What Is An Index Fund And How Does It Work

Ever feel like the stock market is a giant, complicated vending machine that dispenses tiny pieces of companies, and you have no idea which button to press? Yeah, me too. It’s like trying to pick out the perfect avocado – you poke and prod, hope for the best, and sometimes end up with something mushy when you were hoping for creamy goodness. Well, what if I told you there’s a way to get a whole basket of avocados, or a whole tray of mixed fruits, without having to individually inspect each one?

Enter the humble, yet mighty, index fund. Think of it as the ultimate buffet for your money. Instead of hand-picking stocks like you might painstakingly choose the ripest tomatoes at the grocery store, an index fund basically says, “You know what? Let’s just grab a little bit of everything that’s doing well in this particular aisle.” And that, my friends, is pretty darn smart.

The "Everything But The Kitchen Sink" Approach

So, what exactly is an index fund? Imagine you’re at a massive party, and everyone important is there. You could go around and try to have a deep conversation with every single person, learning their life story. That’s kind of like actively picking individual stocks. It takes a lot of time, effort, and frankly, sometimes you just end up talking to the guy who tells the same three jokes all night.

An index fund, on the other hand, is like having a VIP pass to the entire party. It doesn't care if it's chatting with the CEO of a tech giant or the friendly neighborhood baker who just landed a huge contract. It just wants a tiny slice of everyone who's supposed to be there, based on a pre-defined guest list.

That pre-defined guest list? That's what we call an index. The most famous one is probably the S&P 500. Think of the S&P 500 as the “Who's Who” list of the 500 largest publicly traded companies in the United States. It's like the ultimate popularity contest, but for businesses. If a company is big and successful enough to make it onto this list, it’s considered a significant player.

So, an S&P 500 index fund is literally an investment that tries to mirror the performance of that S&P 500 index. It buys a little bit of stock in all 500 companies, in the same proportions as they appear in the index. It’s like buying a pre-made fruit basket with exactly the right mix of apples, oranges, bananas, and whatever else is in there. You get the whole delicious package, no individual fruit selection required.

How Does This Magical Basket Work?

The beauty of an index fund lies in its simplicity. It doesn’t have a high-powered team of stock-pickers agonizing over quarterly reports and trying to predict the next big thing. That’s like having a personal chef who only cooks your favorite meal, every single day, no matter what. Delicious, maybe, but also potentially expensive and a bit boring in the long run.

Instead, index funds are typically passively managed. This means they just aim to match the performance of their chosen index. The fund manager’s job is less about making genius stock picks and more about ensuring the fund accurately tracks the index. Think of it like following a recipe. The index fund manager is the dutiful chef who follows the recipe (the index) to a T. They’re not trying to invent a new culinary masterpiece; they’re just making sure the dish tastes exactly like it’s supposed to.

Because there’s less active decision-making, and fewer people wearing expensive suits analyzing spreadsheets all day, index funds tend to have much lower fees. These fees, often called expense ratios, are like the little service charge at a restaurant. In the world of investing, even a small difference in fees can add up to a significant amount of money over time. It’s like choosing between a $2 coffee and a $5 fancy latte – both give you caffeine, but one leaves more cash in your wallet for other treats.

So, the fund manager buys shares of all the companies in the index, in the correct proportions. If a company's weight in the index increases (because its stock price goes up), the fund buys more of that company's stock. If a company's weight decreases, the fund buys less. It’s a constant, automated process of keeping pace with the market. It’s like a really well-trained dog that always stays right by your side, no matter where you walk.

Why Should You Care About This "Basket"?

Here’s where it gets really interesting, and hopefully, makes you nod your head with recognition. Think about your favorite TV show. You probably don’t watch just one actor’s scenes on repeat, right? You watch the whole show because the ensemble cast, the plot twists, the funny moments – they all contribute to the overall experience. An index fund works in a similar way. It diversifies your investment across many companies, reducing the risk that one bad apple (or one really terrible episode) will ruin your whole investment experience.

If you were to pick just one or two stocks, and that company suddenly had a scandal, or its product flopped (remember New Coke? Oof.), your investment could take a serious hit. It’s like putting all your eggs in one very fragile, hand-painted basket. If you drop that one basket, you’re in trouble.

With an index fund, you own a tiny piece of hundreds, or even thousands, of companies. If one company stumbles, it’s just a minor blip in the grand scheme of things. The other companies in your “basket” are still chugging along, hopefully doing their thing. It’s like having a whole fruit stand – if one apple has a bruise, you just grab another one. Your overall fruit-buying experience isn’t derailed.

This diversification is a really big deal. It’s like the ultimate insurance policy for your money. It’s not about hitting a home run with one stock; it’s about consistently participating in the overall growth of the market. And historically, over the long term, broad market indexes like the S&P 500 have shown a tendency to grow. It's not guaranteed, of course, because markets go up and down like a roller coaster, but the general trend has been upward.

The "Set It and Forget It" Appeal

Another fantastic thing about index funds is that they are incredibly beginner-friendly. You don't need to be a Wall Street wizard or spend hours glued to financial news channels. Once you choose an index fund that aligns with your goals (e.g., an S&P 500 index fund, or a total stock market index fund), you can often just buy it and let it be.

It’s the investment equivalent of setting your car’s GPS and then just enjoying the ride. You set your destination (your financial goal), and the GPS (the index fund) guides you there, adapting to traffic and road closures along the way (market fluctuations). You don't need to constantly be checking the map or fiddling with the steering wheel.

This "set it and forget it" mentality is a game-changer for many people. Life is busy! We have jobs, families, hobbies, and maybe even a sourdough starter to nurture. The last thing most of us need is to add "day trading guru" to our list of responsibilities. Index funds allow you to invest intelligently without it consuming your life.

Many brokerage firms offer index funds with very low minimums, and some even allow you to invest small amounts regularly, like $25 or $50 a month. This is called dollar-cost averaging, and it’s like buying that fruit basket a little bit at a time, regardless of whether the price is a little higher or lower that week. Over time, it tends to smooth out your average purchase price.

The Analogy Game Continues...

Let’s try another one. Imagine you're building a Lego castle. You could spend ages searching for the perfect, rare, specific Lego brick to make one turret absolutely flawless. That’s like picking individual stocks. Or, you could buy a big, pre-selected Lego set that includes a wide variety of bricks, enough to build a whole castle with different features. That’s your index fund. The pre-selected set might not have that one incredibly unique brick, but you’ll likely end up with a much more complete and stable castle, faster and with less frustration.

Or how about this: You’re trying to cook a complicated gourmet meal. You could meticulously source every single ingredient, from obscure spices to farm-fresh produce, spending hours at specialty stores. Or, you could buy a really good quality, ready-made meal kit that has all the pre-portioned ingredients and a clear set of instructions. Index funds are like that high-quality meal kit for your investments. They provide a comprehensive, easy-to-follow way to build wealth without the stress of sourcing every single component yourself.

Even the name, "index fund," sounds a little bit like it's just...following along. It's not trying to be a star player; it's content to be part of the winning team, reflecting the overall performance of the game.

Are There Any Downsides? (Because Nothing's Perfect, Right?)

Okay, so index funds are pretty awesome, but let’s be real. They’re not a magic ticket to becoming a millionaire overnight. Since they aim to match the market, you’re not going to beat the market by a huge margin. If you did pick that one magical stock that went up 1000%, your index fund would only go up a tiny fraction of that. It’s like going to a potluck – you get a taste of everything, but you don’t get to claim the glory for making the absolute best dish.

Also, because they hold all the stocks in the index, if the overall market goes down, your index fund will go down too. There’s no fancy manager trying to bail you out by picking only the "safest" stocks. You ride the market’s waves, both the good and the bad. It’s like a boat in the ocean – it goes up and down with the tide. You can’t make the tide stop for your boat.

:max_bytes(150000):strip_icc()/Investopedia-terms-indexfund-f7a1af966bd34da5b77ca1627607e41b.png)

And while they’re generally low-cost, there are still fees. They’re just usually much, much lower than actively managed funds. So, while it’s not free, it’s a very economical way to invest.

The Takeaway: Simple, Diversified, and Effective

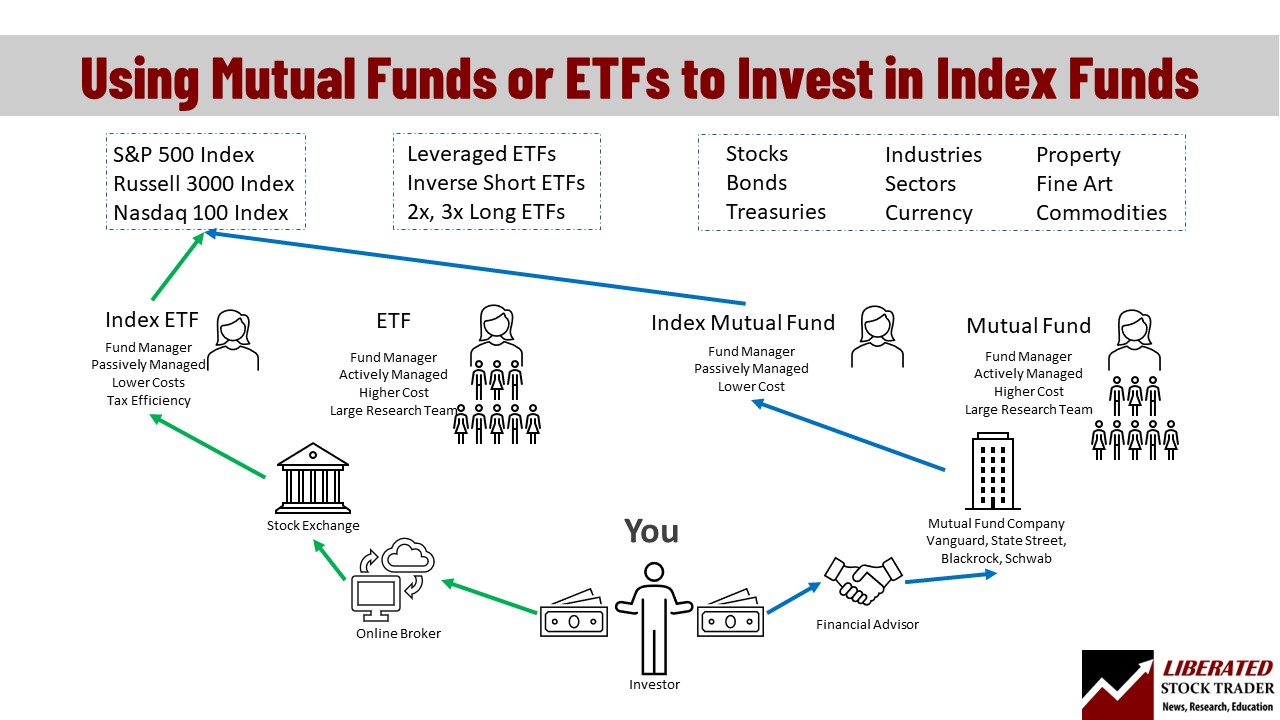

So, what’s the bottom line? An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, like the S&P 500. It does this by holding all, or a representative sample, of the securities in that index.

It's a way to get instant diversification, low costs, and a simple, hands-off approach to investing. It’s like buying a pre-assembled furniture piece instead of spending a weekend wrestling with confusing instructions and tiny screws. It’s accessible, understandable, and historically, a very effective way for everyday people to grow their wealth over the long term.

If the idea of picking individual stocks feels like trying to find a needle in a haystack while wearing mittens, then an index fund might just be your best friend. It’s the investment equivalent of taking the scenic route, enjoying the view, and trusting that the road will lead you to where you want to go, without all the stressful detours and guesswork.

So next time you hear about index funds, don't let the jargon scare you. Remember the fruit basket, the buffet, the meal kit, or the Lego set. It's just a smart, simple way to invest for your future. And that, my friends, is something we can all smile about.