Where Can I Get A Certified Check Or Money Order: Complete Guide & Key Details

Hey there, money maestros and financial adventurers! Ever found yourself in a pickle, needing a super-duper official way to pay for something? Like maybe you're buying a slightly-used, but totally awesome, vintage unicycle from a very particular seller who only accepts certain forms of payment? Or perhaps you're putting a down payment on that charming little cottage that needs a tiny bit of... character renovation? Fear not, for today we're diving headfirst into the wonderful world of certified checks and money orders!

Think of these as the superheroes of secure payments. They’re the dependable sidekicks when your personal check might raise an eyebrow or when you need a guarantee that your hard-earned cash is actually going to reach its intended destination, no funny business allowed!

So, Where Do These Magical Payment Pieces Come From?

The quest for these financial fortresses is surprisingly straightforward. You've got a few trusty steeds to choose from when embarking on this important mission. Each has its own unique charm and accessibility, making it easier than ever to secure your payment.

The Ever-Reliable Banks: Your Financial Fortress!

Your local bank is probably the first place that pops into your head, and for good reason! They are the OG's of secure financial transactions. Whether it's a giant national bank with branches on every corner or your friendly neighborhood credit union, they've got your back.

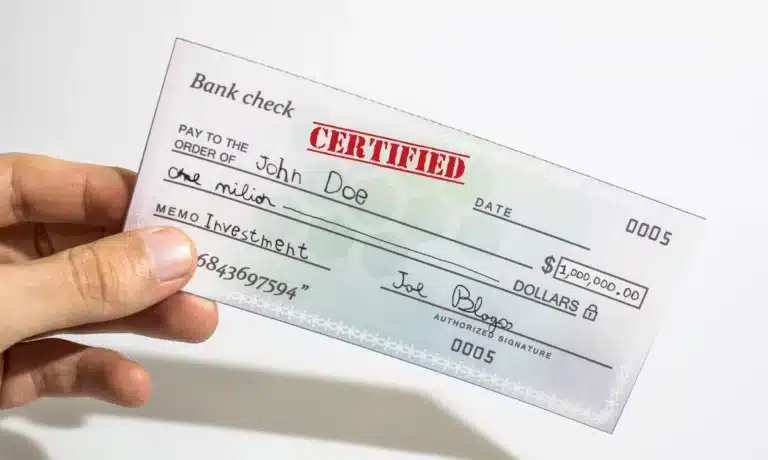

For a certified check, you basically tell your bank, "Hey, I need to pay this person, and I want you to promise this money is in my account and ready to go!" The bank then takes the funds from your account, marks the check as "certified" with their official stamp, and hands it over to you. It’s like a VIP pass for your money – nobody can say "no" to that!

Think of it as your bank giving your check a golden ticket. It’s like saying, "Yep, this cash is 100% here, no ifs, ands, or buts!" This makes sellers feel incredibly secure, especially for larger transactions where trust is key.

For a money order, the process is similar but usually involves a bit less "official stamp" fanfare. You give the bank cash or have them deduct it from your account, and they issue you a pre-paid money order. It’s pre-loaded and ready to be mailed or handed over. Easy peasy!

A little insider tip: Banks might charge a small fee for these services. It’s usually not a king's ransom, but it’s good to be aware. Think of it as a small toll for safe passage!

The Post Office: The Postal Powerhouse!

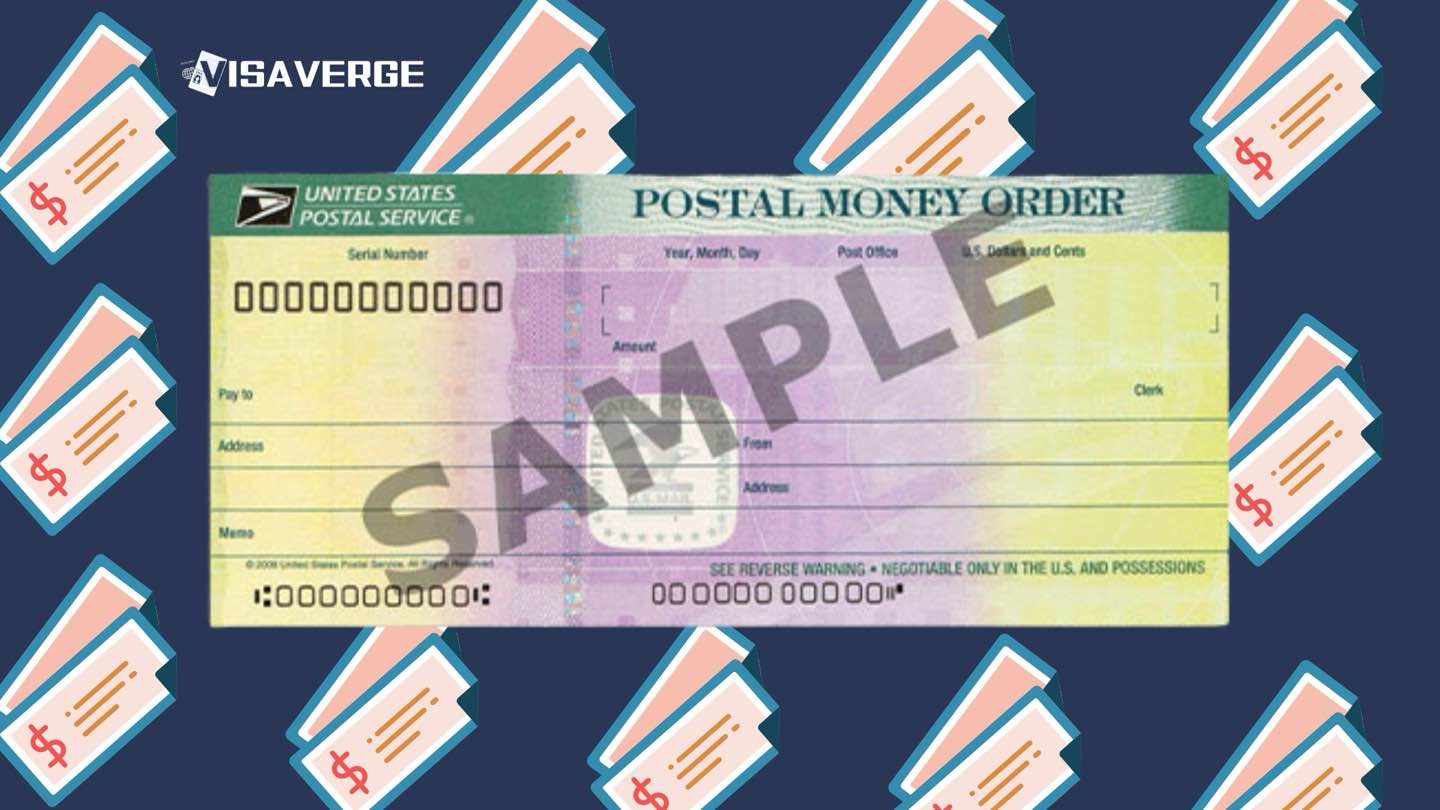

Ah, the United States Postal Service! Who knew those friendly folks delivering your junk mail also held the keys to secure payments? The USPS offers money orders, and they are a fantastic, widely accessible option. You don't even need to have an account with them!

You can walk right into almost any post office, fill out a form, and pay for your money order with cash, a debit card, or sometimes even a personal check. They're like the friendly neighborhood convenience store for money orders!

These USPS money orders are a fantastic choice for smaller to medium-sized payments. They are accepted by tons of merchants and individuals, making them incredibly versatile. Plus, knowing it's backed by Uncle Sam gives you a nice sense of security.

The limits on USPS money orders are pretty reasonable, too. You can get multiple money orders if your payment is a bit larger. It's a bit like assembling a puzzle of secure payments!

Retail Stores: The Unexpected Heroes!

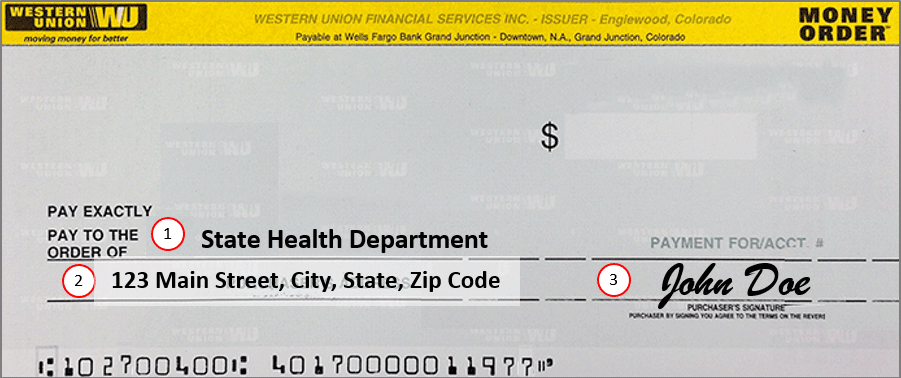

You might be surprised to find out that many of your favorite retail stores also sell money orders! Yes, places like Walmart, CVS, Walgreens, and even some grocery stores have these available, often at their customer service desks or pharmacies.

These are usually issued by third-party companies like MoneyGram or Western Union. The process is very similar to the post office: you pay with cash or a debit card, and they issue you the money order. It's super convenient when you're already out and about!

It’s a fantastic option when you need a money order in a pinch and don’t want to make a special trip to the bank or post office. Imagine needing to pay for that urgent cake order for your best friend’s surprise party – bam! You can grab a money order while you’re picking up the balloons.

Just like with banks, there might be a small fee associated with these. And the limits can vary a bit depending on the store and the issuing company, so it's always a good idea to check beforehand if you're making a large purchase.

Key Details to Keep in Your Financial Backpack

Now that you know where to get these handy payment tools, let's chat about some important stuff to remember. It’s like packing the right snacks for your financial expedition!

Fees: The Tiny Tolls

As we've mentioned, most places will charge a small fee for issuing a certified check or money order. These fees are generally quite modest, often ranging from a dollar or two up to a few dollars. It's the price of peace of mind, and honestly, it's usually worth it!

Banks might have slightly different fee structures, especially if you're not a regular customer. So, a quick call ahead or a peek at their website can save you any minor surprises. Always check the fees before you commit!

Limits: How Much Can You Carry?

There are typically limits on how much you can pay with a single money order. For USPS money orders, the limit is usually around $1,000 per order. If you need to send more, you can simply purchase multiple money orders!

Certified checks, on the other hand, are usually limited only by the amount of money in your account. So, if you're buying that slightly-used, but totally awesome, vintage unicycle for a cool million dollars (hey, we can dream!), a certified check is probably your best bet.

Security: Keeping Your Money Safe

Both certified checks and money orders are considered very secure forms of payment. Unlike personal checks, the funds for them are already guaranteed. This means the recipient can be confident that the money is good!

Keep your money order or certified check in a safe place until you deliver it. Treat it like a precious gem, because, well, it represents your precious cash! And if you lose it, don’t panic – there are usually procedures to get it replaced, though it might take some time and paperwork.

When to Use Which: The Smart Shopper's Guide

So, when do you pull out the certified check, and when does the money order shine? Generally, certified checks are best for larger transactions where the seller might be hesitant about other payment methods. Think car down payments, significant real estate transactions, or high-value item purchases.

Money orders are your go-to for everyday expenses, sending money to friends or family, paying bills that don’t accept online payments, or any situation where you need a secure, guaranteed payment for a smaller to medium amount. They are also excellent for online purchases from individuals who don't accept credit cards.

Ultimately, both are fantastic tools in your financial arsenal. They offer a level of security and certainty that can make your life a whole lot easier when you need to make that important payment.

So, there you have it! The mystery of the certified check and money order is solved. Go forth, brave financial warrior, and secure your payments with confidence and a little bit of flair. Your wallet (and your peace of mind) will thank you!