Why Are High Yield Savings Accounts Going Down: The Real Reason

So, I was chatting with my friend Sarah the other day, you know, the one who's always on top of her finances and religiously checks her savings account interest rates? She let out this frustrated sigh. "My high-yield savings account interest rate," she said, "it's been creeping down. I thought these were supposed to be the gold standard for my emergency fund!"

And honestly, I felt a twinge of recognition. It’s like when you finally find that perfect, slightly-too-expensive coffee shop that makes your morning commute bearable, and then suddenly, bam! They hike their prices or, even worse, change the blend. You’re left wondering, what gives?

Sarah’s question, and my own recent observations, got me thinking. Why are these shiny, high-yield savings accounts suddenly looking a little less…shiny? It’s not like inflation just decided to take a vacation, right? Money is still supposed to be working for us, and when the going gets tough, we’re supposed to be able to rely on those sweet, sweet interest payments. But it seems like everywhere I look, those advertised APYs (Annual Percentage Yields) are starting to feel more like a gentle breeze than a gust of wind.

This isn’t just about Sarah and me. I’ve seen a bunch of articles and social media posts echoing the same sentiment. People are confused, a little annoyed, and frankly, a bit worried. We’ve all been conditioned to chase the best APY, right? It’s practically a sport for personal finance enthusiasts. So when the target starts moving backward, it’s natural to scratch your head and ask, “What’s the real reason behind this deposit rate dip?”

The Blame Game: Is It Just the Fed?

The most immediate answer most people jump to is, of course, the Federal Reserve. And yeah, they play a huge role. Think of the Fed Funds Rate as the big boss in the world of interest rates. When the Fed decides to hike that rate, it’s like a ripple effect through the entire financial system. Banks have to pay more to borrow money from each other, and that cost eventually gets passed down.

Conversely, when the Fed lowers its target rate, borrowing becomes cheaper. And guess what? This often means banks are willing to offer less to hold onto your cash. It makes sense, right? If they can get money cheaper elsewhere, why pay you a premium for it?

/AFCU_70-HYSA-MoneyMarket-2d-padd.png?width=1500&height=1091&name=AFCU_70-HYSA-MoneyMarket-2d-padd.png)

But here’s the twist: the Fed hasn't been lowering rates recently. In fact, they’ve been holding them steady, or even signaling potential future hikes to combat inflation. So if the Fed isn't the sole culprit for the decrease in HYSA rates, what else is going on?

It’s like when your favorite band's new album isn't quite as good as their last one. You can’t just blame the lead singer; there are producers, songwriters, and maybe even the studio environment contributing. Similarly, the banking world is a lot more complex than just one interest rate.

The Real Reason: Supply and Demand (and a Dash of Bank Strategy)

The real reason high-yield savings account rates are going down, despite the Fed’s current stance, is a more nuanced interplay of supply and demand, coupled with some strategic decisions by banks themselves. It’s not as simple as "the Fed did it."

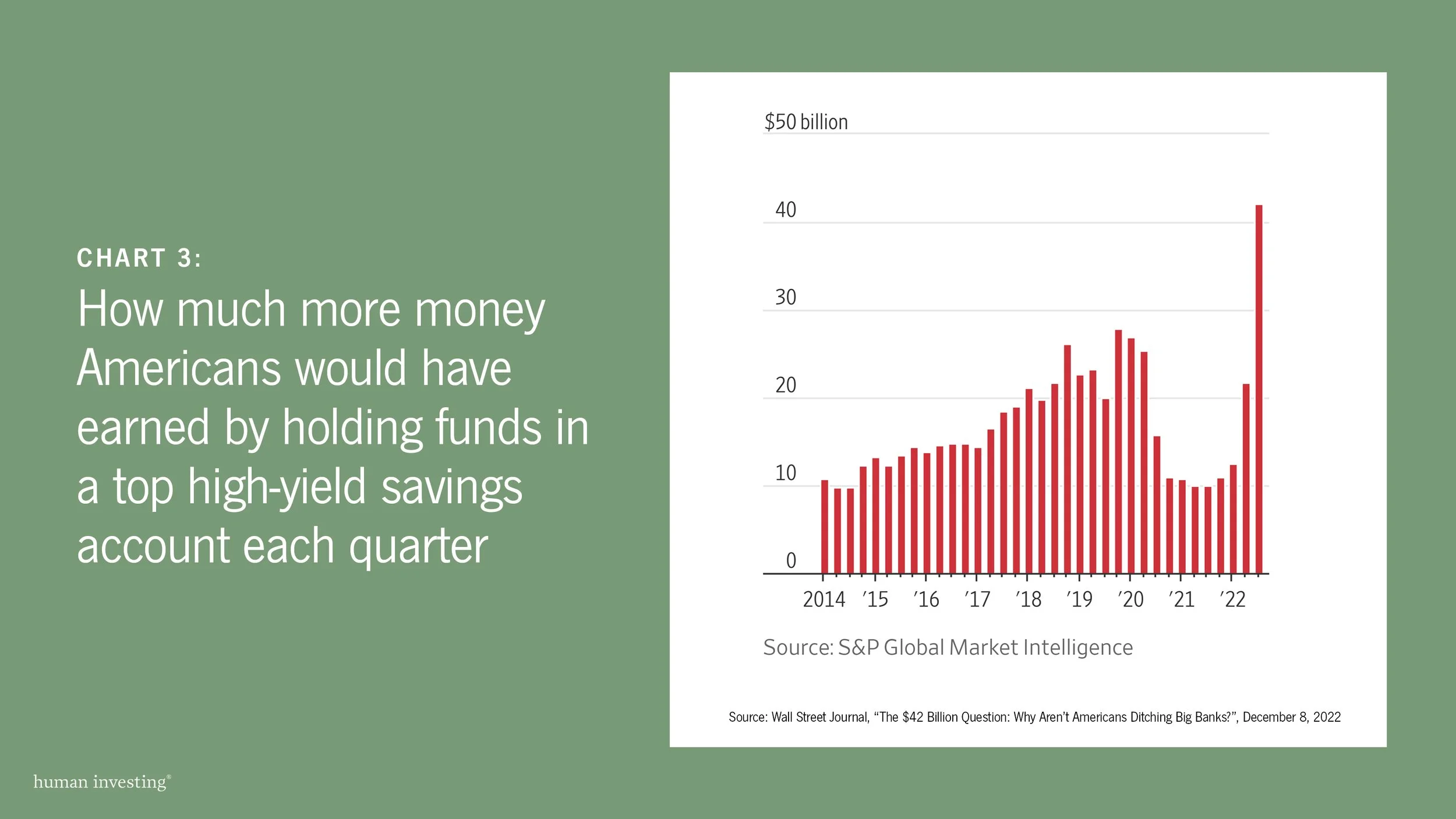

Let's break it down. For a while there, during periods of economic uncertainty or after significant rate hikes by the Fed, banks were desperate for stable funding. They needed deposits to lend out and to meet regulatory requirements. In this environment, offering those super-attractive high-yield rates was a brilliant marketing strategy to lure in depositors like you and me.

Think of it as a bidding war. Banks were bidding higher and higher for your savings dollars. And for us, the consumers, it was a golden age! We were getting paid handsomely just to keep our money safe and accessible. It felt like free money, didn’t it?

But here’s the crucial shift: that desperation has largely subsided. The economic landscape has changed. Banks are now finding they have enough deposits. In fact, some might even have a surplus.

Why? Well, several factors contribute:

/images/2024/08/15/high-yield-savings-account-slab-on-banknotes.jpeg)

- Deposit Inflows: While interest rates on savings accounts might be dipping, many people are still depositing money. Maybe they’re earning decent returns elsewhere (like in money market funds or even the stock market, when it’s performing well), or perhaps they’re just more cautious and prefer the safety of a savings account for a portion of their funds. This increased supply of money in the banking system means banks don’t need to fight as hard to attract it.

- Reduced Lending Demand (Sometimes): Depending on the economic climate, demand for loans from businesses and individuals can fluctuate. If businesses aren't borrowing as much for expansion or individuals aren't taking out as many mortgages or car loans, banks have less need for the massive influx of cash that high-yield accounts attract. They don't need to pay top dollar for funds they can't efficiently lend out.

- Profitability Pressure: Banks are businesses, after all. Their primary goal is to make a profit. While high-yield accounts were great for attracting customers and deposits, they also represent a significant cost for the bank. When they don’t need that money as badly, they’ll reduce the interest they pay to improve their profit margins. It's a classic business move, even if it stings our wallets.

- "Loyalty" is a Two-Way Street (Sort Of): Remember those initial high rates? They were often introductory offers or a way for newer, online-focused banks to gain market share. Once they've built up a customer base, they can afford to be a little less generous. They know that the hassle of moving all your money and setting up new accounts can be a deterrent for many people. So, they might subtly lower rates, banking on inertia. It’s a bit cheeky, I know!

Think of it like this: imagine a popular restaurant offering a crazy-good happy hour special to get people in the door. Once they’re established and have a regular crowd, they might tone down the discount because they know people will still come for the food. The HYSA is the restaurant, your deposit is the customer, and the APY is the happy hour special.

The Nuance of "High Yield"

Another thing to consider is the definition of "high yield" itself. What was considered high a year or two ago might be considered merely "competitive" today. The landscape is always shifting. As the Fed's policy changes (or is expected to change), banks adjust their offerings. It's a constant game of cat and mouse, and we're often just trying to keep pace.

It's also worth remembering that many of these "high-yield" accounts are offered by online banks. These institutions often have lower overhead costs than traditional brick-and-mortar banks. This should allow them to offer better rates. However, even they are subject to the broader market forces of supply and demand for funds. They can't operate in a vacuum.

So, while the "high" in high-yield might feel a little less impressive now, it's important to understand why. It's not necessarily a sign of economic collapse or that banks are suddenly hoarding all your money. It’s more a reflection of a maturing market where the urgent need for deposits has decreased.

So, What’s a Saver to Do?

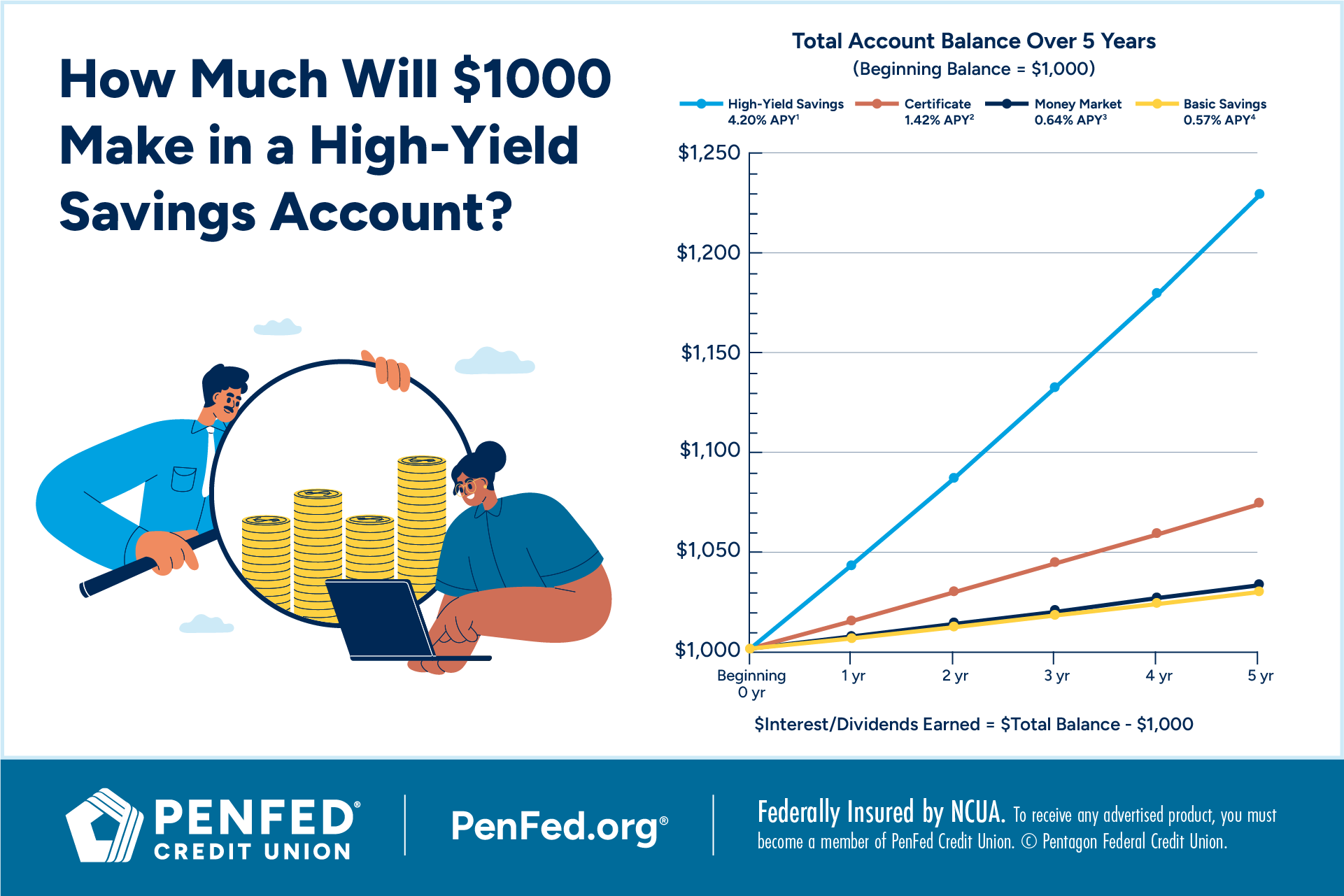

Okay, so the rates are down. Does that mean we should just stash our cash under the mattress? Absolutely not! Even a "lower" high-yield rate is still better than a standard savings account at a traditional bank, which often pays practically nothing. You're still earning something and keeping your money safe and liquid.

Here’s what I’m doing, and what you might consider:

- Keep Shopping Around: The good news is, even with the overall trend, there are still banks offering better rates than others. Don't get complacent! Regularly check comparison sites and financial news outlets for the best APYs. A few extra tenths of a percent here and there can add up over time. It might require a little effort, but your future self will thank you.

- Consider Money Market Funds: For money you don't need immediately but want to keep relatively safe and accessible, money market funds can be an attractive option. Their yields often track short-term interest rates and can sometimes outperform HYSA rates, especially when rates are rising. Just be aware they aren't FDIC insured in the same way as savings accounts, though they are generally considered very low risk.

- Re-evaluate Your Goals: Are you saving for a short-term goal (like a down payment in six months) or a long-term goal? For longer-term goals, you might consider investing a portion of your funds in assets with potentially higher returns, like the stock market or bonds, understanding that this comes with higher risk. Your emergency fund, however, should remain in highly liquid, safe accounts.

- Don't Forget About Inflation: While rates might be down, inflation is still a factor. The goal is to have your savings grow at a rate that at least tries to keep pace with inflation, or at the very least, minimizes the erosion of your purchasing power.

- Understand the Trade-offs: High-yield savings accounts offer a fantastic balance of safety, accessibility, and a decent return. When rates dip, it’s a reminder that there’s no "perfect" financial product for every situation. You're trading some potential for higher growth in exchange for that safety and liquidity.

It's easy to get discouraged when the numbers aren't as impressive as they once were. But the reality is, the financial world is dynamic. What worked yesterday might need a slight adjustment for today. The key is to stay informed, be proactive, and remember that even a slightly lower yield is still working for you!

So, Sarah, and everyone else feeling that sting of declining APYs, take a deep breath. The situation is understandable, and there are still smart ways to manage your savings. It's not the wild west of ultra-high yields anymore, but it’s far from a barren wasteland for your hard-earned cash. Happy saving!