Why Is A 15-year Fixed-rate Mortgage Better Than A 30-year: The Real Reason

Hey there, home dreamers and aspiring homeowners! So, you’re navigating the wild and wonderful world of mortgages, huh? It can feel like trying to decode ancient hieroglyphs sometimes, right? Between the APRs, the points, and the endless stream of jargon, it’s enough to make anyone want to just live in a really cool, really well-decorated treehouse. But fear not! Today, we’re diving into a topic that’s buzzing in the home-buying universe: the 15-year fixed-rate mortgage versus its longer, more laid-back cousin, the 30-year. And we’re going to unearth the real reason why the 15-year might just be your financial fairy godmother.

Now, let's be honest, the 30-year mortgage has had its moment in the sun. It’s the OG, the tried-and-true, the one that lets you spread those payments out like a leisurely Sunday brunch. And hey, for many, that’s a lifesaver. But what if I told you there’s a way to shave off years, save a boatload of cash, and get you to that mortgage-free, "dancing in your kitchen like nobody's watching" phase much, much sooner? Enter the 15-year fixed-rate mortgage. It’s not just about shorter payments; it’s about a smarter financial game plan.

The Interest Interest: Where the Magic Happens

Let’s get down to brass tacks, shall we? The biggest, boldest, most sparkly difference between a 15-year and a 30-year mortgage lies in the total interest you’ll pay. And trust me, it’s a lot. Think of it like this: you’re renting money from the bank to buy your dream pad. The longer you rent it, the more you pay the landlord (the bank) for the privilege. It’s basic math, but the impact is astronomical.

With a 15-year fixed-rate mortgage, you're basically telling the bank, "I'm here for a short, sweet, and efficient stay." Your monthly payments will be higher, no doubt about it. This is the part that can make some folks sweat. But here’s the secret sauce: a larger chunk of that higher payment goes directly towards your principal balance from day one. This is crucial because interest is calculated on the outstanding principal. The less principal you owe, the less interest you’re charged over time. It’s a beautiful snowball effect, but in a good way – a money-saving, debt-slaying way!

Let’s crunch some hypothetical numbers, because who doesn’t love a good number reveal? Imagine a $300,000 loan at a 6% interest rate.

- On a 30-year mortgage: Your monthly principal and interest payment would be around $1,798.65. Over 30 years, you’d pay approximately $347,514 in interest. Yikes.

- On a 15-year mortgage: Your monthly principal and interest payment would jump to about $2,322.72. That’s a significant increase, right? But here’s the kicker: over 15 years, you’d only pay approximately $118,090 in interest.

See that? A roughly $229,000 difference in interest paid. That’s enough for a few epic vacations, a serious home renovation project, or even starting that side hustle you’ve been dreaming about. It’s the kind of money that could fund your kids' college education, or secure a really comfortable retirement. It’s not just about paying off your house faster; it’s about fundamentally changing your financial trajectory.

The Power of Compounding (in Reverse!)

You’ve probably heard of compounding interest, the magic that makes your savings grow exponentially over time. Well, the 15-year mortgage harnesses a similar principle, but in reverse – it accelerates your debt reduction. Because you’re paying down the principal so much faster, you’re essentially “un-compounding” the interest that would have accumulated over a longer term. It’s like taking a shortcut through a financial jungle, emerging with more money and less debt.

Think of it like this: if you’re running a marathon, the 30-year is a leisurely jog, taking in the sights, stopping for snacks. The 15-year is a sprint. You’re going to be tired, but you’ll finish way, way sooner. And the prize? Financial freedom.

Beyond the Interest: Other Sweet Perks of the 15-Year

While the interest savings are the headline act, the 15-year fixed-rate mortgage comes with a supporting cast of fantastic benefits:

1. Faster Equity Building: Your Home Becomes an Asset, Quicker

With higher monthly payments directly impacting your principal, you’ll build equity in your home at a much faster pace. This means your ownership stake grows significantly quicker. Why does this matter? Equity is your financial cushion. It can be leveraged for other investments, home improvements, or even serve as a safety net in emergencies. You’re not just buying a house; you’re building tangible wealth.

Imagine hitting that 50% equity mark in 7-10 years instead of 15-20. That’s a game-changer for your financial flexibility. It’s like getting a superpower upgrade for your personal finance dashboard.

2. A Clearer Path to Mortgage Freedom: Say Goodbye to Debt Sooner!

This is the big one for many. The idea of being completely debt-free is incredibly liberating. With a 15-year mortgage, you can potentially be mortgage-free in your 40s or 50s. Think about it: no more monthly mortgage payments hanging over your head during your prime earning years, or as you start to transition into retirement. That’s the kind of freedom that allows for more travel, more hobbies, and less stress.

It’s the difference between feeling like you’re still tethered to your house and feeling like you truly own your space, and your life. It’s like finally getting to the end of a really great book and feeling that sense of accomplishment and peace.

3. Fixed Rates Mean Predictable Payments: No Nasty Surprises

Just like the 30-year, the 15-year fixed-rate mortgage offers the incredible benefit of predictable monthly payments. Your interest rate is locked in for the entire life of the loan. This means no surprises when interest rates fluctuate. You can budget with confidence, plan your finances meticulously, and sleep soundly knowing your biggest housing expense won’t suddenly skyrocket. This stability is gold, especially in today's often unpredictable economic climate.

It’s like having a steady rhythm in your life’s soundtrack. While adjustable-rate mortgages can feel like a chaotic jazz improvisation, the fixed-rate is a smooth, consistent melody.

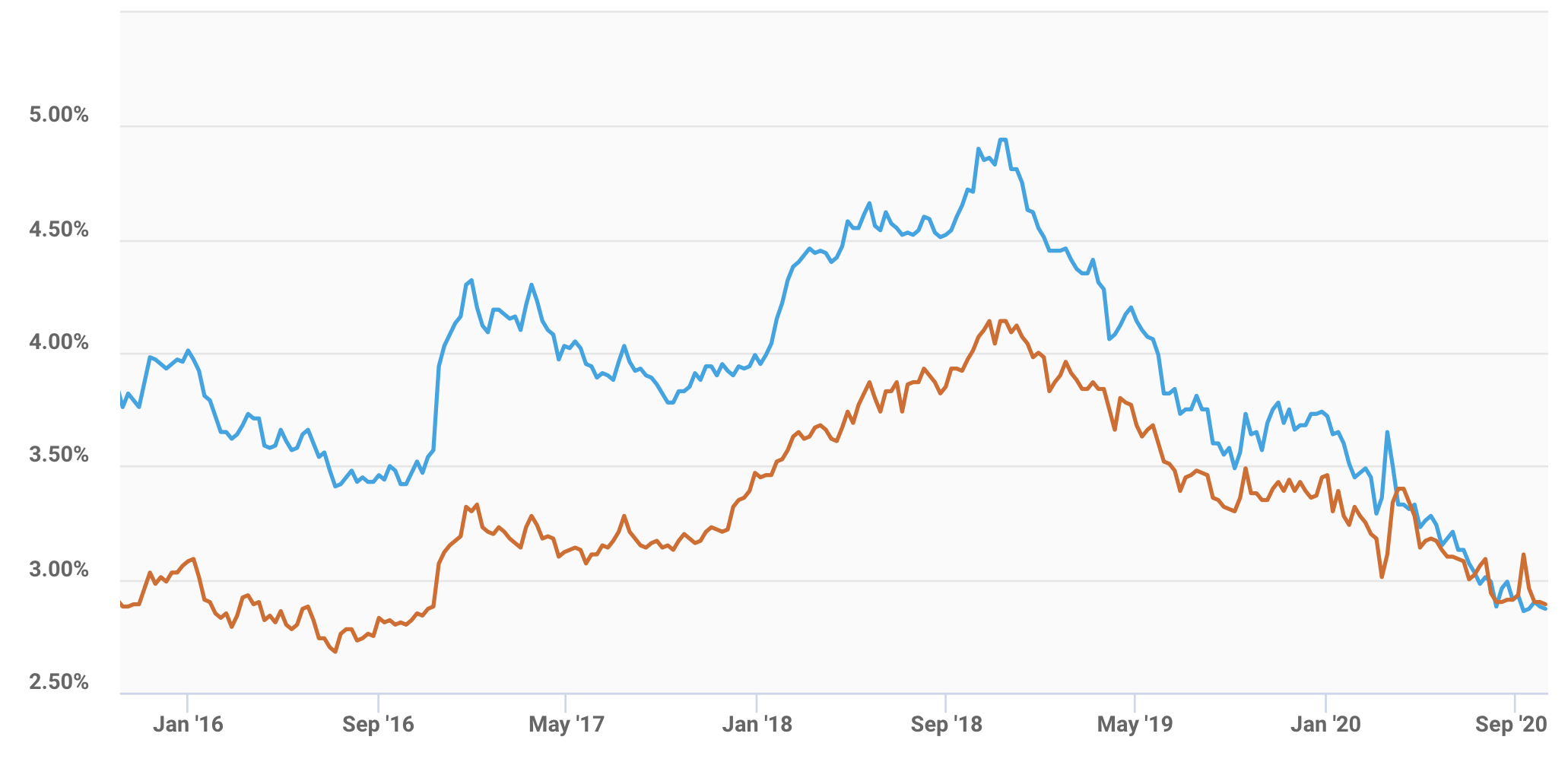

4. Potentially Lower Interest Rates: A Small Bonus

While not always a dramatic difference, lenders often offer slightly lower interest rates on 15-year mortgages compared to 30-year loans. Why? Because they’re taking on less risk. They’re getting their money back faster, which is always a good thing from a lender’s perspective. So, not only are you paying less interest overall, but you might also be securing a slightly better rate from the get-go. It’s a win-win scenario.

It’s like finding an extra perfectly ripe avocado in your grocery bag – a pleasant bonus that enhances the overall experience.

Who is the 15-Year Mortgage For?

So, is the 15-year mortgage your soulmate? It depends on your financial situation and your life goals. It’s generally a fantastic option for:

- People with stable, higher incomes: If your income can comfortably accommodate the higher monthly payments without straining your budget, the 15-year is a brilliant choice.

- Those who want to be debt-free sooner: If the idea of shedding your mortgage debt quickly is a top priority, this is your path.

- Savvy savers and investors: If you have the discipline to make the higher payments, you’ll free up significant cash flow over the long term that can be invested elsewhere for potentially higher returns.

- Buyers who plan to stay in their home long-term: The longer you stay, the more you benefit from the accelerated equity building and interest savings.

It’s not for everyone, of course. If you’re just starting out, have a tighter budget, or anticipate major unpredictable expenses in the near future, the 30-year might offer the breathing room you need. It’s about finding the right fit for your life stage and financial personality.

Making the Leap: Practical Tips

Thinking about making the switch or starting with a 15-year? Here are some practical tips:

- Run the numbers with a trusted advisor: A mortgage broker or financial planner can help you crunch the exact numbers for your specific situation and compare the 15-year and 30-year options side-by-side.

- Assess your budget honestly: Before committing to higher payments, ensure your budget can comfortably absorb them. Factor in not just housing, but also utilities, maintenance, and other living expenses.

- Consider the "what ifs": What if you lose your job? What if you have an unexpected medical expense? Having a solid emergency fund is crucial, especially with higher mortgage payments.

- Don't be afraid to "pay down" a 30-year: If you secure a 30-year mortgage but find you can afford more, you can always make extra principal payments. This can effectively turn your 30-year into a de facto 15-year (or even faster!) without the initial higher payment shock. Just be sure to specify that extra payments go towards the principal.

It’s like packing for a trip – you need to consider the destination, the climate, and what you’ll realistically use. Overpacking can be cumbersome, and underpacking can leave you unprepared.

A Final Thought: Life is Short, Pay Off Your House Faster!

Ultimately, the "real reason" the 15-year fixed-rate mortgage is often considered "better" than a 30-year boils down to one powerful concept: efficiency. It’s about maximizing your financial resources and minimizing the cost of borrowing. It’s the intelligent choice for those who prioritize financial freedom and wealth building over lower monthly payments.

Think about it: every extra dollar you pay towards your principal on a 15-year mortgage is a dollar that’s no longer costing you interest. It’s a dollar that’s building your equity faster. It’s a dollar that’s buying you back your time and your financial independence. In the grand scheme of life, where time is our most precious commodity, accelerating your journey to being debt-free is an incredibly attractive proposition. So, while the 30-year offers comfort, the 15-year offers a path to a more financially liberated and less encumbered future. And who wouldn’t want that?

It’s a bit like choosing between a leisurely stroll through a scenic park or a brisk walk up a challenging, rewarding hill. Both get you somewhere beautiful, but one offers a faster, more invigorating ascent to the summit. Choose the path that best aligns with your vision of a happy, healthy, and financially thriving life.