What Is Difference Between A Roth Ira And Traditional? Explained Simply

Hey there, future millionaire! Or, you know, just someone who wants to make their money work a little harder for them. Let’s chat about something that sounds super boring but is actually kind of like a secret superpower for your wallet: IRAs. Specifically, we’re gonna dive into the difference between a Roth IRA and a Traditional IRA. Think of this as your no-nonsense, no-jargon guide to understanding these retirement superheroes.

So, why should you even care about IRAs? Well, imagine you've got a magic money tree. Planting seeds now and watering them means you get a whole forest of cash later. IRAs are kind of like that, but for your retirement. They're special investment accounts that give you tax breaks. The big question is: which tax break is better for you? That's where our Roth vs. Traditional showdown comes in!

The Big Kahuna: Taxes, Taxes, Taxes!

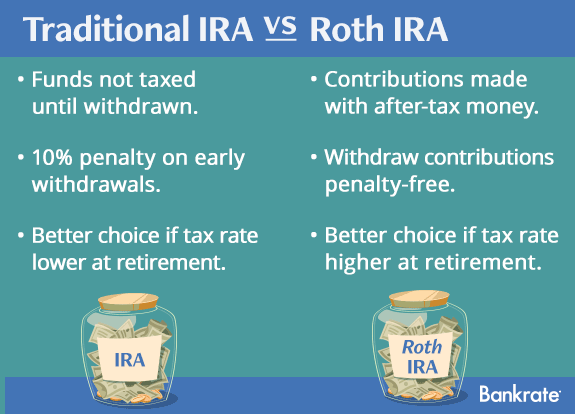

At its core, the difference between a Roth and a Traditional IRA boils down to when you get your tax break. It’s like choosing between paying for your fancy coffee now or getting a discount later. Both are good, but one might fit your current situation better.

Traditional IRA: The "Pay Later" Plan

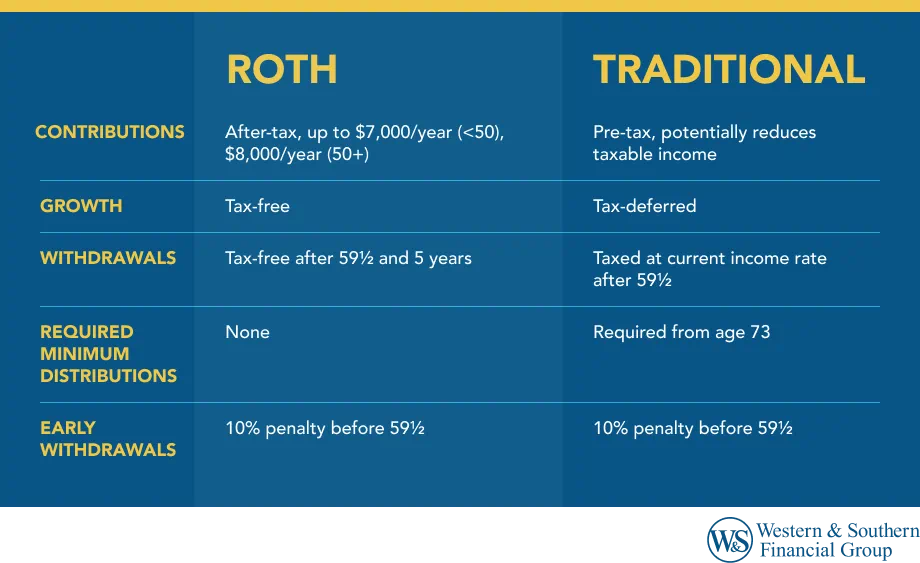

Let's start with the Traditional IRA. Think of this as the "save now, pay taxes later" option. When you contribute money to a Traditional IRA, you might be able to deduct that contribution from your taxable income for the current year. Boom! Instant tax savings. It’s like getting a little refund check from Uncle Sam right now.

So, if you're currently in a higher tax bracket (meaning you earn more money and pay more taxes), a Traditional IRA can be super appealing. You're essentially lowering your current tax bill, which means more cash in your pocket today. Pretty sweet, right?

The catch? When you eventually retire and start taking money out of your Traditional IRA, those withdrawals will be taxed as ordinary income. So, that money you saved on taxes now? You’ll pay it back later, but hopefully, in retirement, you'll be in a lower tax bracket, so it won't sting as much. It’s a gamble, but a calculated one!

Think of it like this: you get a discount on your groceries now, but you pay full price when you eat the food. Makes sense, right? No biggie.

Roth IRA: The "Pay Now, Play Later" Plan

Now, let's swing over to the Roth IRA. This one is the "pay taxes now, enjoy tax-free withdrawals later" champion. With a Roth, you contribute money that you've already paid taxes on. That means you don't get an upfront tax deduction like you do with a Traditional IRA. Bummer? Not necessarily!

The real magic of the Roth IRA happens when you retire. All your qualified withdrawals – that means the money you put in and all the earnings your investments have made over the years – are completely tax-free. Zilch. Nada. Zero tax liability! It’s like getting your coffee for free when you’re older.

This is where the Roth really shines. If you believe you'll be in a higher tax bracket in retirement than you are now, or if you just love the idea of having a big pot of money that no one can touch with a tax bill, the Roth is your best friend. Imagine: you’ve worked hard, saved diligently, and now you get to enjoy your retirement nest egg without the tax man breathing down your neck. That’s the dream, folks!

So, to recap the tax part: * Traditional IRA: Tax deduction now, taxes on withdrawals later. * Roth IRA: No tax deduction now, tax-free withdrawals later.

Who Can Get In On The Action? (Income Limits, Anyone?)

Okay, so taxes are a big deal, but there's another crucial difference: income limits. The government, in its infinite wisdom, likes to put some restrictions on who can contribute to which type of IRA. It's like a VIP club, and sometimes your income determines if you get a golden ticket.

Traditional IRA: Mostly Open House

For the most part, the Traditional IRA is pretty open to everyone, regardless of your income. However, there are rules about whether you can deduct your contributions. If you (or your spouse) are covered by a retirement plan at work (like a 401(k)), your ability to deduct Traditional IRA contributions might be limited based on your income. If you're not covered by a workplace plan, you can usually deduct your contributions no matter how much you make. It gets a little nuanced, but the main takeaway is it's generally more accessible for deductions, especially for higher earners not covered by a workplace plan.

The key here is that anyone can contribute to a Traditional IRA, even if they can't deduct it. You'd just miss out on that immediate tax break.

Roth IRA: The "Cool Kids" Club (with Income Rules)

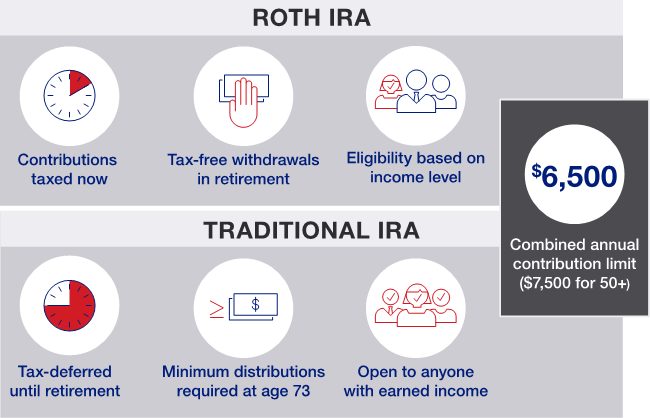

The Roth IRA, on the other hand, has stricter income limitations. If your income gets too high, you might not be able to contribute directly to a Roth IRA at all. The IRS publishes these limits annually, and they can change. So, if you're a high earner, you might have to explore other options, like a "backdoor Roth IRA" (don't worry, it's less shady than it sounds, just a slightly more involved process).

Why the income limits? The government figures that if you're already earning a ton of money, you probably don't need the tax-free withdrawal perk as much as someone who might be in a lower tax bracket later on. They want to help out the folks who will benefit most from that tax-free growth.

It's like if your favorite ice cream shop offered a "buy one, get one free" deal, but only for customers who spend less than $10. If you're about to drop $50, you don't get the deal. That's kind of how the Roth IRA income limits work.

Withdrawal Rules: The Nitty-Gritty

So, we've talked about taxes and income, but what about actually getting your money out? This is where things get a little more interesting, especially with the Roth IRA.

Traditional IRA: Age is Just a Number (for withdrawals)

With a Traditional IRA, you can usually start taking withdrawals penalty-free once you turn 59 and a half. Before that, if you take money out, you'll likely face a 10% early withdrawal penalty on top of paying income taxes. There are some exceptions, of course, like for first-time home purchases or certain medical expenses, but generally, it's best to leave that money alone until retirement age.

You also have to start taking required minimum distributions (RMDs) from a Traditional IRA once you reach a certain age (currently 73, but it's been creeping up). The government wants its tax revenue, so they'll make you start taking money out, whether you need it or not.

Roth IRA: A Little More Flexibility (with a Caveat)

The Roth IRA has a really cool perk: you can withdraw your contributions (the money you put in) tax-free and penalty-free at any time, for any reason. That's right, you can literally take your principal back if you have a super-urgent need for it, without owing Uncle Sam a dime or paying a hefty penalty. How awesome is that?

However, this flexibility applies only to your contributions. If you try to withdraw your earnings (the money your investments made) before you turn 59 and a half and before you've had the account for at least five years, you could still be hit with taxes and penalties. So, while the Roth offers some impressive liquidity for your initial investment, it's still primarily a retirement savings vehicle.

The five-year rule for Roths is important. Think of it as a probation period. You need to have had the Roth account open for at least five years for your earnings to be considered qualified withdrawals in retirement. This rule applies even if you're over 59 and a half. So, open it early, and let the clock tick!

The "Which One Is Right For Me?" Decision Tree

Alright, so we've covered the main differences. Now, the million-dollar question: which one should you choose? It really depends on your personal financial situation and your crystal ball predictions about your future tax bracket.

Consider a Traditional IRA If:

- You're currently in a higher tax bracket than you expect to be in retirement.

- You want to reduce your taxable income now and get an immediate tax break.

- You don't qualify for Roth IRA contributions due to high income.

- You're okay with paying taxes on your withdrawals in retirement.

Remember, the deduction is the star of the show here. It's like getting a coupon for your taxes right away. If saving money on taxes today is your priority, the Traditional IRA might be your jam.

Consider a Roth IRA If:

- You're currently in a lower tax bracket than you expect to be in retirement.

- You want the peace of mind of knowing your retirement withdrawals will be completely tax-free.

- You value the flexibility of being able to withdraw your contributions if absolutely necessary.

- You’re younger and have more time for your investments to grow tax-free.

- You don’t mind paying taxes on your contributions now.

The Roth is like a commitment to future financial freedom from taxes. It's betting on yourself and your future earning potential, or at least your future tax rates being higher.

What if I'm Still Not Sure?

Hey, it's not always black and white! Sometimes, the best approach is to have both. You can contribute to a Traditional IRA and a Roth IRA in the same year, as long as your total contributions don't exceed the annual IRA contribution limit. This can give you a blend of immediate tax benefits and future tax-free income. It’s like having your cake and eating it too, with a little bit of extra frosting.

Also, don't forget about other retirement savings vehicles like 401(k)s or 403(b)s offered by your employer. These often come with their own set of tax advantages and employer matching, which is basically free money! Always max out any employer match first, as that's an immediate return on your investment.

The Bottom Line: Your Future Self Will Thank You

Choosing between a Roth and a Traditional IRA is a personal decision. There's no single "right" answer that applies to everyone. It’s about understanding your current financial picture, your projected future, and what tax scenario makes you sleep best at night.

Don't let the jargon intimidate you. At its heart, it's just about making smart choices with your money to build a secure and happy future. Whether you opt for the immediate tax relief of a Traditional IRA or the tax-free freedom of a Roth IRA, the most important step is to start saving. Every dollar you put away today is a gift to your future self.

So, take a deep breath, do a little research based on your own situation, and make a plan. Your future retired self, sipping a piña colada on a beach somewhere (or just enjoying a quiet afternoon with a good book and zero tax worries), will be eternally grateful for the smart decisions you’re making right now. Go get 'em, champ!