What Is The Fair And Accurate Credit Transactions Act? Explained Simply

Hey there, sunshine seekers and savvy savers! Ever find yourself wondering about the mysterious forces that shape your financial vibe? You know, the behind-the-scenes stuff that determines if you get approved for that dream apartment, that cool new credit card with the killer rewards, or even that sweet vintage car you spotted online? Well, buckle up, because we're diving into the world of credit reporting, and today’s star is a rather important, if slightly unglamorous, piece of legislation: The Fair and Accurate Credit Transactions Act, or FACTA for short. Think of it as your financial wingman, looking out for your best interests in the wild west of credit information.

Now, before you start picturing dusty legal documents and stuffy boardrooms, let's reframe this. FACTA isn't about boring regulations; it's about your power. It’s about ensuring that when companies report your financial habits, they're doing it the right way – fairly and accurately. Because let's be real, your credit report is like your financial passport in the modern world. It’s a snapshot of your reliability, and it deserves to be pristine and truthful.

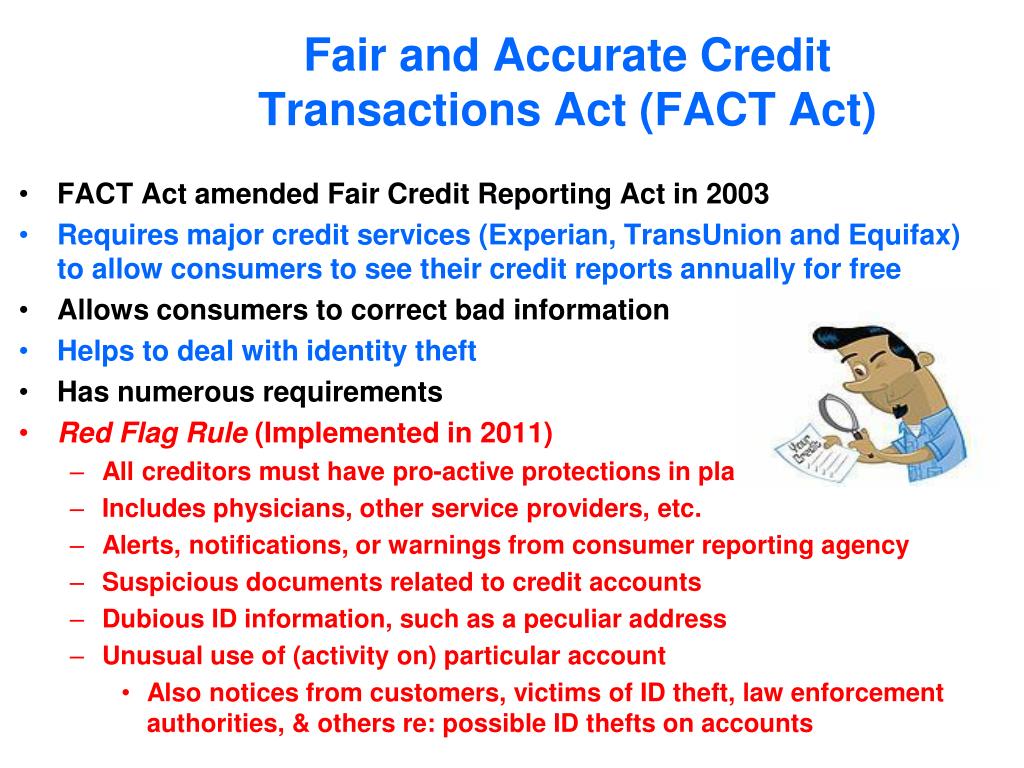

So, what exactly is this FACTA thing, and why should you care? Imagine it as a set of rules that keeps the credit bureaus (those big three: Equifax, Experian, and TransUnion) and the companies that report to them (your banks, credit card companies, landlords, etc.) honest. It's all about preventing your financial story from being miswritten, which, trust me, can have ripple effects bigger than a misplaced comma in a bestselling novel.

The “Fair” Part: Your Right to Know and Correct

Let's break down the “Fair” in FACTA. This is where you get some serious superpowers. First off, you have the right to know what's being said about you. That's right, you can get a free copy of your credit report from each of the three major bureaus every 12 months. Think of it as an annual financial check-up. You wouldn't skip your doctor's appointment, right? Your credit report deserves the same attention.

How do you snag this golden ticket? It's actually super easy. Just head over to AnnualCreditReport.com. This is the official and only website authorized by federal law to provide your free reports. Don't fall for those shady sites promising "free credit reports" that actually lead you down a rabbit hole of sign-ups and hidden fees. We’re talking about the real deal here, folks.

Why is this important? Because mistakes happen! Maybe a payment was reported late when you were right on time. Perhaps an account that should be closed is still showing up. Or, in a scarier scenario, you might find a mysterious new account opened in your name – a classic sign of identity theft. FACTA gives you the ammunition to fight back.

If you find something wrong, you have the right to dispute inaccuracies. You don't need to be a legal eagle for this. You simply contact the credit bureau reporting the error and explain the situation. Provide any supporting documents you have – copies of cancelled checks, payment confirmations, letters from creditors. The bureau then has to investigate your claim, typically within 30 days. They’ll contact the company that provided the information and get to the bottom of it. It’s like having a personal investigator for your financial history!

This right to dispute is crucial. Imagine this: You’re applying for a mortgage, and a glaring error on your credit report makes you look like a financial risk. FACTA ensures you have the recourse to get that corrected before it derails your homeownership dreams. It’s about fairness, plain and simple.

The “Accurate” Part: Keeping Your Financial Story Honest

Now, onto the “Accurate.” This is where FACTA puts the onus on the companies reporting your information. They have to take reasonable steps to ensure the accuracy of the data they're sending to the credit bureaus. This means they can't just be lazy or careless with your financial details.

For instance, if you’ve been a victim of identity theft, FACTA provides a framework to help you deal with it. You can place a fraud alert on your credit file. This is like putting a neon sign on your account saying, "Hey, keep an extra eye out, I might have been compromised!" Lenders who receive a credit application from you will be alerted to the fraud alert and will need to take extra steps to verify your identity before extending credit. It’s a fantastic first line of defense.

Furthermore, if you become a victim of identity theft, FACTA allows you to get a free credit report from each bureau after you've filed a police report about the theft. This helps you monitor the damage and ensure no further fraudulent activity is occurring. It's like having a secret mission to restore your financial integrity.

Another cool aspect is the truncated Social Security number on credit reports. You know how your Social Security number is super sensitive? FACTA requires credit bureaus to truncate your SSN on credit reports they provide to you. This means only the last four digits will be visible. It's a small but mighty step to protect your personal information from prying eyes, especially if your report somehow falls into the wrong hands.

Think of it this way: these companies are essentially writing chapters of your financial biography. FACTA is the editor, making sure the facts are straight and the narrative is honest. It prevents your financial reputation from being unfairly tarnished by an errant pen stroke.

Beyond the Basics: Fun Little Extras and Cultural Notes

FACTA isn't just about dry legalities; it has some pretty neat side effects that touch our daily lives. For example, remember those pre-approved credit card offers that used to flood your mailbox? FACTA brought us the National Do Not Call Registry for telemarketing calls, but it also gives you the power to opt-out of pre-approved credit offers. Yes, you can tell those credit card companies, "No, thank you!"

How? You can opt-out for five years by calling 1-888-5-OPT-OUT (1-888-567-8688) or visiting OptOutPrescreen.com. You can opt-out permanently by submitting a written request after starting the online or phone opt-out process. Imagine a mailbox free from the siren song of endless credit offers! It's a little slice of peace in a world of constant solicitation.

Culturally, FACTA aligns with a growing awareness of consumer rights. In an age where our digital footprints are vast and our personal data is constantly being collected, laws like FACTA are essential for maintaining a sense of control. It’s akin to the right to privacy we expect in our homes, but applied to our financial lives.

Consider the popularity of shows like "Black Mirror," which often explore the darker side of technology and data. FACTA is a real-world counterpoint, a piece of legislation designed to prevent those dystopian scenarios from becoming our financial reality. It’s about ensuring technology serves us, rather than enslaves us.

Here’s a fun fact for you: The original FACTA was signed into law in 2003. Since then, it has been amended and strengthened, showing a continuous effort by lawmakers to adapt to the evolving financial landscape. It’s a living, breathing piece of legislation, much like our own financial lives.

+(1+of+4).jpg)

Practical Tips to Harness FACTA’s Power

So, how can you actively use FACTA to your advantage? It’s all about being proactive and informed.

1. Annual Credit Report Ritual: Make it a point to get your free credit reports from AnnualCreditReport.com at least once a year. Spread them out – get one from Equifax every four months, one from Experian four months later, and one from TransUnion after that. This way, you’re constantly monitoring your credit. Think of it as your financial horoscope, but with actual data!

2. Vigilance is Key: When you get your reports, don't just skim them. Read them carefully. Check every account, every address, every inquiry. If something looks off, trust your gut. It’s better to question a small detail than to let a big problem fester.

3. Dispute with Confidence: If you find an error, don't be intimidated. FACTA is on your side. Write clear, concise dispute letters. Keep copies of everything. Follow up if you don't hear back within the expected timeframe. You’re not asking for a favor; you're exercising your rights.

4. Opt-Out of the Noise: Take a few minutes to opt-out of pre-approved credit offers. It’s a simple step that can reduce clutter and temptation. Your mailbox (and your financial focus) will thank you.

5. Identity Theft Preparedness: If you ever suspect identity theft, act fast. Contact the credit bureaus to place a fraud alert and consider filing a police report. FACTA provides the framework for you to recover and rebuild.

6. Monitor Your Mail and Email: Be aware of any unfamiliar account statements or notifications. These can be early warning signs of fraudulent activity. FACTA empowers you to be the guardian of your financial identity.

Think of these tips like mastering a new recipe. Once you know the steps and ingredients, it becomes second nature, and the result is delicious (in this case, financially secure!).

A Little Reflection: FACTA in Your Everyday Life

So, what does this all boil down to for you and me, as we navigate the everyday hustle? FACTA is more than just a law; it’s a promise of fairness in our financial interactions. It’s the quiet assurance that when you’re building your life – whether it’s saving for a down payment, planning a vacation, or just buying groceries – your financial reputation is being treated with respect.

It’s like the unwritten rule of a good friendship: honesty and accuracy. You expect your friends to tell you the truth, and you expect them to represent you fairly. FACTA applies that same principle to the world of credit. It's about having a level playing field, where your hard work and responsible financial behavior are accurately reflected.

Next time you get a credit card offer, or apply for a loan, or even just think about your financial goals, remember FACTA. It’s the silent guardian, the helpful guide, ensuring your financial story is told truthfully. And in a world that’s constantly asking for our information, that’s a pretty comforting thought, wouldn’t you agree?