plant that's being watered by its own growth, which sounds magical but in the loan world, it means more money you owe. You're basically accumulating debt on top of debt. It’s the financial equivalent of forgetting to water your houseplants and then being surprised when they look sad and droopy.

This doesn't mean unsubsidized loans are inherently "bad." They are often necessary to cover the full cost of attendance. They are simply different. They require a bit more awareness and planning. You might want to consider making interest payments while you're still in school if you can afford it, just to keep that balance from ballooning. It's like choosing to pay for that extra topping on your pizza upfront, rather than letting it add to your bill later.

So, What's the Big Difference Again?

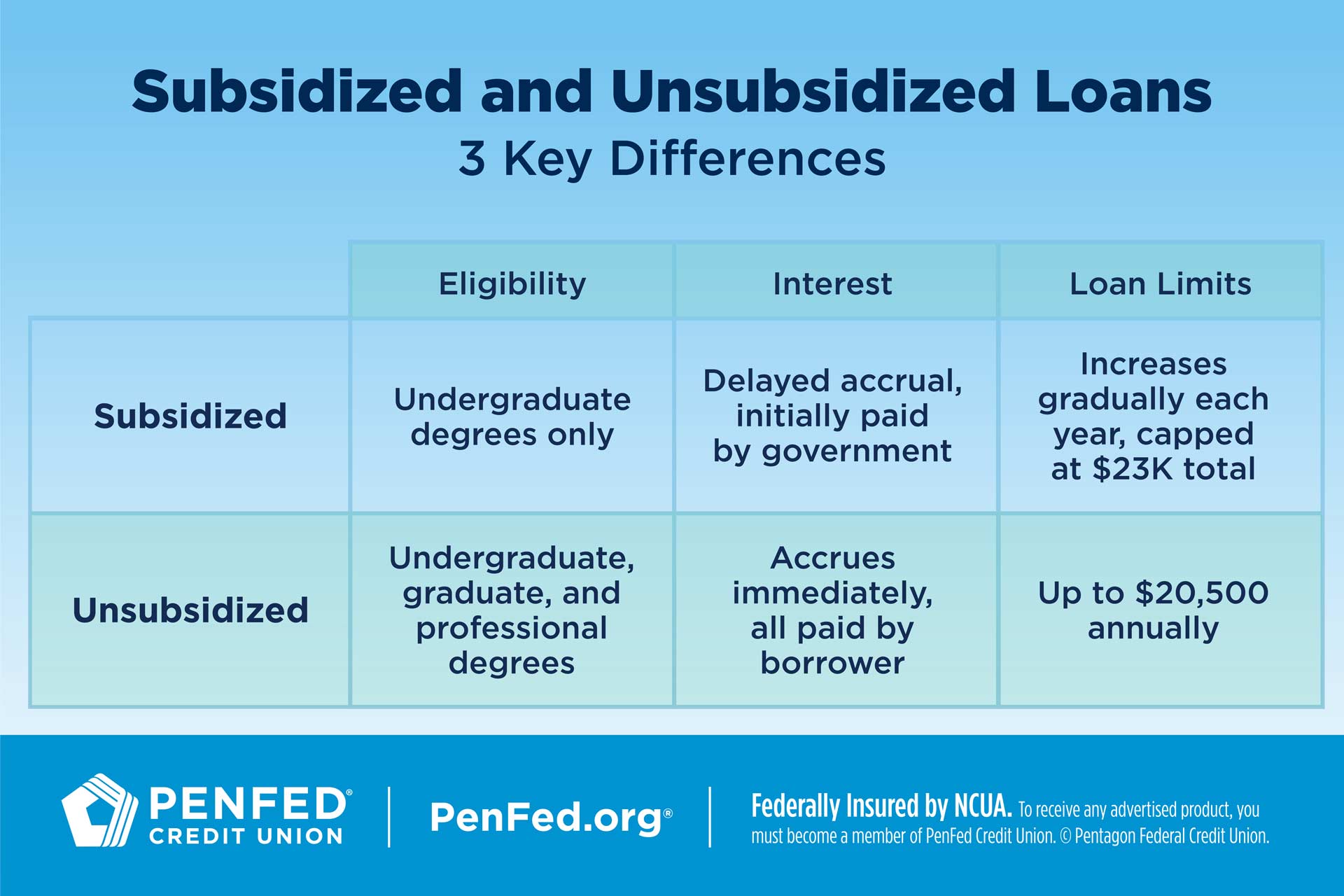

Let's break it down one last time, super simply. It all boils down to who is paying the interest and when.

Subsidized Loans: * The government pays the interest while you're in school (at least half-time), during your grace period, and during deferment. * Think of it as the government sponsoring your education interest-wise. * Your loan balance won't grow with interest during these periods. * Generally considered the more favorable option if you qualify.

Unsubsidized Loans: * You pay the interest from the moment the loan is disbursed. * Interest accrues and is added to your loan balance while you're in school. * Your loan balance will grow over time due to accumulating interest. * Available to more students, regardless of financial need.

Which One Should You Go For?

If you qualify for a subsidized loan, it's usually your first port of call. Why? Because it saves you money in the long run. It's like getting a discount on a big purchase – everyone loves a good discount, right? It means less debt to pay back after graduation, which can feel like a huge weight lifted. Imagine graduating with your diploma in one hand and a significantly smaller loan statement in the other. That's the dream!

Unsubsidized loans are still a valuable tool, especially if the subsidized loans don't cover all your educational expenses. Many students will need to take out both types. The key is to be informed and to plan accordingly. Understand that the balance will grow, and factor that into your future budget. Maybe start a small savings account while you're in school to try and tackle some of that interest. Even putting away $20 a month can make a difference down the line. It's like packing your own snacks for a road trip instead of relying on expensive gas station buys.

When you're applying for financial aid, usually through the FAFSA (Free Application for Federal Student Aid), you'll see which loans you're eligible for. The government aims to offer subsidized loans to students who demonstrate financial need. Unsubsidized loans are generally available to all students, regardless of need, though there are often annual and aggregate limits on how much you can borrow.

It's also good to remember that there are different types of federal student loans. The ones we're talking about – subsidized and unsubsidized – are typically Direct Subsidized Loans and Direct Unsubsidized Loans, part of the William D. Ford Federal Direct Loan Program. These are federal loans, meaning they come with more consumer protections and repayment options than private loans. So, stick to federal loans if you can!

Think of the whole loan process like assembling IKEA furniture. The instructions might seem daunting at first, but if you take it one step at a time, and understand each piece, you can get it done. Subsidized and unsubsidized loans are just two of those pieces. One is like the helpful diagram showing you where the screws go, and the other is like the bag of screws you have to manage yourself. Both are essential to building your future!

Ultimately, understanding the difference between subsidized and unsubsidized student loans is about empowering yourself to make the best financial decisions for your education. It’s not about being scared of debt; it’s about being smart about it. So, go forth, get that education, and may your loan statements be as manageable as your laundry pile (or at least, close to it!). Happy borrowing!