Which Bank Is Best For Currency Exchange

Alright, so you’re planning an adventure, huh? Jetting off to somewhere exotic where the currency is more exciting than Monopoly money? Or maybe you just need to send some cash to a cousin who’s living the dream across the pond. Whatever your reason, one question inevitably pops up: which bank is actually the best for swapping your hard-earned dough for those foreign bits and bobs?

Let’s be honest, dealing with currency exchange can sometimes feel like navigating a jungle without a machete. You’ve got fees, you’ve got rates that seem to change faster than your teenager’s mood, and then there are those sneaky little markups. Nobody wants to feel like they’re being fleeced before their vacation even begins, right? It’s like showing up to a fancy restaurant and finding out they charge extra for the water! Unheard of!

So, let’s break it down, friend. We’re not going to get bogged down in super technical jargon. Think of this as your friendly chat over coffee, where I spill the beans on making your money go further when it crosses borders.

The Usual Suspects: Your Everyday Banks

Your first thought might be, "Well, duh, I’ll just go to my trusty bank!" And hey, that’s a perfectly sensible starting point. You know them, they know you (or at least they know your account number, which is pretty much the same thing these days).

Generally speaking, your local bank can definitely handle currency exchange. They’ll have a pretty good selection of major currencies, and it’s super convenient. You can often do it online, through their app, or just walk in with your passport and a smile.

The Good Stuff:

- Convenience: Already have an account? Easy peasy.

- Security: You’re dealing with a regulated institution, so your money’s generally safe.

- Familiarity: No need to learn a whole new system.

The Not-So-Good Stuff (and this is where it gets a little spicy):

- Rates: This is the biggie. Banks often don’t offer the absolute best exchange rates. They’ve got overheads to cover, and sometimes that means they build a little extra wiggle room into their rates. It’s like they’re saying, "Sure, we’ll get you those euros, but we’ll also have a little souvenir for ourselves."

- Fees: On top of potentially less-than-stellar rates, you might encounter various fees. Some banks have a flat fee per transaction, while others might have a percentage-based fee. It can really add up, especially for larger amounts.

- Availability: Need a super obscure currency for your trek to Timbuktu? Your local branch might not have it on hand. You might need to pre-order, which can add an extra step and a bit of stress.

So, while your bank is a reliable friend, they might not be the best deal friend. Think of them as the reliable uncle who always shows up, but maybe doesn’t bring the fanciest gifts.

The Currency Exchange Specialists: The Pros Who Do It All Day

Now, let’s talk about the places that specialize in this whole money-swapping business. You’ve probably seen them at airports (though airport kiosks are a whole other can of worms we’ll get to later – spoiler alert: they’re usually the most expensive!) or in busy city centers. These are your dedicated currency exchange bureaus.

These guys are in the game of buying and selling foreign currency. It’s their bread and butter. And because it’s their main gig, they often have to be more competitive to attract customers.

The Good Stuff:

- Potentially Better Rates: Because they deal in volume and it’s their core business, they can offer more competitive exchange rates than your average bank. They’re often closer to the "mid-market rate" (that’s the real, wholesale rate you see on Google).

- Wider Range of Currencies: Need to exchange that really specific coin from a tiny island nation? These specialists are more likely to have it, or be able to get it for you.

- Speed: For smaller amounts, they can often be super quick.

The Not-So-Good Stuff:

- Location: Sometimes you have to go out of your way to find a good one. And let’s not even talk about those airport ones – they’re notorious for ripping you off. It’s like paying a premium for the privilege of being stressed and rushed.

- Fees Still Exist: While their rates might be better, they won’t necessarily be free. They’ll still have their own way of making a profit, so always ask about any hidden fees or charges.

- Security Concerns (for some): While most are legitimate, you might feel a little more cautious dealing with a smaller, independent exchange bureau compared to a massive bank. Do your research on their reputation.

Think of these guys as the expert chefs who know all the secret ingredients to make your money taste better. But you still gotta read the menu carefully!

The Digital Dynamos: Online Platforms and Apps

Okay, this is where things get really interesting in the modern world. Online currency exchange platforms and apps have popped up like mushrooms after a rainstorm, and for good reason! They’re shaking things up, and often in a good way for our wallets.

These platforms leverage technology to reduce their overheads, and this can translate into some seriously attractive rates and lower fees for you. They’re all about making it seamless and digital.

The Good Stuff:

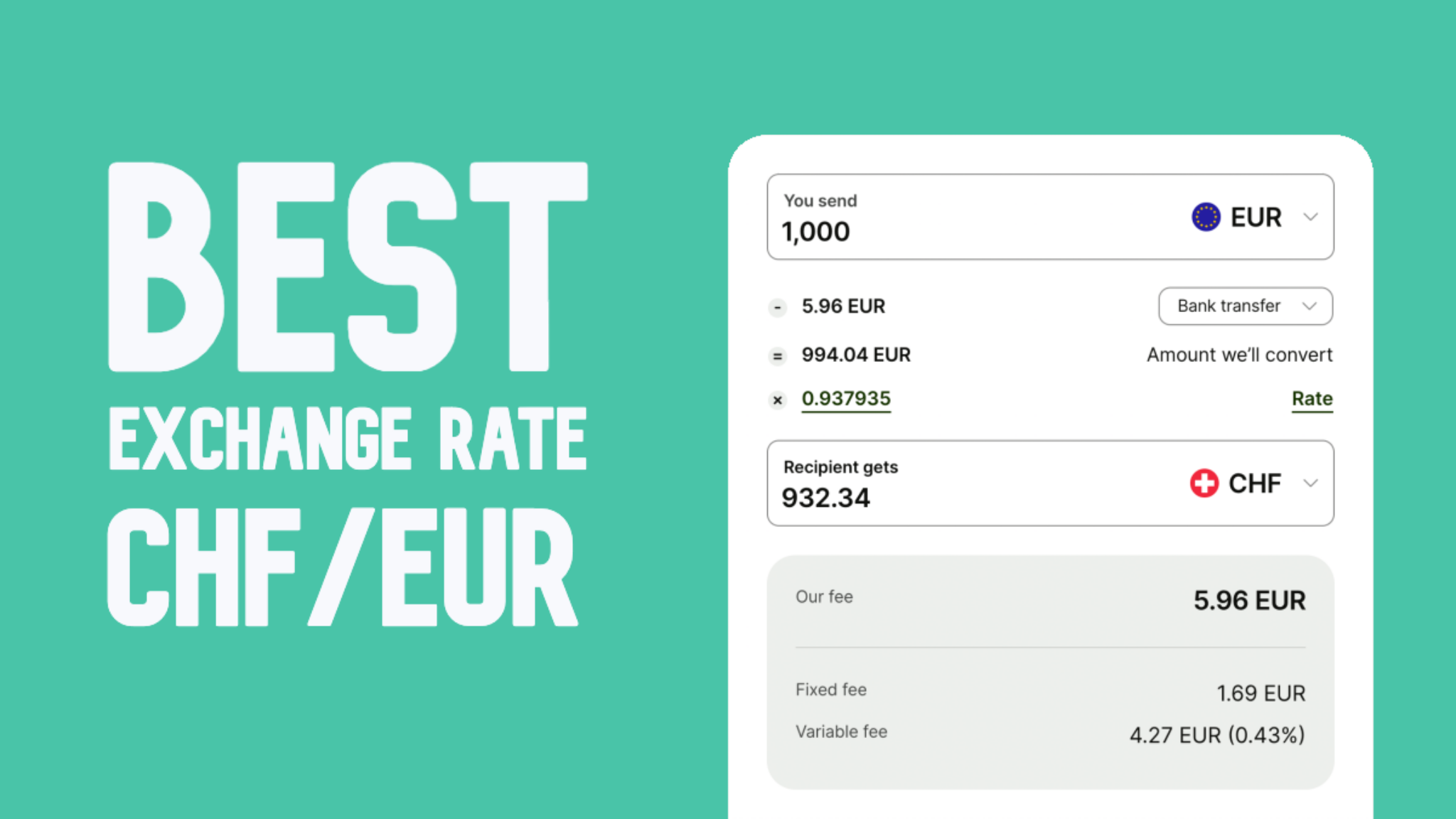

- Excellent Rates: This is often their superpower. Online platforms are frequently way more competitive than traditional banks, sometimes even beating out physical exchange bureaus. They operate with lower costs, so they can afford to pass those savings onto you.

- Convenience is King: You can do it all from your couch, in your pajamas, at 2 AM if you suddenly remember you need to send money. No more rushing to the bank or searching for an open exchange bureau.

- Transparency: Most reputable platforms are super clear about their rates and any fees involved. What you see is usually what you get, which is a refreshing change!

- Travel Cards/Multi-Currency Accounts: Many of these services offer dedicated travel money cards or multi-currency accounts. You can load them up with different currencies, lock in rates, and then use the card like a debit card abroad. Super handy and can save you a fortune compared to using your regular credit/debit card for every little purchase.

The Not-So-Good Stuff:

- Takes Time: If you need cash right now, some online services might not be the quickest. You might need to order currency to be delivered to your home, or transfer money to a travel card, which takes a few business days. Plan ahead!

- Minimums/Maximums: Some platforms might have minimum transaction amounts, or limits on how much you can exchange per day or year.

- Research is Key: There are a lot of these platforms out there. You need to do a little homework to find the reputable ones with the best deals. Don’t just jump on the first one you see!

Examples of these might include services like Wise (formerly TransferWise), Revolut, or dedicated online currency exchange sites. They’re the tech-savvy whiz kids of the money world.

The Travel Card Approach: A Smart Way to Pay Abroad

Speaking of digital, let’s dive a little deeper into those nifty travel cards and multi-currency accounts offered by many online platforms and even some banks. This is a game-changer for frequent travelers.

Instead of exchanging physical cash, you load money onto a card linked to an account that can hold multiple currencies. You can then exchange money within the app when the rates look good, or let it convert automatically when you spend.

The Good Stuff:

- Excellent Exchange Rates: These cards often use very competitive rates, sometimes close to the interbank rate.

- Reduced ATM Fees: Many offer free or low-cost ATM withdrawals abroad, which is a huge plus if you prefer having some cash on hand.

- Security: If your card is lost or stolen, it’s much easier to freeze or cancel than a wallet full of cash.

- Budgeting Tool: You can see exactly how much you’ve spent in each currency, which is a fantastic way to keep your spending in check.

- No More Fumbling for Change: Just tap and go!

The Not-So-Good Stuff:

- Not Everywhere Accepts Cards: While card acceptance is widespread, there are still places (especially in more remote areas or smaller markets) where cash is king.

- Potential for Fees: Always check the small print for any foreign transaction fees, ATM withdrawal fees, or inactivity fees.

- Requires Planning: You need to load funds onto the card in advance.

These are like having a personal financial assistant for your travels, always looking out for the best deals on your behalf.

Beware the Airport Kiosk! (And Other Tourist Traps)

Okay, so I mentioned this before, but it bears repeating because so many people fall for it. Airport currency exchange booths are almost always the worst option. They know you’re in a bind, you’re rushing, and you’re likely to pay through the nose for the convenience.

Their exchange rates are often dreadful, and their fees can be astronomical. It’s like paying a VIP surcharge just to get your money exchanged when you’re already VIP enough to be traveling!

Similarly, some small, independent exchange places in very touristy areas might also have inflated rates. Always, always compare!

So, Which Bank is Best? The Honest Answer...

Here’s the kicker: there isn’t one single "best" bank or service for everyone, for every situation. It’s like asking which is the best flavor of ice cream – it depends on your mood, your needs, and what’s available!

However, we can give you some golden rules and a general pecking order:

- For Convenience & Small Amounts (if you’re not too bothered about the absolute best rate): Your own bank is a decent, reliable choice.

- For Potentially Better Rates & More Currencies (if you don’t mind a little extra research and planning): Dedicated currency exchange specialists (physical or online) are often a good bet.

- For the Best Overall Value, Flexibility, and Tech-Savvy Travelers: Online platforms and multi-currency travel cards are often the winners. They generally offer the most competitive rates and the lowest fees.

- Avoid (like the plague): Airport exchange booths! Unless you're desperate and have no other choice. Even then, maybe try to find an ATM first.

The Secret Sauce: How to Get the Best Deal

No matter who you choose, here are my top tips for making your money work harder:

- Shop Around: Seriously, this is the golden rule. Don’t just go with the first option you see. Compare rates and fees from at least two or three different places. Use online comparison tools if they’re available.

- Check the "Real" Rate: Look up the mid-market rate (the wholesale rate) for the currency you need. This will give you a benchmark to see how good (or bad!) an offer is. It’s like knowing what a good price for a used car is before you go to the dealership.

- Factor in ALL Fees: Don’t just look at the exchange rate. Are there transaction fees? Transfer fees? ATM withdrawal fees? Sometimes a slightly worse rate with zero fees is better than a great rate with loads of hidden charges.

- Plan Ahead: The more time you have, the more options you have, and the better deals you’re likely to find. Last-minute currency grabs are almost always more expensive.

- Consider a Travel Card: If you travel regularly, a good multi-currency travel card can be an absolute lifesaver and money-saver.

- Order Online, Pick Up In Person: Some online services allow you to order currency online at a good rate and then pick it up at a physical location, which can be a nice balance of convenience and value.

Ultimately, the "best" bank for currency exchange is the one that offers you the most favorable combination of rates, fees, and convenience for your specific needs. It’s about being an informed traveler, armed with knowledge, ready to conquer the world (and your finances)!

So go forth, my friend! Exchange your money with confidence, knowing you’ve done your due diligence. May your adventures be grand, your souvenirs plentiful, and your currency exchange experiences surprisingly painless. Happy travels!