Which Of The Following Statements Is Correct About Secured Loans: Complete Guide & Key Details

Ever feel like your bank account is playing hide-and-seek with your dreams? You know, that feeling when you really want that shiny new gadget, or maybe even a slightly less-shiny, but still very necessary, new washing machine because your old one sounds like a rock concert in a tumble dryer? That’s where loans come in, right? But then you hear words like "secured" and "unsecured," and suddenly it feels like you’re trying to decipher ancient hieroglyphs after a particularly strong cup of coffee. Don’t worry, we’ve all been there. Let’s break down secured loans in a way that’s as easy as deciding what pizza topping is the most essential (it’s definitely pepperoni, by the way).

So, what exactly are these "secured" loans we’re talking about? Think of it like this: imagine you’re borrowing your neighbor’s fancy power drill. Your neighbor, a wise soul, isn't just going to hand it over with a shrug. They might say, "Okay, but if something happens to it, you owe me a new drill, or at least enough to buy one." That’s the essence of a secured loan! It’s a loan where you, the borrower, offer up something you own as a sort of safety net for the lender. This "something" is called collateral. If you can’t pay back the loan, the lender gets to keep that collateral. It’s like a promise, but with a real-world consequence if that promise gets broken.

The "Collateral" Concept: More Than Just a Fancy Word

Let’s dive a little deeper into this collateral thing. It’s the star of the show when it comes to secured loans. What kind of things can you use as collateral? Loads of stuff, really. The most common ones you’ll see are things like your house or your car. Think about it: you’re asking for a big chunk of money, maybe for a down payment on that dream home or to get that reliable set of wheels. The bank, bless their cautious hearts, wants to know that if, by some twist of fate, you can’t make your payments, they’re not just left twiddling their thumbs. They can take the house or the car and sell it to get their money back. It’s not ideal for anyone, of course, but it makes the lender feel a whole lot more comfortable.

But it’s not just the big ticket items. Sometimes, you might even use savings accounts or investment portfolios as collateral. Imagine this: you have a nice nest egg, a little pot of money you’ve been saving diligently. You need a loan for something important, and the bank says, "Okay, we can lend you the money, but we’ll just keep a tiny hold on a portion of your savings until you’ve paid us back." It’s like a best friend holding onto your keys while you borrow their car – they know you’ll give them back, but they have a little peace of mind. The key takeaway here is that the collateral is tangible. It’s something the lender can actually put their hands on, or at least has a legal claim to, if things go south.

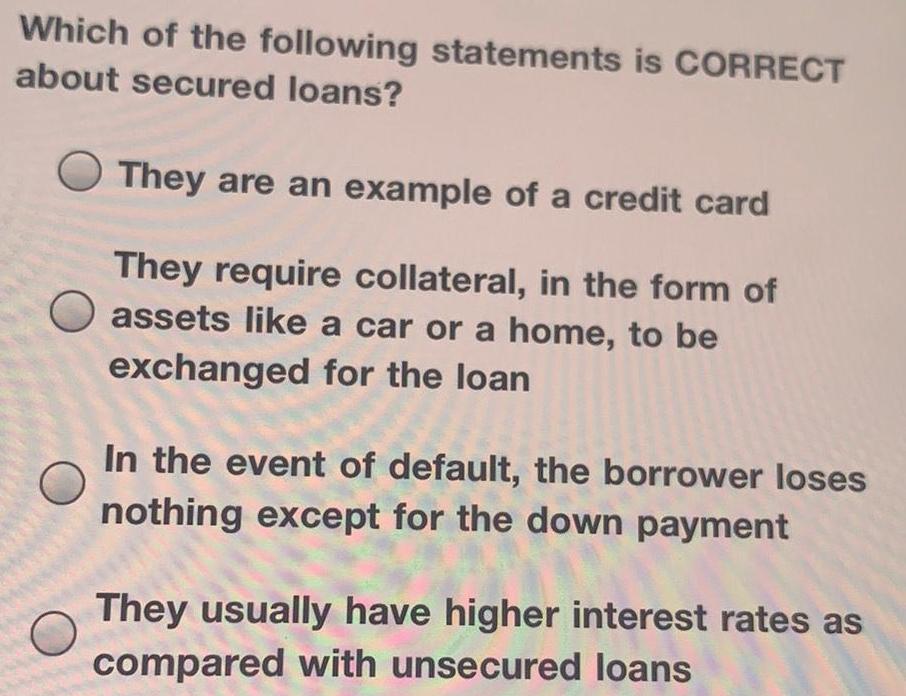

Which Of The Following Statements Is Correct About Secured Loans? Let's Play Detective!

Now, let’s get to the fun part, the quiz! Imagine you’re presented with a few statements about secured loans. Which one is most likely to be the truth, the whole truth, and nothing but the truth? Let’s look at some common contenders you might encounter:

Statement A: "Secured loans have no risk for the lender."

Hmm, sounds a bit too good to be true, doesn't it? Like finding a unicorn that also does your taxes. While secured loans reduce the risk for lenders, they don't eliminate it entirely. There's always a chance that the collateral might not fetch the full loan amount if it needs to be sold. Plus, there are costs involved in repossession and selling. So, this statement is incorrect. Lenders are always playing a game of calculated risk, even with collateral.

Statement B: "To get a secured loan, you must already own a business."

This one’s a bit of a red herring, like a fake treasure map leading you to a garden gnome convention. You absolutely do not need to own a business to get a secured loan. As we’ve seen, most people get secured loans using their homes (mortgages!) or cars (car loans!). These are pretty standard things for individuals to own. So, this statement is incorrect. Your personal assets are fair game for collateral.

Statement C: "Secured loans often come with lower interest rates than unsecured loans."

Now, this is where things start to get interesting, and this statement usually hits the nail on the head. Think back to our power drill analogy. The neighbor is more willing to lend you that fancy drill if they know they have something to fall back on, right? Because of this reduced risk for the lender, they can afford to offer you a better deal. Lower interest rates mean you pay less over the life of the loan. It’s like getting a discount for being a responsible borrower (or at least, for having something valuable to offer as security). So, this statement is very likely correct!

Statement D: "Collateral is only required for very large loan amounts."

While it's true that larger loans, like mortgages, almost always require collateral, it's not the only time you'll see it. As we mentioned, car loans are a prime example. You're not borrowing millions of dollars for a car (usually!), but the car itself serves as the collateral. So, this statement is a bit of an oversimplification and therefore, likely incorrect. Collateral is about the lender’s comfort level with the risk, not just the sheer size of the loan.

The Main Takeaway: Why Secured Loans Are Your Friend (Sometimes!)

So, after all that detective work, it’s clear that the statement about lower interest rates is usually the winner when it comes to secured loans. Why is this important to you, the everyday person trying to navigate the financial waters? Because understanding this can save you a good chunk of change. If you're looking to borrow money and you have an asset you're willing to use as collateral, you can often get a loan with more favorable terms.

Think of it like this: you’re going to a potluck. Everyone brings a dish. If you bring your famous seven-layer dip (the one everyone raves about), you’re definitely going to get more compliments and maybe even a slightly bigger slice of the cake. In the loan world, your collateral is your "famous seven-layer dip." It makes you a more attractive borrower to the lender, and they reward you for it with a sweeter deal.

Real-Life Examples: Where Secured Loans Show Up

Let's bring this back to your everyday life. You’ve probably encountered or even used secured loans without even realizing the fancy terminology. Here are a few:

- Mortgages: This is the big one. When you buy a house, the house itself is the collateral for the loan. If you stop paying, the bank can take your house. It’s a huge commitment, but it’s how most people achieve homeownership.

- Car Loans: Want to buy a new (or new-to-you) car? The car you're buying is typically used as collateral. The loan amount is tied directly to the value of the vehicle.

- Home Equity Loans: Once you've built up some equity (meaning you've paid off a good chunk of your mortgage or the value of your home has increased), you can borrow against that equity. Your home is still the collateral. It’s like tapping into your home’s built-in savings account.

- Secured Personal Loans: While less common than the others, you can sometimes get a personal loan secured by things like a savings account or a certificate of deposit (CD). This might be a good option if you have a solid savings but need quick access to cash for something unexpected, like a major appliance repair (remember that rock concert washing machine?).

The beauty of these loans, from a borrower's perspective, is that they generally have more accessible qualification requirements compared to unsecured loans, especially for larger amounts. Because the lender has that safety net, they’re often willing to lend to a wider range of people. It’s like a restaurant offering a special discount to people who bring their own reusable containers – they’re incentivizing a behavior that benefits them.

The Flip Side: What Happens If You Can't Pay?

Now, we can’t talk about secured loans without mentioning the not-so-fun part: what happens if you default on the loan. This is where the collateral really comes into play. If you stop making payments, the lender has the legal right to repossess the collateral. For a car loan, this means they’ll take your car. For a mortgage, it means foreclosure on your home. It’s a serious consequence, and it’s precisely why lenders are willing to offer better rates. They’re banking on the fact that most people will do everything they can to avoid losing their valuable assets.

It’s important to be completely honest with yourself about your ability to repay before you take out any loan, especially a secured one. It's like agreeing to pet-sit a friend's very high-maintenance iguana. You really want to help, but if you know you’re going to be out of town for three weeks with no one to feed it, it’s probably not a good idea. So, always read the fine print and understand the risks involved.

In Conclusion: Secured Loans and Your Financial Toolkit

So, there you have it! Secured loans are a powerful tool in your financial toolkit. They offer a way to borrow larger sums of money, often at more attractive interest rates, because you’re providing the lender with security in the form of collateral. Remember, the statement that usually rings true is that secured loans often come with lower interest rates than unsecured loans due to the reduced risk for the lender.

It’s all about understanding the trade-off: you’re offering up an asset as collateral in exchange for potentially better borrowing terms. Just make sure you’re comfortable with the asset you’re offering and, most importantly, confident in your ability to make those payments. Think of it as a well-placed bet where you have a solid stake. And who doesn't like a good, well-placed bet? Now go forth and borrow wisely, my friends!