Wti Crude Oil Price Per Barrel Today Usd

Just the other day, I was chatting with my neighbor, Brenda. She’s one of those wonderful people who always has a perfectly manicured lawn and a story ready. We were talking about her upcoming road trip, a grand adventure to the Grand Canyon she's been planning for ages. She started lamenting about how much gas prices had gone up, sighing dramatically and saying, "It feels like I'm going to need to take out a second mortgage just to fill up the minivan!"

Brenda’s lament, while a bit exaggerated for comedic effect, got me thinking. It’s funny how something as seemingly distant as a barrel of oil, specifically something called WTI Crude Oil, can have such a direct, palpable impact on our everyday lives, from Brenda’s road trip to the very coffee we're probably sipping right now. It’s like a hidden puppeteer, pulling strings we often don't even notice until the show gets a little too expensive.

So, let’s dive into this whole WTI crude oil thing. What’s it all about, and more importantly, what’s the price per barrel today in USD? Because knowing that, even just as a general idea, can offer some fascinating insights into… well, everything!

The Mysterious WTI and Why It Matters

First off, what does WTI even stand for? It's an acronym that probably pops up on your news feed or a financial website sometimes, looking all serious and important. WTI stands for West Texas Intermediate. Now, you might be thinking, "Okay, that sounds very specific. Is it just oil found in West Texas?" And you'd be pretty close!

WTI is a specific type of crude oil, renowned for its high quality and low sulfur content. Think of it as the champagne of crude oil, if you will. It's relatively light and sweet, which makes it easier and cheaper to refine into gasoline, diesel fuel, and other petroleum products that we, the regular folks, actually use. This is in contrast to other types of crude oil, like Brent crude (which is more common in Europe and Africa), or heavier, sourer crudes that require more complex refining processes. So, in a nutshell, WTI is a benchmark for light, sweet crude oil produced in the United States.

Why is it a benchmark? Because its price is widely used as a reference point for pricing other crude oils. When you hear about the price of oil fluctuating, more often than not, it's the price of WTI or Brent crude that’s making the headlines. And since the US is such a massive consumer and producer of oil, WTI's price has a domino effect not just domestically, but on a global scale. It’s like the leading actor in a play; everyone else tends to follow their cue.

So, Where Are We Today? (The Burning Question!)

Now for the juicy bit, the part Brenda was probably muttering about as she calculated her gas tank's potential thirst. What is the WTI Crude Oil price per barrel today in USD? This is where things get a bit… fluid. (Pun intended, of course! You gotta have a little fun, right?). The price of oil is notoriously volatile. It can swing wildly based on a dizzying array of factors. It's like trying to predict the weather, but with more economic and geopolitical drama thrown in.

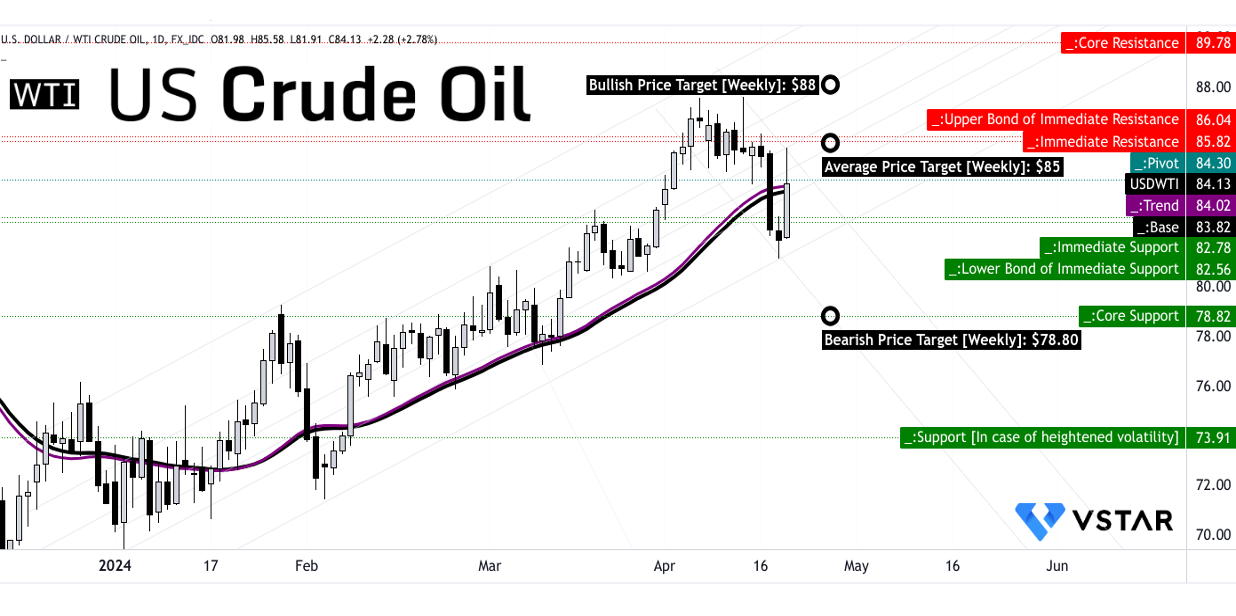

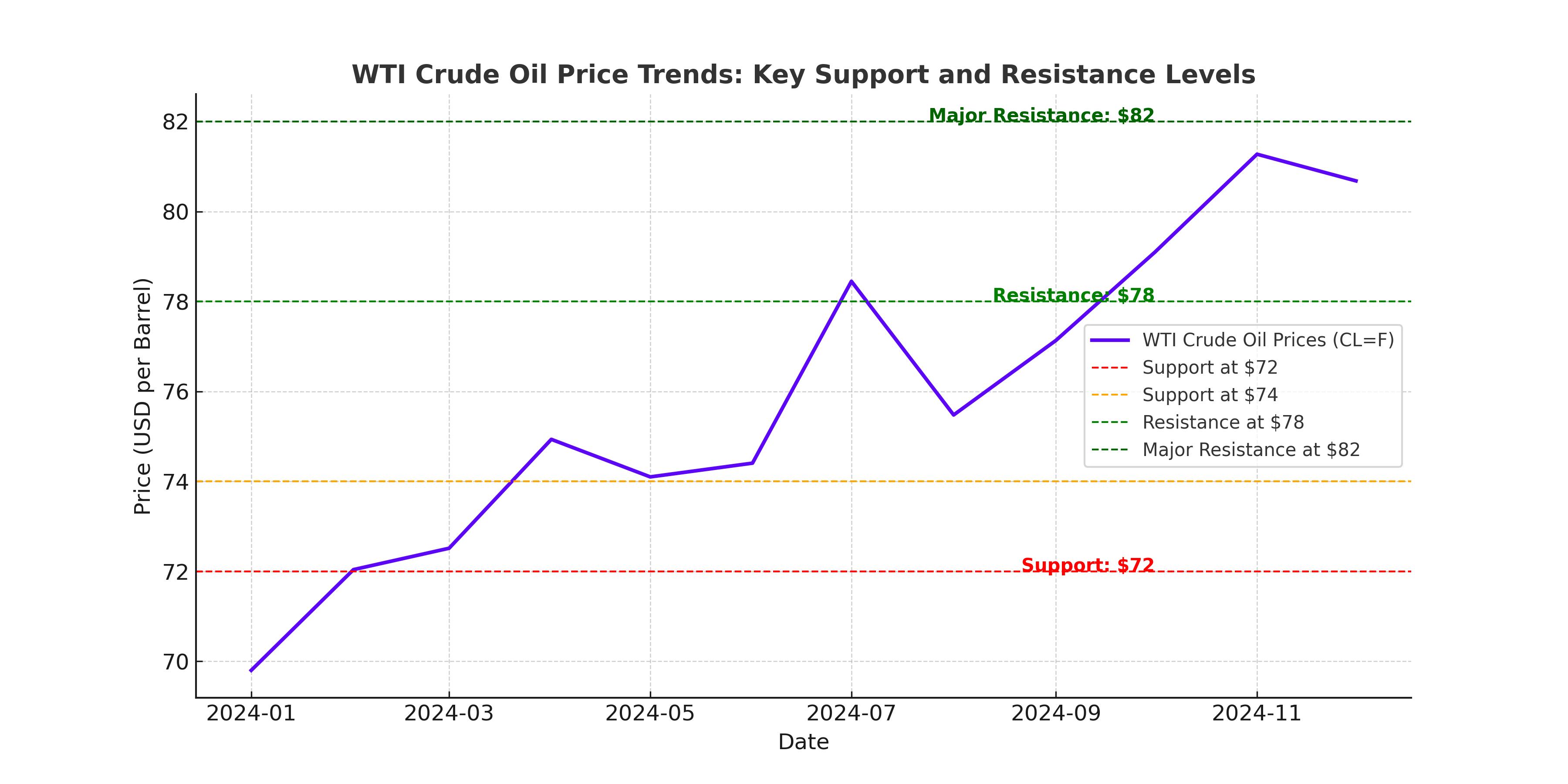

As of my last check, and this is where you'll want to do your own quick search for the absolute latest number because it changes by the minute, the price of WTI crude oil has been hovering in the low to mid-80s USD per barrel. (I’m deliberately being a little vague here because by the time you read this, it could be $82.50, $83.75, or maybe even $84.10. The internet waits for no one, and neither do oil prices!).

Think about that for a second. Less than a hundred dollars for a barrel that, when refined, will power your car, heat your home (if you're in a place that uses heating oil), and form the basis of countless plastic products we use daily. It’s still a significant amount of money, but it’s also a testament to the sheer volume and energy contained within that single barrel. It’s pretty mind-boggling when you break it down.

What Makes the Price Dance?

Why does this number, the price per barrel, go up and down like a yo-yo? Oh, where to begin! It's a complex dance, and frankly, sometimes even the experts scratch their heads. But here are some of the major players in this economic ballet:

Supply and Demand (The Classic Duo): This is your most fundamental economic principle. If there’s more oil being pumped out of the ground (high supply) than people need (low demand), prices tend to fall. Conversely, if demand outstrips supply, prices tend to rise. Simple, right? Well, not so fast.

Geopolitics (The Wild Card): This is where things get really interesting, and often, a little scary. Wars, political instability in major oil-producing regions (think the Middle East, Russia, Venezuela), or sanctions can significantly disrupt supply. If a major oil field suddenly becomes inaccessible due to conflict, that's a huge chunk of oil taken off the market, and prices will likely spike. It’s like someone suddenly closing off a major highway – traffic jams and higher prices for everyone else are inevitable.

OPEC+ (The Cartel with Clout): The Organization of the Petroleum Exporting Countries (OPEC) and its allies (hence OPEC+) are a group of major oil-producing nations that can collectively influence global oil supply by agreeing to production cuts or increases. When they decide to pump less oil, prices usually go up. When they decide to pump more, prices can come down. They're basically the conductors of the oil orchestra, trying to keep things in tune with their members' interests.

Economic Growth and Recessions (The Mood Swings): When the global economy is booming, businesses are expanding, people are traveling more, and factories are churning out goods. All of this requires energy, driving up demand for oil. During economic downturns or recessions, the opposite happens. Industrial activity slows, travel decreases, and demand for oil falls, putting downward pressure on prices. So, the general health of the world economy is a big mood indicator for oil prices.

Inventories (The Stash): How much oil do countries and companies have stored in tanks? High inventories can signal ample supply and potentially lead to lower prices. Low inventories suggest that supply might be tighter, which can push prices up. Think of it like your pantry – if it's overflowing with food, you're less worried about its price. If it's looking a bit bare, you might start watching prices more closely.

The US Dollar (The Global Currency): Since oil is primarily traded in US dollars, the strength or weakness of the dollar can also influence oil prices. When the dollar is weaker, it takes more dollars to buy a barrel of oil, making oil more expensive for holders of other currencies, and vice versa. It's a bit of a tangled web, isn't it?

Speculation and Futures Markets (The Crystal Ball Gazers): A significant portion of oil trading happens not for immediate delivery, but on futures markets, where traders bet on what the price will be in the future. This speculation can amplify price movements, sometimes creating swings that are driven more by market sentiment than by immediate supply and demand realities. It’s like people placing bets on a horse race before the horses have even left the starting gate – the anticipation can affect the odds!

Why Should Brenda (and You) Care About the Price Per Barrel?

Okay, so we know what WTI is and a bit about why its price moves. But why should Brenda, or any of us, really pay attention to the WTI Crude Oil price per barrel today in USD? Well, Brenda’s road trip is just the tip of the iceberg (or perhaps, the oil slick?).

Your Gas Tank: This is the most obvious one. The price you pay at the pump for gasoline is directly influenced by the price of crude oil. When crude oil prices rise, gas prices usually follow suit, making your daily commute, that weekend getaway, or Brenda’s epic journey to the Grand Canyon more expensive. Conversely, falling crude prices can lead to a welcome break at the gas station.

Heating and Cooling: In many regions, heating oil is derived from crude oil. So, when WTI prices are high, your winter heating bills can go through the roof. Similarly, the energy required to produce electricity, which powers your air conditioning in the summer, is often generated from fossil fuels, whose prices are linked to crude oil. That little thermostat setting has a global ripple effect!

Everything Else: This is where it gets really pervasive. Crude oil isn’t just for fuel. It’s a fundamental component in the production of plastics, fertilizers, pharmaceuticals, cosmetics, synthetic fabrics, asphalt, and thousands of other products. So, a rise in oil prices means that the cost of producing these goods increases. This can lead to higher prices for everything from the shampoo you use to the tires on your car to the packaging on your groceries. It’s a subtle, but significant, inflationary pressure.

The Economy at Large: For countries that are major oil producers, like the United States, fluctuations in WTI prices have a direct impact on their economy, influencing everything from corporate profits in the energy sector to government revenue. For oil-importing nations, high oil prices can strain their economies and lead to trade deficits. It's a massive global economic engine, and its speed and direction are heavily influenced by the price of this black gold.

A Glimpse into the Future?

Predicting the future of oil prices is a fool’s errand, and believe me, plenty of very smart people have tried and failed spectacularly. However, understanding the factors that influence the WTI Crude Oil price per barrel today in USD gives us a better framework for understanding the economic news and the potential direction things might be heading.

Are we heading for sustained higher prices? Or will supply increases and a potential slowdown in global demand bring them back down? It’s a constant push and pull. We’re seeing a lot of focus on energy transition and renewable sources, which should theoretically reduce our reliance on crude oil in the long run. But in the here and now, oil is still king, or at least a very powerful prince, in the global energy landscape.

So, the next time Brenda sighs about gas prices, or you see a headline about oil markets, you’ll have a slightly better grasp of the complex forces at play. That number, the WTI crude oil price per barrel, is more than just a financial statistic; it’s a pulse of the global economy, a driver of countless industries, and, yes, a direct contributor to the cost of filling up Brenda’s minivan for her trip to the Grand Canyon. It’s a fascinating, if sometimes frustrating, relationship we have with this fundamental commodity.

It’s worth keeping an eye on, not just for your wallet, but for a broader understanding of how the world works. After all, who knows what fascinating economic connections you might discover next? Maybe you'll even start seeing oil in your morning coffee! (Okay, probably not that last part. But you get the idea!).