What Is The Primary Function Of The Federal Reserve System? Explained Simply

Ever wondered what keeps the wheels of the economy turning smoothly, preventing wild swings in prices, and making sure you can actually buy your favorite cup of coffee without it costing an arm and a leg? It’s not magic, and it’s not a secret cabal (at least, not in the way the movies portray it!). It’s the work of a fascinating, albeit often misunderstood, institution: the Federal Reserve System, affectionately known as "The Fed." Now, "Fed" might sound a bit like a grumpy babysitter, but in reality, it's more like the incredibly skilled conductor of a giant orchestra – the U.S. economy. Understanding its primary function isn't just for economics nerds; it’s actually incredibly useful for all of us. It’s the unseen force that impacts your job prospects, the interest rates on your car loan, and even the value of your savings. So, let's dive in and demystify this crucial part of our financial landscape in a way that's actually… dare I say it… fun?

The Fed's Big Gig: Keeping Things Stable

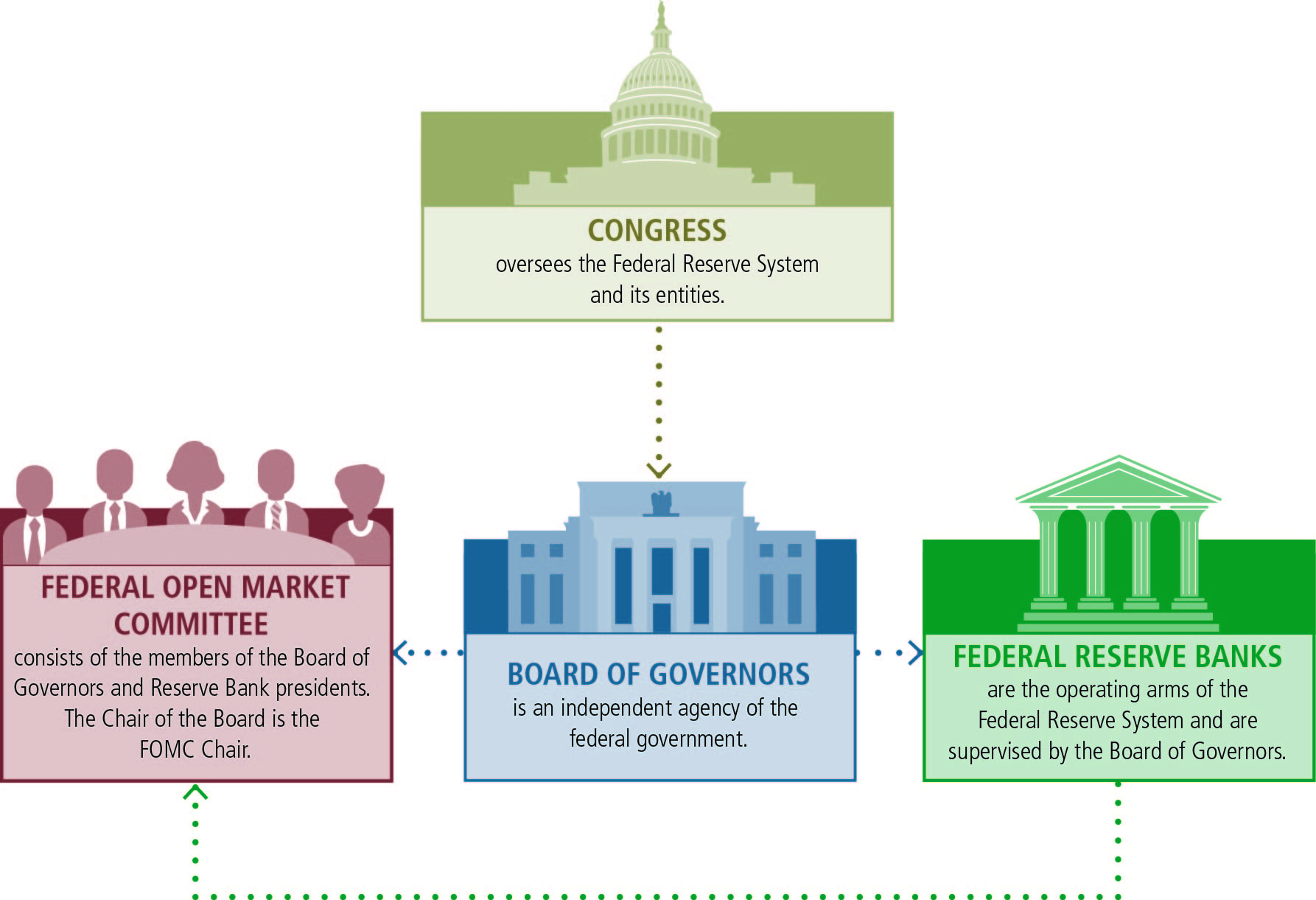

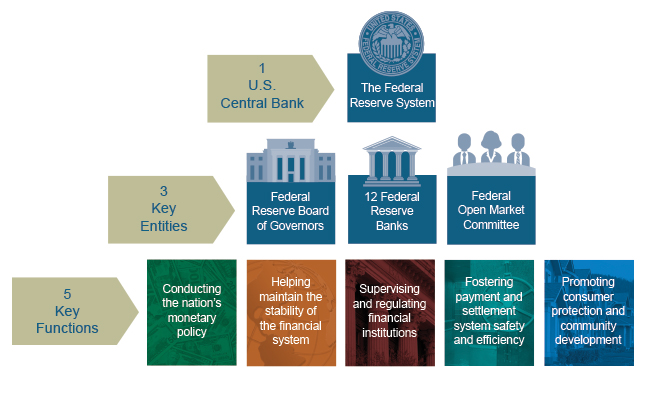

So, what exactly is the primary function of the Federal Reserve System? In the simplest terms, its main job is to maintain a stable and healthy U.S. economy. Think of it as the economy's doctor, constantly monitoring its vital signs and intervening when necessary to keep it from getting too sick or too feverish. This overarching goal breaks down into a few key areas:

1. Maximum Employment: The Fed aims for a job market where nearly everyone who wants a job can find one. It's about having a strong and vibrant workforce.

2. Stable Prices: This is a big one! The Fed works to keep inflation – the general increase in prices and fall in the purchasing value of money – under control. Nobody likes it when their hard-earned cash buys less and less each year, right?

3. Moderate Long-Term Interest Rates: This helps ensure that borrowing and lending are predictable, which is super important for businesses making big investments and for individuals planning for major purchases like a home.

Federal Reserve System | Statista

These three goals, often referred to as the Fed's "dual mandate" (though the interest rate part is often folded into price stability), are like the pillars holding up the roof of our economic well-being. When these pillars are strong, the whole structure is more resilient.

Why Does This Matter to YOU?

You might be thinking, "Okay, that sounds important for the big picture, but how does it affect my daily life?" Well, the Fed's actions have a ripple effect that touches everyone. When the Fed is successful in its mission:

:max_bytes(150000):strip_icc()/The-federal-reserve-system-and-its-function-3306001_final-7ed205221ee243f0bfa72b8b27226282.png)

- Your job is more secure. A healthy economy with maximum employment means businesses are more likely to hire and keep their employees.

- Your money holds its value. Stable prices mean that the money you earn today will still have a decent purchasing power tomorrow, next week, and next year. No one wants to experience the shock of seeing their savings dwindle because of runaway inflation.

- Borrowing is more predictable. Whether you're looking to buy a car, a house, or even start a small business, stable interest rates make planning and budgeting much easier. You're less likely to be blindsided by sudden, drastic increases in the cost of borrowing.

- The financial system is sound. The Fed also plays a crucial role in overseeing banks and making sure the overall financial system is safe and sound. This prevents crises that could hurt everyone, just like when a major bank had trouble a while back.

Essentially, the Federal Reserve System acts as a guardian of our economic stability. It’s not about dictating every single economic event, but about providing the right conditions for growth and prosperity. They do this primarily through influencing the availability and cost of money and credit in the economy, which is a fancy way of saying they manage interest rates and the amount of money circulating.

Think of it this way: If the economy is like a car, the Fed is the driver who’s carefully navigating the road. They’re not just flooring the accelerator or slamming on the brakes arbitrarily. They’re looking ahead, adjusting the speed, and making sure the ride is as smooth and safe as possible for everyone on board. And while the driver might not always be visible or their actions immediately apparent, their skill and focus are absolutely critical to reaching the destination – a strong and prosperous America.

The Tools of the Trade (Simplified!)

How does the Fed actually do all this? They have a few key tools in their toolbox:

- Setting Interest Rates (The Big One!): The Fed can influence a key interest rate called the federal funds rate. This is the rate at which banks lend reserves to each other overnight. When the Fed raises this rate, it generally makes borrowing more expensive throughout the economy, which can cool down inflation. When they lower it, borrowing becomes cheaper, which can encourage spending and boost employment. It's like turning a dial to speed up or slow down the economic engine.

- Buying and Selling Government Securities: The Fed can buy or sell U.S. Treasury bonds. When they buy these securities, they inject money into the banking system, making more money available for lending. When they sell them, they pull money out of the system. This is called open market operations and is a powerful way to influence the money supply.

- Reserve Requirements: Banks are required to keep a certain percentage of their deposits on hand as reserves. The Fed can adjust this requirement, though this tool is used less frequently now. If they increase the requirement, banks have less money to lend; if they decrease it, they have more.

So, the next time you hear about "The Fed" in the news, you'll know it's not just some abstract economic entity. It's a vital organization working behind the scenes, with sophisticated tools and a clear mission: to keep our economy on a steady, healthy path. And that's pretty important, and dare we say, pretty cool!