What Is The Current Interest Rate For Unsubsidized Student Loans? Explained Simply

Alright, gather 'round, my financially-challenged friends! Let's talk about something that might make your eyes glaze over faster than a lukewarm donut at a conference: student loan interest rates. Specifically, the dreaded unsubsidized kind. Now, I know what you're thinking. "Unsubsidized? Is that like when you try to assemble IKEA furniture without the instructions and end up with a wonky bookshelf that leans precariously?" Pretty much!

Think of it this way: subsidized loans are like getting a piggyback ride from a generous aunt who pays for some of the journey. Unsubsidized loans? You're on your own, pal. The government isn't throwing you any lifelines here. They're basically saying, "Here's the money, now go forth and get that degree! And, uh, good luck with the repayment part!"

So, what's the damage? What's the magic number that determines how much extra cash you'll be handing over for the privilege of holding that diploma? Drumroll, please... (imagine a very sad, slightly out-of-tune drumroll).

As of right now, for the 2023-2024 academic year, the interest rate for Direct Unsubsidized Loans for undergraduate students is a cool 5.50%. Yeah, you heard that right. Five. Point. Five. Zero. It's not quite as terrifying as, say, a surprise pop quiz on quantum physics, but it's definitely enough to make your wallet do a little jig of despair.

Now, for the graduate students out there, you get to play with the big kids. Your Direct Unsubsidized Loan rate for the 2023-2024 academic year is a slightly heftier 7.05%. Oof. That's like adding an extra dessert to your bill every single time you go out to eat, except this dessert lasts for a decade or more. And it comes with a side of existential dread.

Wait, wait, wait! I can hear you all collectively sighing from here. "But I thought interest rates were always going up and down like a yo-yo on a sugar rush!" And you're not entirely wrong. These rates are set annually, and they're tied to the U.S. Treasury's auction of 10-year notes. So, imagine the government holding an auction for its IOUs, and whatever price those notes fetch dictates your loan's destiny. It's like a high-stakes game of Monopoly, but instead of passing Go, you're just trying to avoid bankruptcy.

Here's a fun, albeit slightly alarming, fact: Back in the ancient times of the 2006-2007 school year, undergraduate unsubsidized loan rates were a whopping 6.8%. And graduate students were staring down the barrel of 8.00%. So, in a way, we're kind of winning? Maybe? It's all about perspective, right? Like, if your house is on fire, but only a little bit, you can pat yourself on the back that it's not a full-blown inferno.

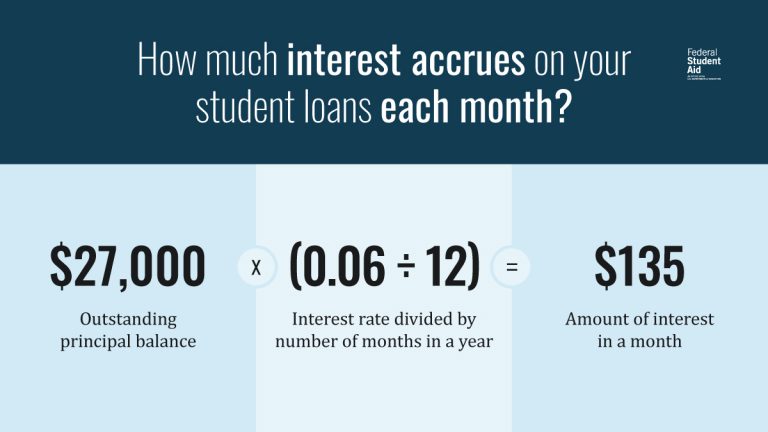

Let's break down what this 5.50% or 7.05% actually means in plain English. It's the cost of borrowing that money. It's the price tag for all those late-night study sessions fueled by questionable cafeteria coffee and the promise of a brighter future. For every dollar you borrow, you're going to owe that dollar back, plus a little extra for every year it's outstanding. It's like rent on your money.

Think of it this way: if you borrow $10,000 at 5.50% interest and don't pay it back for a year (which, let's be honest, is a super simplified scenario), you'd owe about $550 in interest. Add that to your original $10,000, and bam! You're looking at $10,550. Now, imagine that snowball effect over a decade or more. Suddenly, that seemingly small percentage starts to look a bit more like a hungry dragon guarding your future earnings.

And here's where things get really interesting (and by interesting, I mean potentially soul-crushing). These rates are fixed. That means once you take out the loan for that academic year, that rate is locked in for the life of the loan. So, if interest rates in the wider economy decide to do a happy dance and go down later, your loan rate is going to be chilling on its own little island, unaffected by the festivities. It's like being stuck in a time warp where only your loan interest rate is concerned.

The other key player here is the Unsubsidized part. Remember our friend, the subsidized loan? The government pays the interest while you're in school and during grace periods. Unsubsidized? Nope. The interest starts accumulating the moment that money hits your student account. It's like the meter is running from day one, even if you're busy trying to figure out how to use a centrifuge or write a thesis that doesn't sound like a drunk squirrel wrote it.

So, what's the takeaway from all this number-crunching? Well, first off, it's good to be aware of these rates. Knowledge is power, or at least, it's the power to make slightly more informed financial decisions, which in the world of student loans is like finding a unicorn. Secondly, it underscores the importance of trying to borrow only what you absolutely need. Every dollar you borrow will eventually come back to you with a tiny, yet persistent, friend named interest.

And if you're about to embark on this glorious journey of higher education, or if you're already knee-deep in it, please, for the love of all that is financially sound, explore every scholarship, grant, and work-study opportunity you can find. Think of them as little angels swooping in to save you from the clutches of interest rates. Every bit helps!

In conclusion, the current interest rate for unsubsidized student loans for undergraduates is 5.50%, and for graduate students, it's 7.05% for the 2023-2024 academic year. It's a fixed rate, and the interest starts accruing immediately. It’s not the most fun conversation to have over a latte, but understanding it is a crucial step in navigating the labyrinth that is student loan repayment. Now go forth and conquer that degree, and may your financial future be as bright as your academic achievements!