Which Bank Is Better Bank Of America Or Wells Fargo: Best Options Compared

Hey there, money explorers! Ever find yourself staring at two giant banking names, like Bank of America and Wells Fargo, and wondering which one’s the “better” pick? It’s a question that pops up a lot, right? Like trying to choose between your favorite pizza toppings – both are good, but sometimes one just feels right for what you’re craving. Well, grab a comfy seat and a virtual coffee, because we’re gonna dive into this a little, no stuffy financial jargon allowed, I promise!

Think of it this way: Bank of America and Wells Fargo are kind of like the seasoned veterans of the banking world. They’ve been around the block, they’ve got branches practically everywhere, and they offer a whole smorgasbord of services. But “veteran” doesn’t always mean “identical,” does it? Just like how two seasoned chefs might have their own signature dish, these banks have their own flavors.

So, what makes one bank “better” than another, anyway? It’s totally subjective, isn't it? What’s a dream come true for one person might be a total snooze-fest for another. It all boils down to what you need from your bank. Are you someone who likes to walk into a branch and chat with a teller? Or are you more of a “swipe, tap, and done” kind of person, living happily in the digital realm?

Let’s Talk About the Giants: Bank of America & Wells Fargo

First up, let’s give a nod to Bank of America. They’re huge, and when we say huge, we mean really huge. Think of them as the big, friendly neighborhood giant. They’ve got a massive footprint across the US, so chances are, there’s a branch or an ATM not too far away, no matter where you are. For folks who value that physical presence, that’s a big plus, right?

What’s cool about Bank of America is their sheer range of products. They’ve got checking accounts, savings accounts, credit cards, mortgages, investment services – you name it, they probably have it. It’s like a one-stop shop for all your financial needs. And their mobile app? It’s pretty slick. You can do a lot of your banking without ever having to leave your couch. Pretty convenient, wouldn't you say?

Then there’s Wells Fargo. Another absolute titan in the banking arena. They also have a serious presence nationwide, so if you’re the type who likes options and accessibility, they’re definitely in the running. Wells Fargo has been around for ages, giving them a real sense of history and, for some, a feeling of stability.

Just like Bank of America, Wells Fargo offers a comprehensive suite of financial tools. Whether you’re looking to open a simple checking account or embark on a complex investment journey, they’ve got the resources. Their digital tools are also quite robust, aiming to make managing your money as seamless as possible in our increasingly digital world. It’s all about making life a little bit easier, right?

Peeking Under the Hood: What Differentiates Them?

Okay, so they both offer a lot. But what are the little things that might make you lean one way or the other? This is where it gets interesting!

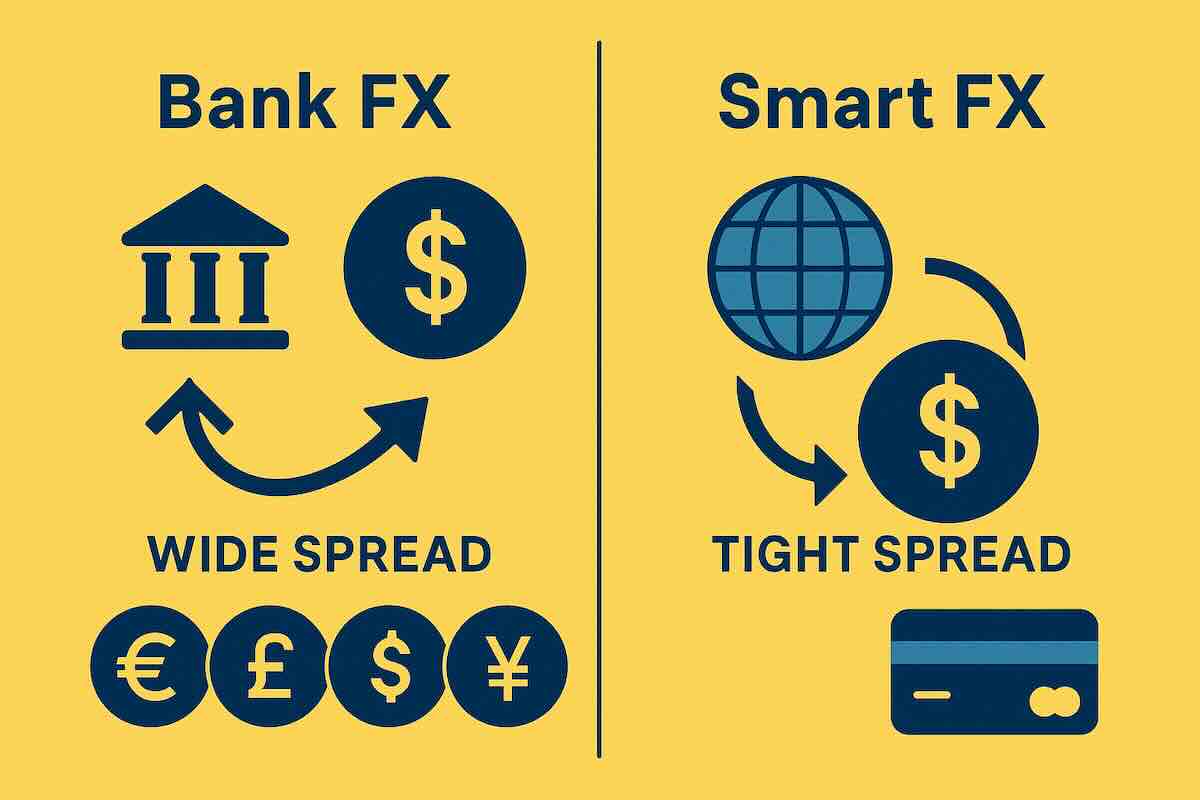

Let’s talk about fees. Ah, fees. The not-so-fun part of banking, but oh-so-important. Both banks have various checking and savings accounts with different fee structures. Some might have monthly maintenance fees that can be waived if you meet certain requirements, like maintaining a minimum balance or having direct deposits. Others might have fewer fees but offer fewer perks. It’s like choosing between a fancy restaurant with a cover charge or a cozy cafe with a slightly higher menu price – you gotta figure out which model works for your wallet.

Bank of America’s Preferred Rewards program is a pretty neat feature if you’re a high-balance customer. The more you have with them, the more benefits you can unlock, like higher interest rates on savings or fee waivers. It’s a way to reward loyalty, which is kind of cool.

Wells Fargo also has its own set of rewards and perks, often tied to the types of accounts you hold and your relationship with the bank. They’re constantly tweaking these to stay competitive, so it’s always worth checking their current offers.

The Digital Experience: Are They Keeping Up?

In today’s world, your phone is practically your bank branch. So, how do these two stack up in the app department? Both Bank of America and Wells Fargo have invested heavily in their digital platforms. You can expect features like mobile check deposit, bill pay, account transfers, and even some budgeting tools.

Bank of America’s app is generally well-regarded for its user-friendliness. It’s often praised for its clean design and ease of navigation. If you’re someone who likes a straightforward, intuitive experience, their app might be a winner.

Wells Fargo’s app is also quite capable. They’ve been working hard to enhance their digital offerings, and many users find it to be a reliable tool for managing their finances on the go. It’s like having a virtual assistant for your money, and that’s pretty powerful.

Customer Service: The Human Touch

Even with all the digital wizardry, sometimes you just need to talk to a person, right? Whether it’s a quick question or a more complex issue, customer service can make or break your banking experience. This is an area where opinions can really diverge.

Historically, both banks have had their ups and downs with customer service. Some people rave about their positive interactions, while others have shared less-than-ideal experiences. It often depends on the specific branch, the representative you interact with, and the nature of your issue. It’s like going to a busy restaurant – sometimes you get a fantastic server, and sometimes… well, you know.

If you’re someone who prioritizes in-person interactions, visiting a local branch to get a feel for the atmosphere and the staff can be a good idea. For phone support, it’s worth checking recent reviews or trying to connect during off-peak hours.

What About the Nitty-Gritty: Interest Rates and Loan Options?

Now, let’s get into some of the numbers. When you’re talking about savings accounts, interest rates are key. Generally speaking, you might find that neither of these massive banks offers the absolute highest interest rates compared to some smaller online banks or credit unions. They tend to be more competitive in their checking accounts and loan products.

However, they do offer a wide variety of savings options, including high-yield savings accounts (though again, check those rates carefully!) and money market accounts. If you’re looking for a place to park your cash with a bit of growth potential, it’s worth comparing their specific APYs (Annual Percentage Yields).

When it comes to loans – mortgages, auto loans, personal loans – both Bank of America and Wells Fargo are major players. They have extensive experience and a broad range of products. If you’re looking for a mortgage, for instance, their established presence and variety of loan types can be appealing. However, it’s always a smart move to shop around and compare rates and terms from multiple lenders, including smaller institutions and online lenders, to ensure you’re getting the best deal.

So, Which One is “Better”? The Big Reveal!

Here’s the truth bomb, folks: there’s no single “better” bank. It’s all about what fits your personal financial puzzle.

Choose Bank of America if:

- You value a huge national presence and want branches nearby.

- You’re looking for a sleek and user-friendly mobile app.

- You’re interested in their Preferred Rewards program and have significant assets.

- You want a one-stop shop for a wide array of financial products.

Choose Wells Fargo if:

- You appreciate a bank with a long-standing history and a solid reputation for stability.

- You’re looking for a comprehensive range of services and a strong digital platform.

- You want to explore various loan options from a well-established lender.

- You’re looking for a bank that’s been a consistent presence for many years.

Ultimately, the best way to decide is to do a little digging. Visit their websites, compare their account features and fees side-by-side, and if possible, visit a local branch. Think about your own habits and needs. Do you need cutting-edge technology? Or is a friendly face at the counter more your speed? What feels right for you is the best bank.

Happy banking, everyone! May your money grow and your accounts be ever in the green!