What Is How Much Super Will I Need To Retire? A Simple Explanation

Ever find yourself staring into the crystal ball of your future, picturing yourself on a beach somewhere, cocktail in hand, with zero emails to answer? It’s a lovely thought, right? But then reality hits like a rogue wave: retirement. And with it comes the big, juicy question that makes most people’s eyes glaze over: “So, how much super do I actually need to make that dream a reality?”

Now, before you start mentally calculating your grocery bill for the next 50 years, let’s take a deep breath. This isn't about becoming a mathlete. Think of it more like planning a really awesome, long-term holiday. You need to know how much money you’ll need to keep the fun going, right? Superannuation, or ‘super’ as we affectionately call it Down Under, is basically your personal retirement fund. It’s money that’s been tucked away, growing for you, so that when you decide to hang up your work boots, you’ve got a nice little nest egg to live on.

So, what makes figuring out your ‘how much super’ quest so surprisingly… well, not boring? For starters, it’s all about you. This isn't some one-size-fits-all formula handed down from on high. Your ideal retirement looks different from mine, and that’s the fun part! Do you dream of leisurely afternoons exploring art galleries, or are you more of a ‘relive your youth on a Harley Davidson’ kind of retiree? Your spending habits in retirement will be as unique as your fingerprint.

Imagine this: you’re playing a game of ‘Retirement Bingo’. Each square represents something you’ll want to do or pay for. The more squares you want to tick off, the more ‘super points’ you’ll need. Simple, right? We’re talking about things like keeping a roof over your head (whether that’s your current home or a cozy cottage by the sea), keeping yourself fed and watered (fancy dinners or simple picnics?), staying healthy (doctor’s visits, maybe some yoga classes?), and of course, all the fun stuff! Travel? Hobbies? Spoiling the grandkids? These all add up. The beauty is, you get to decide what goes on your bingo card.

Now, you might be thinking, “Okay, so I need to figure out my dream retirement. But where do I even start with the numbers?” This is where the magic of a little bit of planning comes in. It’s not about knowing the exact dollar amount down to the last cent right now. It’s about getting a good, educated guess. Think of it as drawing a rough map of your destination before you start packing your bags.

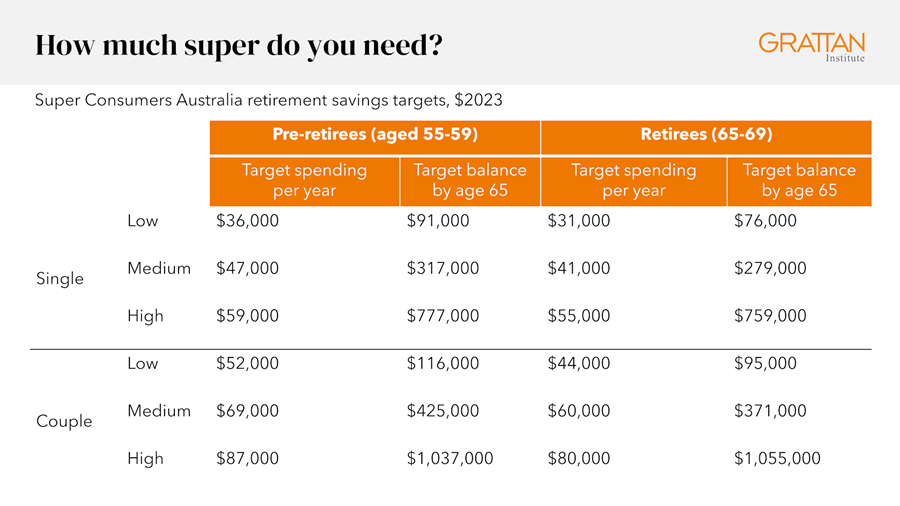

One of the most talked-about benchmarks is the Retirement Income Covenant. Don’t let the fancy name scare you! It’s basically a guideline that suggests a certain income you might need to live a comfortable retirement. For many, a commonly cited figure is around 70% of your pre-retirement income. So, if you’re earning, say, $80,000 a year now, you might aim for around $56,000 a year in retirement. This isn't a hard and fast rule, but it’s a fantastic starting point.

But here’s the twist that makes this whole ‘super’ thing a bit like a detective story: inflation. Ever notice how the price of a coffee seems to creep up over time? That’s inflation at play. It means your money might not buy as much in the future as it does today. So, your $56,000 target in 20 years will need to be a bit higher to have the same buying power. This is where your super fund’s investment performance becomes your trusty sidekick. Hopefully, your super is growing at a rate that outpaces inflation, giving your nest egg a good boost!

Another fascinating element is the Age Pension. For many Australians, this government-funded payment provides a safety net. It can supplement your super, meaning you might not need to rely solely on your own savings. The amount you receive from the Age Pension can depend on your income and assets. So, understanding how your super might interact with the Age Pension is like unlocking a secret level in your retirement planning game.

The real charm in figuring out “how much super do I need?” lies in its adaptability. It’s a journey, not a destination. You might start with one idea of your retirement, and then life happens! Maybe you have a change of heart, or maybe your health circumstances shift. The wonderful thing is that you can revisit these calculations. You can tweak your bingo card, adjust your spending expectations, and see how your super savings are tracking. It’s a dynamic process that keeps you engaged with your financial future.

Think about it: instead of just blindly putting money into a fund, you’re actively participating in shaping your own golden years. You’re making choices that reflect your values and your aspirations. It’s empowering! It’s the difference between being a passenger and being the captain of your retirement ship. And that, my friends, is what makes this whole conversation about ‘how much super’ so surprisingly special and, dare we say, even a little bit exciting!