What Is The Difference Between Expansionary And Contractionary Monetary Policy? Explained Simply

Imagine your favorite cozy coffee shop. It's the kind of place where the barista knows your name, and the smell of freshly baked croissants is practically a hug. Now, let's talk about how the economy, like this beloved coffee shop, can sometimes feel a little too full of steam or, conversely, a bit too chilly and empty. That's where the folks at the central bank, often nicknamed the "Money Magicians" (okay, maybe not officially, but it sounds cooler, right?), come in with their special tools: expansionary and contractionary monetary policy.

Think of these policies as the central bank adjusting the "thermostat" of the economy. When things feel a bit sluggish, like when the coffee shop is empty and the croissants are getting a little stale, the Money Magicians want to warm things up. This is where expansionary policy shines. It's like turning up the heat and opening the doors wide, inviting everyone in for a warm beverage and a delicious treat.

So, how do they do this "warming up"? Well, one of their favorite tricks is to lower the interest rates. Imagine the bank is offering loans for new espresso machines or extra seating at the coffee shop. If the interest rate is super low, it’s like getting a fantastic deal – almost too good to be true! This makes it cheaper for businesses to borrow money to expand, hire more people (think of adding a cheerful new barista!), or invest in new shiny equipment. For you and me, it also means that borrowing money for a new car or a home improvement project becomes more affordable. Suddenly, that dream kitchen remodel doesn't seem so out of reach!

Another expansionary trick is when the central bank decides to inject more money into the system. This isn't like printing money in your basement (please don't do that!). It's more like the Money Magicians deciding to buy a bunch of government bonds. When they buy these bonds, they're essentially putting more cash into the hands of banks, who then have more to lend out. It's like the coffee shop owner getting a surprise infusion of cash from a generous benefactor, allowing them to buy more beans, hire that extra baker, and maybe even run a "buy one, get one free" croissant special to get people excited!

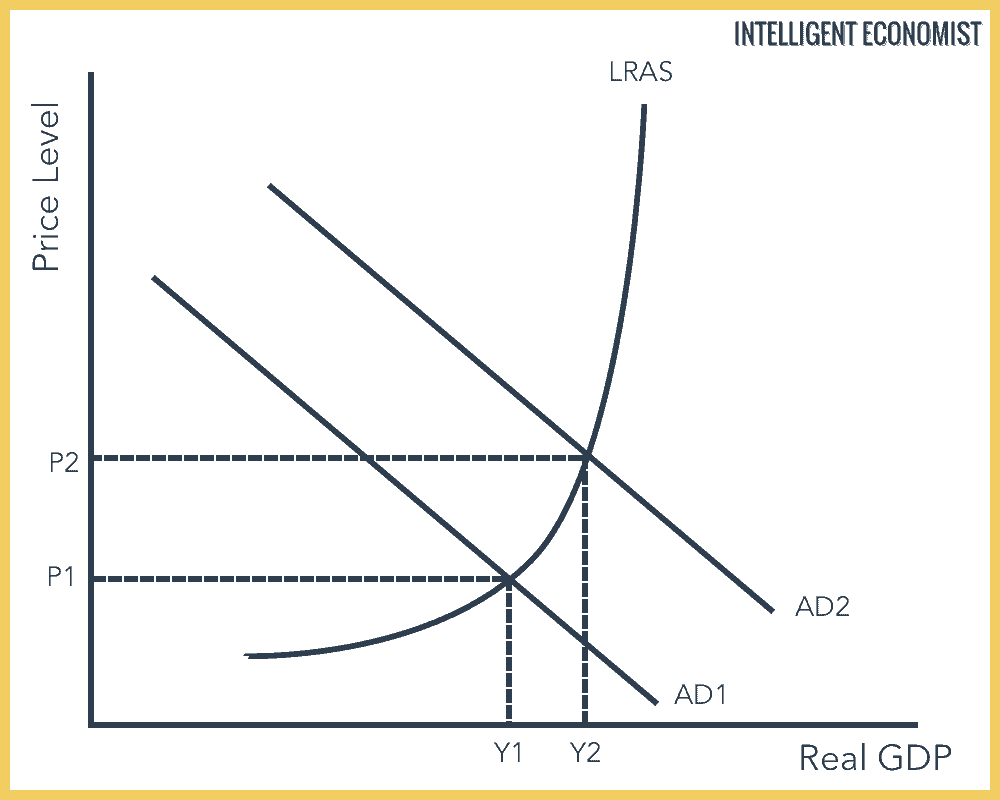

The goal of all this expansionary jazz is to get people spending and businesses investing. When money flows more freely, people feel more confident about their jobs and their futures, so they're more likely to go out, buy things, and enjoy life. It’s that happy, bustling atmosphere in the coffee shop, with people chatting, laughing, and enjoying their lattes. It’s the sound of a healthy, growing economy, humming with activity!

Now, what happens if things get a little too warm? What if the coffee shop is so packed that the baristas are stressed, the croissants are flying off the shelves before they're even baked, and prices start to creep up because everyone wants a slice of that deliciousness? This is when things can get a bit overheated, and we might be looking at inflation. Inflation, in simple terms, is when prices for goods and services go up across the board. It’s like your favorite coffee suddenly costing a dollar more, and then another dollar, and then another. Not so fun for your wallet!

When the economy feels like it's running a marathon at a sprint pace, the Money Magicians need to tap the brakes. This is where contractionary policy comes into play. Think of it as the central bank turning down the thermostat and perhaps putting up a little "Shhh, we're cooling down" sign on the coffee shop door. The goal here is to slow things down just a tad, to prevent prices from spiraling out of control.

How do they achieve this cooling effect? Their go-to move is to raise interest rates. Remember how low interest rates made borrowing cheap? Well, higher interest rates make borrowing more expensive. Suddenly, that new espresso machine loan for the coffee shop owner looks a lot less appealing. For us, taking out a loan for that car or home remodel becomes a bigger commitment. This encourages people to be more cautious with their spending and borrowing, which helps to take some of the heat off the economy.

Another contractionary tactic involves the central bank doing the opposite of what they did in expansionary policy: they might sell government bonds. When they sell these bonds, they are essentially pulling money out of the banking system. This means banks have less money to lend, which naturally tightens the purse strings a bit. It’s like the coffee shop owner deciding to cut back on the fancy latte specials for a while to ensure they have enough cash to cover their essentials.

The aim of contractionary policy isn't to shut down the coffee shop, but rather to ensure it remains a pleasant and sustainable place for everyone to enjoy. It's about finding that sweet spot where business is good, but not so frantic that things become unaffordable or unsustainable.

So, in a nutshell, expansionary policy is like giving the economy a warm, invigorating hug to encourage growth and spending. It’s all about making borrowing cheaper and money more readily available. On the other hand, contractionary policy is like a gentle, calming hand on the shoulder, encouraging a bit of a breather to keep prices stable and the economy from overheating. It’s about making borrowing a little more expensive and money a bit scarcer.

These two types of policies are the central bank's way of keeping the economic engine running smoothly, not too fast, not too slow, but just right – much like ensuring our favorite coffee shop always has enough beans for a perfect brew and enough tables for everyone to enjoy their cozy corner.