Which Statement Best Describes What Happens When People Declare Bankruptcy: Best Picks & Buying Guide

Hey there! So, you’re curious about what really goes down when someone says, "Yep, I'm declaring bankruptcy." It’s a topic that sounds kinda scary, right? Like, the end of the world, financial Armageddon, all that jazz. But honestly, it’s not always as dramatic as the movies make it out to be. Think of it more like a really intense, official reset button for your finances. We’re gonna chat about it, spill some tea, and figure out what that actually means. Grab your imaginary coffee, let's dive in!

So, what's the gist? When you declare bankruptcy, you're basically telling the court, "Look, I've got way too much debt and I just can't keep up." It's a legal process, of course, and there are different types, but the main idea is to get some relief from overwhelming debts. It's not a magic wand that makes everything disappear instantly, though. Far from it, actually. It's more of a structured way to deal with financial chaos.

The best statement to describe what happens? It's a tough call, because it's so multifaceted. But if I had to pick one, it would probably be something along the lines of: "Bankruptcy is a legal process that offers individuals and businesses a chance to either reorganize their debts and create a repayment plan or liquidate certain assets to pay off creditors, ultimately providing a fresh financial start under court supervision." Yeah, I know, it's a mouthful. But it covers the big two: reorganization and liquidation. We'll break those down, don't you worry.

Chapter 7 vs. Chapter 13: The Big Two

When people talk about personal bankruptcy, they're usually thinking of two main types: Chapter 7 and Chapter 13. These are like the two different flavors of financial do-overs. And which one you go for totally depends on your situation. It’s not a one-size-fits-all deal, and frankly, that's a good thing!

Let's start with Chapter 7. This is often called "liquidation" bankruptcy. Imagine you've got a bunch of stuff you don't really need and can't afford to keep, and the court says, "Okay, let's sell some of that to pay off your debts." It sounds a bit harsh, I know. But there are a lot of exemptions. You don't lose everything. Your home, your car (if you have equity in them), and essential personal belongings are often protected. It’s like a financial purge, but a legally sanctioned one. Pretty wild, right?

The idea behind Chapter 7 is to get rid of most of your unsecured debts, like credit card bills, medical debt, and personal loans. It's usually faster than Chapter 13, often taking just a few months from start to finish. But, and this is a big "but," you usually have to pass a "means test" to qualify. This test basically checks if your income is low enough to warrant this kind of relief. So, if you're still pulling in a decent paycheck, Chapter 7 might not be in the cards for you. It's all about proving you really need the help.

Then we have Chapter 13. This one is often called "reorganization" or "wage earner's" bankruptcy. Instead of selling off your stuff, you work out a repayment plan for your debts over three to five years. You make these regular payments to a trustee, who then distributes the money to your creditors. It’s like a structured debt-paydown program, but with the protection of the bankruptcy court. So, if you have a regular income and want to keep your assets, like your house or car, Chapter 13 might be your jam. It's a commitment, for sure, but it can be a lifeline.

The key difference? Chapter 7 is about discharging (or getting rid of) debt by liquidating assets, while Chapter 13 is about reorganizing debt and repaying a portion of it over time. Both are designed to help, but they work in fundamentally different ways. And choosing the right one? Well, that's where things get a little more nuanced. It's not like picking out a new pair of shoes, sadly. You gotta think it through.

What Actually Happens: Step-by-Step (Kind Of)

Okay, so you've decided bankruptcy is the path for you. What's the actual process like? Imagine a super-official obstacle course, but with paperwork. Lots and lots of paperwork. You’ll need to gather all your financial information: income, expenses, assets, debts. It’s like a financial autopsy. Seriously, they want to know everything. Don't try to hide anything, folks. That's a big no-no.

Next, you'll likely need to take a credit counseling course. This is usually a requirement before you can file. They want to make sure you've explored all your options and understand what you're getting into. It’s not exactly a fun spa day, but it’s part of the deal. Think of it as homework for your financial future.

Then comes the biggie: filing the bankruptcy petition. This is the official document that tells the court you want to declare bankruptcy. You’ll file it with the bankruptcy court in your district. This is when the "automatic stay" kicks in. What's that? It’s like a magical force field that stops most creditors from calling you, suing you, or trying to collect debts. Poof! The harassment stops. It’s one of the biggest reliefs people experience. Ah, sweet silence.

After you file, a trustee is appointed to oversee your case. This is a neutral party who will review your paperwork, manage any assets that need to be liquidated (in Chapter 7), and ensure your repayment plan is followed (in Chapter 13). They’re not your friend, but they’re not your enemy either. They’re just doing their job. Don’t get on their bad side!

Then there’s the meeting of creditors. Don't let the name scare you. It's usually a pretty brief meeting with the trustee. Your creditors can show up and ask questions, but often they don't. It's like a formal check-in. "Yep, this is all real. Let's move on."

If you filed Chapter 7, the trustee will likely sell off any non-exempt assets to pay your creditors. Then, the court will issue an order of discharge, officially releasing you from most of your debts. It's like a financial phoenix rising from the ashes. For Chapter 13, you'll start making your payments according to your approved plan. If you successfully complete the plan, you’ll receive a discharge for any remaining eligible debts.

It's a marathon, not a sprint. And it definitely requires some serious commitment. But the end goal is to get you back on your feet, right?

What Happens to Your Stuff? The Asset Shuffle

This is where people get really nervous. "Am I going to lose my house? My car? My prized Beanie Baby collection?" Let's talk about assets and bankruptcy. It's a bit of a delicate dance, and it really depends on the type of bankruptcy and what state you live in.

In Chapter 7, as we touched on, some assets are sold to pay creditors. But here's the good news: exemptions. Every state has its own set of exemptions, and then there are federal exemptions. These are basically legal protections that allow you to keep certain essential property. So, your primary residence, your car (up to a certain value), your household furnishings, and personal belongings are often protected. It’s not like they’re going to come and take your toothbrush, thankfully!

The trustee will look at your assets and figure out what's "non-exempt." If you have, say, a vacation home that's not your primary residence and has significant equity, that's probably going to be on the chopping block. It's about distinguishing between what you need and what's considered a luxury or excess asset in the eyes of the law. It’s not personal, it’s just… legal.

Now, if you're in Chapter 13, the game changes a bit. The whole point is to keep your assets. So, while you're making your repayment plan, you generally get to hold onto your house, your car, and your other belongings. The trustee's main job is to make sure you're making your payments, not to sell off your possessions. So, if you're worried about losing your home and you have a steady income, Chapter 13 might be the better option. It's all about holding onto what matters.

It’s crucial to be completely honest about all your assets. Trying to hide anything can lead to serious trouble, including dismissal of your case. The court wants transparency. So, lay it all out there. Better to be upfront and work with the system than to get caught in a lie. That’s just asking for more trouble than you already have!

The Impact: What's the Long-Term Vibe?

Okay, so you’ve gone through the bankruptcy process. You’re debt-free (or on your way!). But what’s the lasting effect? It’s not like suddenly everything is sunshine and rainbows, unfortunately. There’s definitely a significant impact, and it’s something you need to be prepared for.

The most obvious impact is on your credit score. Declaring bankruptcy is a huge red flag to lenders. It will absolutely tank your credit score. We're talking a major hit. This means getting new credit cards, loans, or even renting an apartment can become a challenge. You'll likely need to rebuild your credit from scratch, which takes time and effort. It’s like starting at the bottom of the financial ladder again. But it’s a climb you can make.

How long does it stay on your credit report? For Chapter 7, it stays for 10 years from the filing date. For Chapter 13, it's also 7 years from the filing date, though the repayment plan itself can last up to 5 years. So, it's not a ghost that disappears overnight. It's a pretty persistent reminder.

However, and this is a big however, it’s not the end of your financial life. Think of it as a learning experience. You’ve gone through a tough time, you've learned what pitfalls to avoid, and you have a chance to rebuild. Many people successfully rebuild their credit and go on to achieve financial stability. It requires discipline, patience, and smart financial choices. So, while the mark is there, your future isn’t necessarily doomed.

You might also face challenges getting certain jobs, especially those that require a high degree of financial responsibility. Some employers do check credit reports as part of the hiring process. So, it's something to be aware of. But again, it’s not a universal ban. Many employers focus on skills and experience.

The upside? You’re free from crushing debt! That’s a massive weight lifted. You can finally sleep at night without worrying about overwhelming bills. You have a chance to start fresh, make better decisions, and build a more stable financial future. It’s a painful reset, but a reset nonetheless. And sometimes, a reset is exactly what you need to get back on track.

Is It a "Best Pick"? Who Should Consider It?

So, is bankruptcy ever a "best pick"? That’s a loaded question. It’s rarely the ideal choice, but sometimes, it's the necessary choice. It's like choosing between a root canal and living with a throbbing toothache forever. One is unpleasant, but the other is just… debilitating.

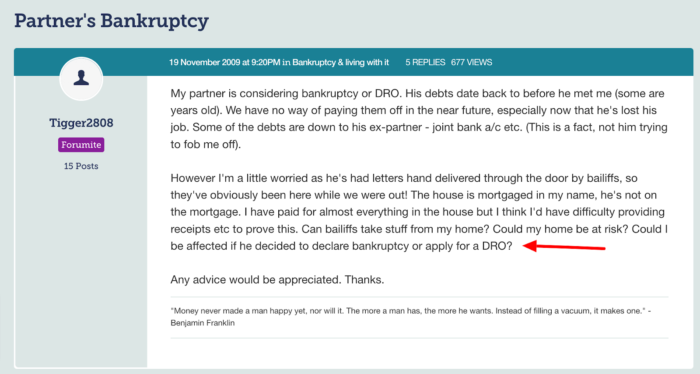

Who should consider it? People who are drowning in debt and have exhausted all other options. If you’ve tried debt consolidation, negotiation, and you’re still facing relentless collection calls and the threat of lawsuits, then bankruptcy might be your best recourse. It’s for folks who are experiencing genuine financial hardship.

Think about it:

- Overwhelming unsecured debt: Credit cards, medical bills, personal loans that you can't realistically repay.

- Loss of income or significant decrease in earnings: Job loss, illness, or other unforeseen circumstances that have made it impossible to keep up.

- Facing foreclosure or repossession: When you're on the brink of losing your home or vehicle, bankruptcy can offer a temporary or permanent solution.

- Harassing creditors: When debt collectors are making your life miserable, the automatic stay can provide much-needed peace.

It’s not for the faint of heart, and it’s definitely not a casual decision. It’s a serious undertaking with long-term consequences. That’s why consulting with a qualified bankruptcy attorney is absolutely essential. They can assess your situation, explain your options, and guide you through the process. They’re the navigators in this stormy financial sea. Don't try to go it alone!

Ultimately, bankruptcy is a tool. A powerful, potentially life-altering tool. It’s designed to give you a second chance when you’re facing insurmountable financial challenges. It's not a sign of failure, but a legal mechanism for recovery. And for some, it’s truly the best option available to get their lives back on track.

The Buying Guide: (If You Can Call It That!)

Okay, so there’s no "buying guide" for bankruptcy in the traditional sense. You don't go to a store and pick out a bankruptcy package. But there are important "purchases" or "investments" you need to make in the process. Think of it as investing in your future freedom.

The most important "purchase" is likely legal representation. Seriously, this is not a DIY project for most people. A good bankruptcy attorney will cost money, but their expertise can save you from making costly mistakes. They know the ins and outs of the law, can help you choose the right chapter, and represent you in court. It’s an investment in a smoother, more successful outcome. It’s like hiring a guide when you’re lost in the wilderness.

Then there are the credit counseling and debtor education courses. These usually have a fee associated with them. They’re mandatory, so factor them into your budget. They’re usually not super expensive, but they add up. Think of them as required fees for your financial rehabilitation.

You'll also encounter court filing fees. These are mandatory fees paid to the court to initiate your bankruptcy case. They vary depending on the type of bankruptcy and the district, but they're a necessary cost of doing business, legally speaking. So, keep some cash aside for these bureaucratic necessities.

And if you're considering Chapter 7 and have non-exempt assets that will be sold, you might need to pay for certain things yourself to free them from liquidation. This is called "reaffirmation," and it essentially means you agree to keep paying for a specific debt (like a car loan) even after bankruptcy. This can be complex and requires legal advice.

The "buying guide" here is really about identifying the costs involved and preparing for them. It’s about understanding that getting financial relief often comes with its own set of expenses. But remember, the goal is to emerge from this process with less debt overall. So, these upfront costs are often worth it for the long-term benefits.

So, there you have it. Bankruptcy is complex, impactful, and not for the faint of heart. But for many, it's a necessary step towards a more stable and debt-free future. It's a legal process, yes, but it’s also a personal journey towards financial recovery. And that, my friend, is something worth understanding.