What Is The Best Investment For Retirement Right Now? Explained Simply

Alright, settle in, grab your (metaphorical) latte, and let's talk about the magical, mystical, sometimes terrifying world of retirement investing. You know, that thing we all should be doing but often put off until… well, until we remember the alarming rate at which our hair is disappearing, or the fact that our favorite comfy pants are starting to feel a little snug. Yep, that retirement. And the burning question: what’s the best investment for it, like, right now?

If you’re expecting me to pull a rabbit out of a hat labeled “Guaranteed Retirement Riches,” you might want to adjust your expectations. This isn't a get-rich-quick scheme, folks. It’s more like a get-comfortably-old-and-able-to-afford-that-really-fancy-cheese-board scheme. And the truth is, there’s no single magic bullet, no crystal ball that points to one perfect stock that’ll make your golden years sparkle like a disco ball in zero gravity.

But! And this is a big, juicy, life-affirming “but” – there are strategies, and some are definitely way better than others. Think of it like choosing your adventure in a video game. Do you want to go for the risky but potentially epic loot, or the steady, reliable path that gets you to the castle eventually, albeit with slightly fewer dragons slain?

The "No One Knows For Sure" Disclaimer (Because Honesty is the Best Policy, Even When it's Slightly Depressing)

Let's get this out of the way. The stock market is basically a giant, unpredictable weather system. One day it's sunshine and rainbows, the next it's a Category 5 hurricane of "Oh dear, my 401(k) is weeping." So, anyone who guarantees returns is probably also selling beachfront property in Nebraska. Don't trust them. Seriously, run away. And maybe send me their contact info so I can warn others.

However, we can talk about what’s generally considered a good bet, based on, you know, decades of people smarter than me (and probably richer than me) looking at this stuff. It's about playing the odds, not winning the lottery.

So, What's the Big Idea? Diversification, Baby!

Imagine you’re at an all-you-can-eat buffet. Are you going to pile your plate with just mashed potatoes? No! You’d get bored, you’d probably regret it later, and your digestive system would stage a full-blown rebellion. Investing is the same. You don’t want all your eggs in one basket. Or all your retirement dreams tied to the fate of one quirky tech startup that makes self-folding laundry baskets (though, I admit, the idea has merit).

This magical concept is called diversification. It means spreading your money around. Like a responsible squirrel hiding nuts in various locations, just in case a rogue badger tries to raid its stash. If one investment tanks, the others can hopefully keep your retirement fund from doing a dramatic swan dive off a cliff.

The Usual Suspects: Stocks, Bonds, and the Rest of the Gang

When people talk about retirement investments, a few familiar faces usually pop up. We’ve got:

Stocks (The Thrill Rides)

These are like owning a tiny piece of a company. If the company does well, your stock price goes up, and you do a little jig. If the company tanks, you might shed a single, dramatic tear. Historically, stocks have offered the highest potential for growth over the long term. They’re the engine of wealth creation. But they can also be… well, a bit like riding a unicycle on a tightrope. Exciting, yes, but with a higher risk of a face-plant.

The trick with stocks for retirement is to not put all your eggs in the “early-stage meme stock” basket. Think broader. Think about companies that have been around, companies that make things people actually need (like, you know, food and electricity – revolutionary, I know!).

Bonds (The Steady Eddies)

Bonds are essentially loans you give to governments or corporations. They’re generally considered safer than stocks. You lend them money, they promise to pay you back with interest. It’s like your eccentric aunt lending you money, but with a formal contract and less nagging about getting a "real job."

Bonds are your retirement fund’s comfort blanket. They provide income and tend to be less volatile than stocks. However, their growth potential is usually lower. So, less of a roller coaster, more of a gentle stroll in the park. Which, as you get older, might sound incredibly appealing.

The "Magic" of Index Funds and ETFs (Your Personal Buffet Assistant)

Now, picking individual stocks and bonds can feel like trying to find a needle in a haystack that’s on fire. It's exhausting, and frankly, most of us don’t have the time or the encyclopedic knowledge of paperclip manufacturing trends.

Enter index funds and Exchange Traded Funds (ETFs). These are like pre-packaged investment meals. An index fund, for example, aims to mirror the performance of a specific market index, like the S&P 500 (which represents 500 of the largest U.S. companies). So, instead of buying one stock, you’re buying a tiny slice of all those companies. Instant diversification! It’s like having a buffet assistant who tells you, “Just take a little bit of everything, it’s all good!”

ETFs are similar but trade on exchanges like stocks. They offer that same diversification but with the flexibility to buy and sell throughout the day. They’re generally low-cost, which is a big win. You know how those fees can sneak up on you like a ninja in the night? Low fees mean more money for your retirement, not for someone else’s yacht fund.

So, What’s the "Best" Right Now? (Drumroll Please...)

Okay, the moment of truth. If I had to put my (metaphorical) retirement savings on something right now, with the caveat that I’m not a financial advisor and you should definitely talk to one who charges by the hour and doesn’t have a crystal ball, it would be a diversified portfolio heavily weighted towards low-cost index funds or ETFs.

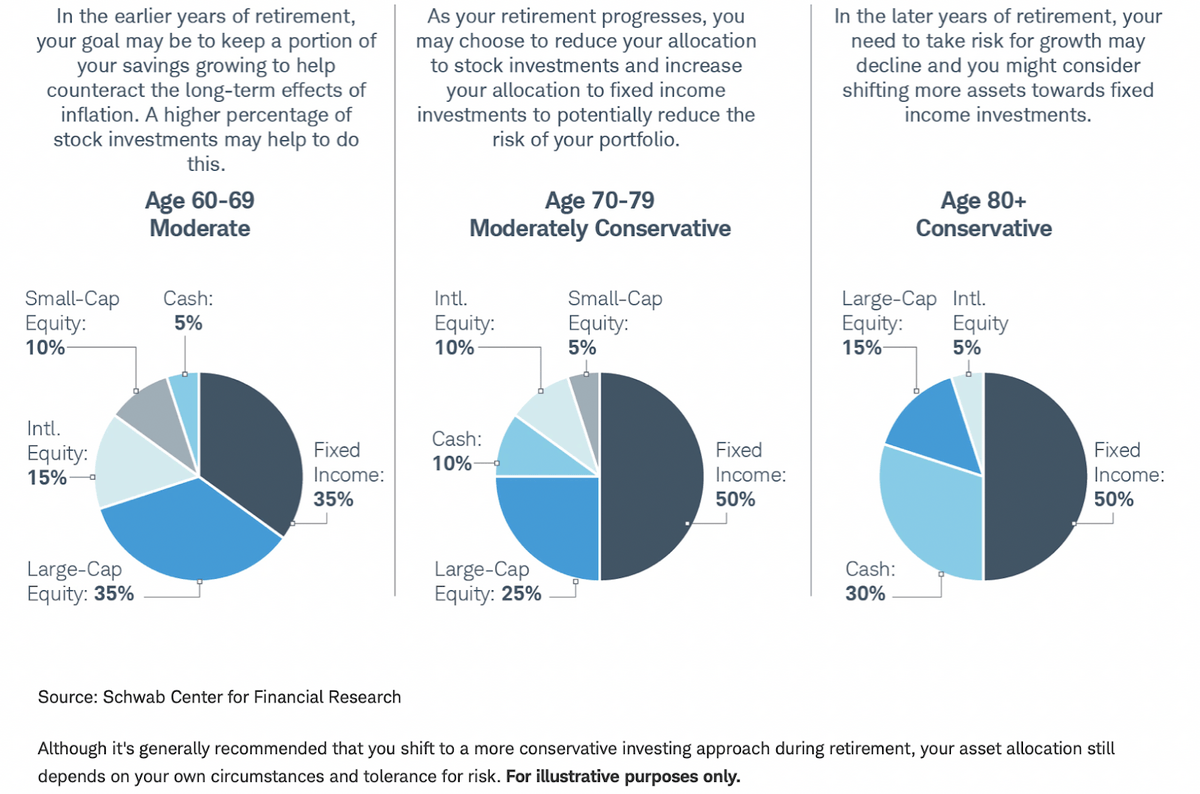

Think about a mix. For younger folks with a longer time horizon, you might lean more towards stock-heavy index funds (like an S&P 500 ETF). As you get closer to retirement, you’d gradually shift more towards bonds to de-risk. It’s like gradually slowing down your car as you approach a scenic overlook. You don’t slam on the brakes, you just ease off the gas.

Why This Approach Rocks (Besides the Obvious "Not Going Broke" Part)

Low Costs: Less money spent on fees means more money working for you. It's simple math, but oh-so-important.

Diversification: You’re not putting all your chips on one number. If one part of the market sneezes, the rest of your portfolio likely won’t catch the plague.

Simplicity: You don’t need to be a Wall Street wizard to understand this. It’s about playing the long game with a sensible strategy.

Historical Performance: Over decades, diversified portfolios have consistently shown strong growth. They’re not going to make you a billionaire overnight, but they are fantastic at helping you build a nest egg that can actually support your retirement dreams (like that aforementioned fancy cheese board, or maybe a trip to see penguins).

A Final Word of Encouragement (and a Gentle Nudge)

The best investment for your retirement right now is one that you actually start and then stick with. Procrastination is the silent killer of retirement dreams. It’s the little gremlin whispering, “You’ve got time, have another donut.” Don’t listen to the gremlin!

So, take a deep breath. Do a little research. Consider those low-cost, diversified index funds or ETFs. And remember, the journey to a comfortable retirement is less about finding a hidden treasure map and more about consistently putting one foot in front of the other. Now, go forth and invest wisely, you magnificent future retiree!