What's The Annual Return On Top University Endowment Funds: Best Picks & Buying Guide

Ever wondered what happens to all those generous donations that pour into our favorite universities? It's not like they're just piling up in dusty vaults to be used for… well, what exactly? Turns out, these amazing institutions have been quietly playing the stock market, and they're pretty darn good at it! We're talking about their endowments – basically, huge piles of money invested to keep the university running for… well, forever. And the returns these clever folks are raking in are enough to make your jaw drop.

Think of it like this: a university's endowment is like a giant piggy bank that never gets emptied. Instead, it's constantly being fed by donations and, importantly, by making smart investments. The goal is to grow that money so the university can fund scholarships, build new libraries, pay world-class professors, and maybe even keep the coffee machines stocked with decent beans (a crucial factor for any student, let's be honest).

So, what kind of magic are we talking about? We're looking at some seriously impressive annual returns. While the exact numbers fluctuate year to year, the top university endowments are consistently outperforming the average investor. We’re not talking about a few extra bucks here and there. We’re talking about the kind of growth that allows a university to dream big, to embark on groundbreaking research, and to offer opportunities to students who might otherwise never have a chance.

The Usual Suspects (and a Few Surprises!)

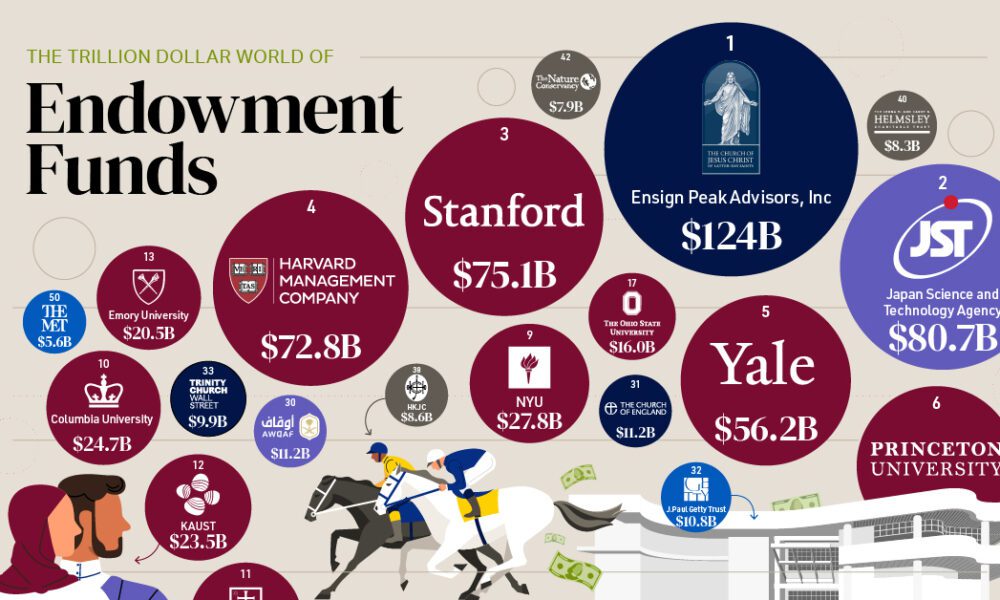

When you think of big-name universities, you probably think of places like Harvard, Yale, and Stanford. And yes, they are indeed financial titans. Their endowments are legendary, often rivaling the GDP of small countries. It’s almost comical how much money they manage. Imagine having so much cash that you can casually invest in everything from cutting-edge tech startups to prime real estate in bustling cities. These universities aren’t just educating future leaders; they’re also incredibly savvy financial institutions.

But it’s not just the Ivy League giants. We’re seeing some incredibly strong performances from other institutions that might surprise you. Keep an eye on places like the University of Texas System and the University of California. These public university systems, often overlooked in the private school glamour, are managing massive endowments and generating fantastic returns. It’s a testament to the fact that smart financial stewardship isn't confined to just one corner of the academic world.

What’s even more heartwarming is how this money trickles down. A significant chunk of these endowment returns goes directly into scholarships. This means that a student who might have only dreamed of attending a top university can now do so, thanks to the foresight and financial prowess of their alma mater. It’s a beautiful cycle of giving and growth, where past generosity fuels future opportunities.

What’s Their Secret Sauce? (It’s Not Just Luck!)

So, how do they do it? It’s a blend of highly skilled investment managers, a long-term perspective, and a willingness to diversify. These endowments aren't just buying stocks. They’re investing in a wide array of assets: private equity, hedge funds, real estate, natural resources, and yes, even art!

Think about it: while you might be nervously checking your 401(k) every day, these university funds are playing the long game. They’re not chasing quick wins; they’re building wealth for generations. They have the luxury of time, and they use it to their advantage. It’s like the tortoise and the hare, but the tortoise is also a financial wizard with a team of economists.

One of the fascinating aspects is their foray into alternative investments. While many of us stick to what we know, these endowments are comfortable taking calculated risks in areas that can offer higher returns. This includes investing in companies that are still in their infancy but have the potential to become the next big thing. It's a bit like betting on a talented but unproven athlete – high risk, but with the potential for a massive payoff.

And let’s not forget the sheer scale of their operations. When you're managing billions, you have access to investment opportunities that are simply not available to the average person. They can negotiate better deals, attract top talent, and have the resources to conduct in-depth research.

A Peek into the Future: What Does This Mean for You?

While you can’t directly invest in a university endowment (unfortunately, they don't offer shares to the public!), understanding their strategies can be incredibly insightful. It highlights the power of diversification, the importance of a long-term outlook, and the potential for smart investing to create lasting impact.

So, the next time you see a gleaming new science building or hear about a groundbreaking discovery coming out of your alma mater, remember the silent power of its endowment. It’s not just about tuition fees; it’s about a robust financial engine working tirelessly behind the scenes to ensure that our universities can continue to educate, innovate, and inspire for years to come. And that, in itself, is a pretty wonderful return on investment for all of us.

It's a remarkable feat of financial engineering, ensuring that the pursuit of knowledge and opportunity continues, generation after generation. Truly inspiring!

The dedication of these institutions to long-term financial health is a beacon for responsible management, proving that with smart planning, even the loftiest goals are achievable.